It's been quite an unusual, if profitable, scenario on Wall Street in recent years, as most major asset classes - including equities, bonds, and gold - have all been moving higher at the same time. That's a relative rarity, but while the frenzy around artificial intelligence (AI) has helped propel equities to new highs, a tricky macroeconomic backdrop has been supportive for safe-haven assets like Treasuries and gold. Even as investors continue to root for Fed rate cuts this year, inflation remains high, and the economy remains strong - complicating the path toward looser monetary policy.

Along with persistently high inflation and a weaker U.S. dollar, gold futures (GCJ24) have also been supported by ongoing geopolitical conflicts in Gaza and Ukraine, alongside heavy buying by global central banks. Earlier today, gold sailed to the latest in a string of new record highs.

For investors seeking exposure to gold as analysts hike their forecasts for the precious metal, exchange-traded funds (ETFs) that hold the physical asset are one of the most straightforward options. Given their similar structure, the price action on all three is nearly identical - so investors should consider fees, liquidity, and other details before buying shares. Here's a closer look at three physical gold ETFs that track the metal's performance.

1. SPDR Gold Shares (GLD)

Established in 2004 as a trust that holds physical bullion, SPDR Gold Shares (GLD) is the world's largest physically backed gold ETF, with assets under management (AUM) of about $61.4 billion. State Street Global Advisors acts as the trustee of the SPDR Gold Shares.

Up 12.6% on a YTD basis, GLD has an expense ratio of 0.40%. Its average daily share volume is over 8 million, making it extremely liquid.

Notably, for investors who want to play gold via options, GLD is likely the best bet; its average 30-day contract volume is 204,251, which suggests the fund's calls and puts are much more actively traded than those of other physical gold ETFs.

2. abrdn Physical Gold Shares ETF (SGOL)

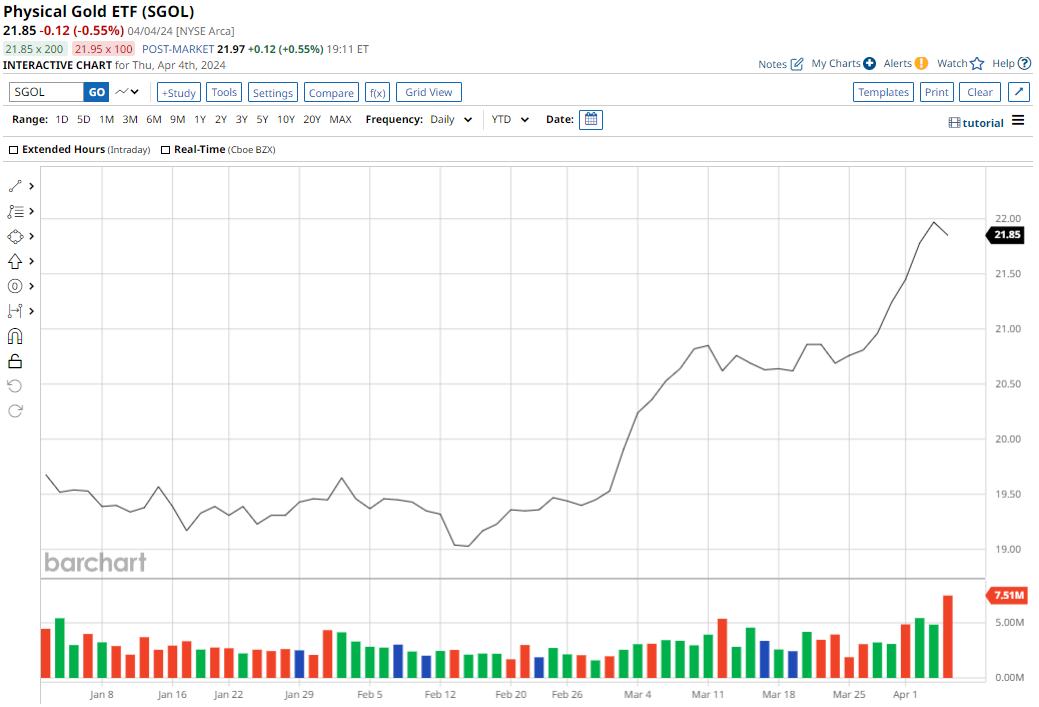

The abrdn Physical Gold Shares ETF (SGOL) is an ETF that tracks the price of gold bullion by holding physical gold bars stored in secure vaults, primarily in Zurich and London. Acquired by Aberdeen Standard Investments on April 27, 2018, from its original launcher, ETF Securities, the ETF has a current AUM of about $3.1 billion.

SGOL is up 12.5% on a YTD basis. With an average daily share volume of 3.75 million, it's not quite as active as GLD, but offers plenty of liquidity for investors - and with a slimmer management fee of 0.17%.

Options on SGOL have yet to catch on, though, with daily contract volume sometimes failing to break into double digits.

3. iShares Gold Trust (IAU)

We round up our list with the iShares Gold Trust (IAU), which also holds physical gold bullion in secure vaults. Backed by the world's largest investment manager, BlackRock (BLK), the ETF's AUM currently stands at about $28.4 billion.

The ETF has gained 12.5% on a YTD basis, and offers an expense ratio of 0.25%. Its average daily share volume is right around 7 million, not far behind GLD.

Average 30-day option volume on IAU, however, is less than 4,000 contracts.