There were 1,394 unusually active options in Wednesday’s options trading. Of these, 894 (64%) were calls, while 500 (36%) were puts. That’s a bullish indicator for stocks.

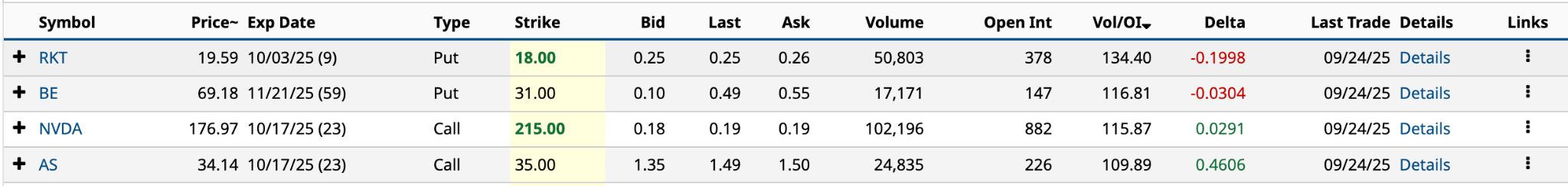

The fourth-highest Vol/OI (volume-to-open-interest) ratio yesterday was the Oct. 17 $35 call for Amer Sports (AS), the fast-growing sporting goods conglomerate, whose brands include Salomon, Wilson, Arc’teryx, and Louisville Slugger.

The call option’s volume was 24,835, 109.89 times higher than the open interest of 226. The volume for the $35 call alone was 2.5 times the stock’s 30-day average options volume.

Interestingly, while AS stock is up 163% from its January 2024 IPO price of $13, it has declined 16% in the past month, suggesting that investors believe its August 25 all-time high of $42.36 marked a market top.

While I am generally positive about the company and its business, in May, I suggested that some profit-taking was in order, as its stock would likely experience a cooling off in the second half of the year.

Amer’s share price has since fallen by 11%, which would be considered a “cooling off” since it was on a two-month heater (up 81%) at the time of my comments.

Where to next? Here are three ways to play its Oct. 17 $35 call for both bearish and bullish investors.

Mildly Bearish About Amer Stock

Of the three investor sentiments, I would say I’m mildly bearish about AS stock.

Even with the company’s ambitious long-term financial goals, released last Thursday, which include annual revenue growth of 13.5% over the next five years based on the midpoint of its guidance, along with 50 basis points of operating margin expansion annually, its valuation appears exceptionally high.

According to S&P Global Market Intelligence, analysts estimate that Amer will earn $2.53 a share in 2030, five years from now. It currently trades at 13.5 times this estimate. In 2025, Amer’s expected to earn $0.85 a share; it trades at 40.2 times this year’s consensus.

The market is expensive in many areas. Amer is one of them. I don’t doubt it can continue to grow revenues by double digits. Still, I do wonder about the bottom-line potential given the possibility of a global recession at some point due to tariff costs.

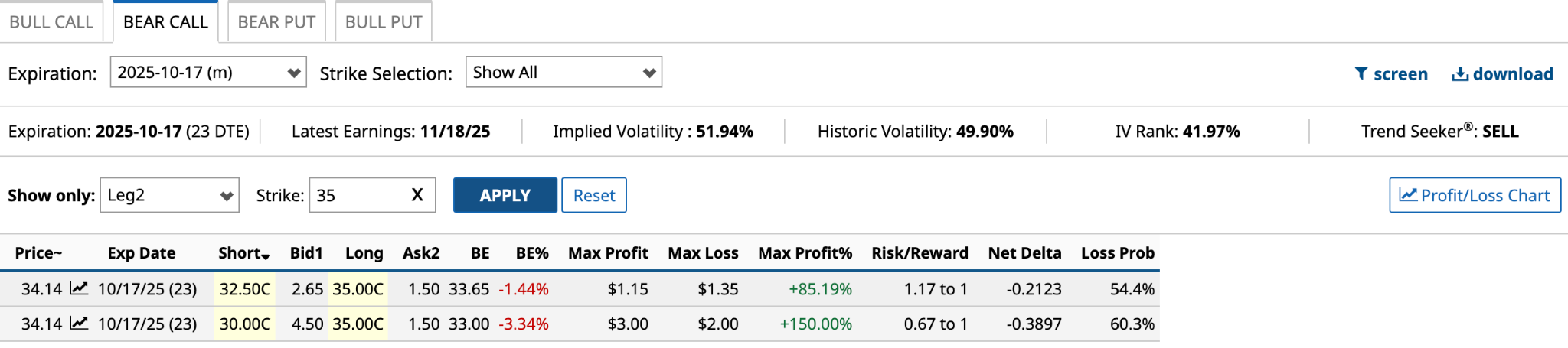

A bear call spread is good for someone who’s mildly bullish. It involves selling a call whose strike price is ITM (in the money) and buying a second call expiring on the same day at a higher strike price OTM (out of the money).

Based on the Oct. 17 $35 call from yesterday, I have two possibilities:

To generate the maximum profit of 150.0%, you’ll want Amer’s share price to be below the $30 strike price at expiration in mid-October. Your maximum loss of $200 would happen if its share price is above $35 in 23 days.

I like the risk/reward ratio of 0.67 to 1.

Mildly Bullish About AS

I would say this is for anyone bullish about the company’s future, but concerned about the near-term outlook, given the stock’s 16% loss over the past month.

In the stock’s favor near-term, the Barchart Technical Opinion is a Weak Buy, suggesting it’s got a shot to move higher, not lower, in the next 23 days. Meanwhile, the expected move over the next 23 days, up or down, is $3.09, which puts the upper price at $37.23, well above the $35 strike price.

Rather than go with a bull call spread, which is the opposite of the bear call spread, I’m going to suggest buying a cash-secured call. This involves buying a long call in this case, the Oct. 17 $35 strike, and setting aside $3,500 to buy the stock either at $35 or at a lower price if it drops over the next 23 days.

Based on yesterday’s $1.50 ask price, you’re paying $150 for a raincheck to buy AS stock at a later date. Let’s say the stock falls to $31.05 in the next week [$34.14 closing price from yesterday - $3.09 expected move]. You could buy 100 shares at the lower price and let the call expire worthless on Oct. 17.

If, on the other hand, it moves up $3.09 in the next week to $37.23, you could exercise your right to buy 100 shares at $35, generating a paper profit of $73 [$2.23 appreciation less $1.50 ask price]. While $73 might not sound like much, it’s an annualized return of 109% [$73 / $3,500 * 365 / 7].

Over-the-Moon Bullish About Its Near-Term Share Price

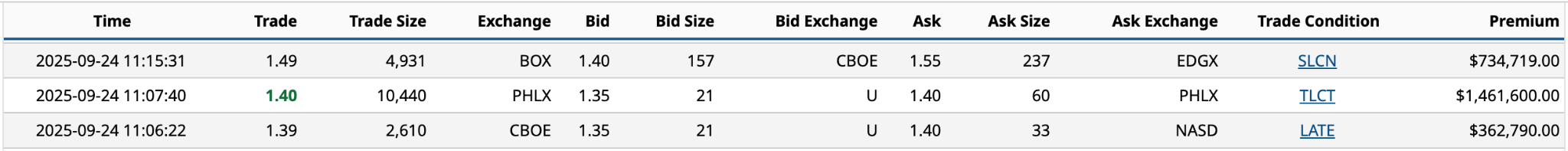

Examining trades of over 10 option contracts yesterday for the Oct. 17 $35 call, I noticed three large trades between 11:06 and 11:15 a.m. These three accounted for 72% of the call’s daily volume.

I don’t see any corresponding put trades, so I’m going to assume these are all either long call buys or covered calls by existing Amer stockholders looking to generate some income.

For example, let's say an institution bought 1.04 million shares of the 105 million shares sold by Amer in its January 2024 IPO. As of yesterday’s close, they’re up 163% on their investment. Perhaps they feel it’s getting too expensive. They sell 10,440 covered calls for $1.46 million in premium.

Assuming the shares trade above $35 at expiration, and they’re forced to sell their stock, they exit with a significant realized gain on the shares and $1.46 million in income. Not a bad parting gift--but I digress.

The bullish strategy to consider is a synthetic long position, which simulates the risk and reward of an actual long position by buying a $35 call and selling a $35 put with the same expiration date of October 17.

Based on options prices, as I write this Thursday morning, the net credit on the long call and short put is $1.05 [$2.30 bid price for short put - $1.25 ask price on long call].

Calls Puts

So, the breakeven on both the upside and downside is $33.95.

Let’s say the upper price is $37 at expiration, your profit would be $305 [$37 share price - $33.95 breakeven * 100]. At the lower price of $32 at expiration, your loss would be $195 [$32 share price - ($33.95 breakeven * 100)].

However, remember, this is only a trade if you are extremely bullish in the near term.