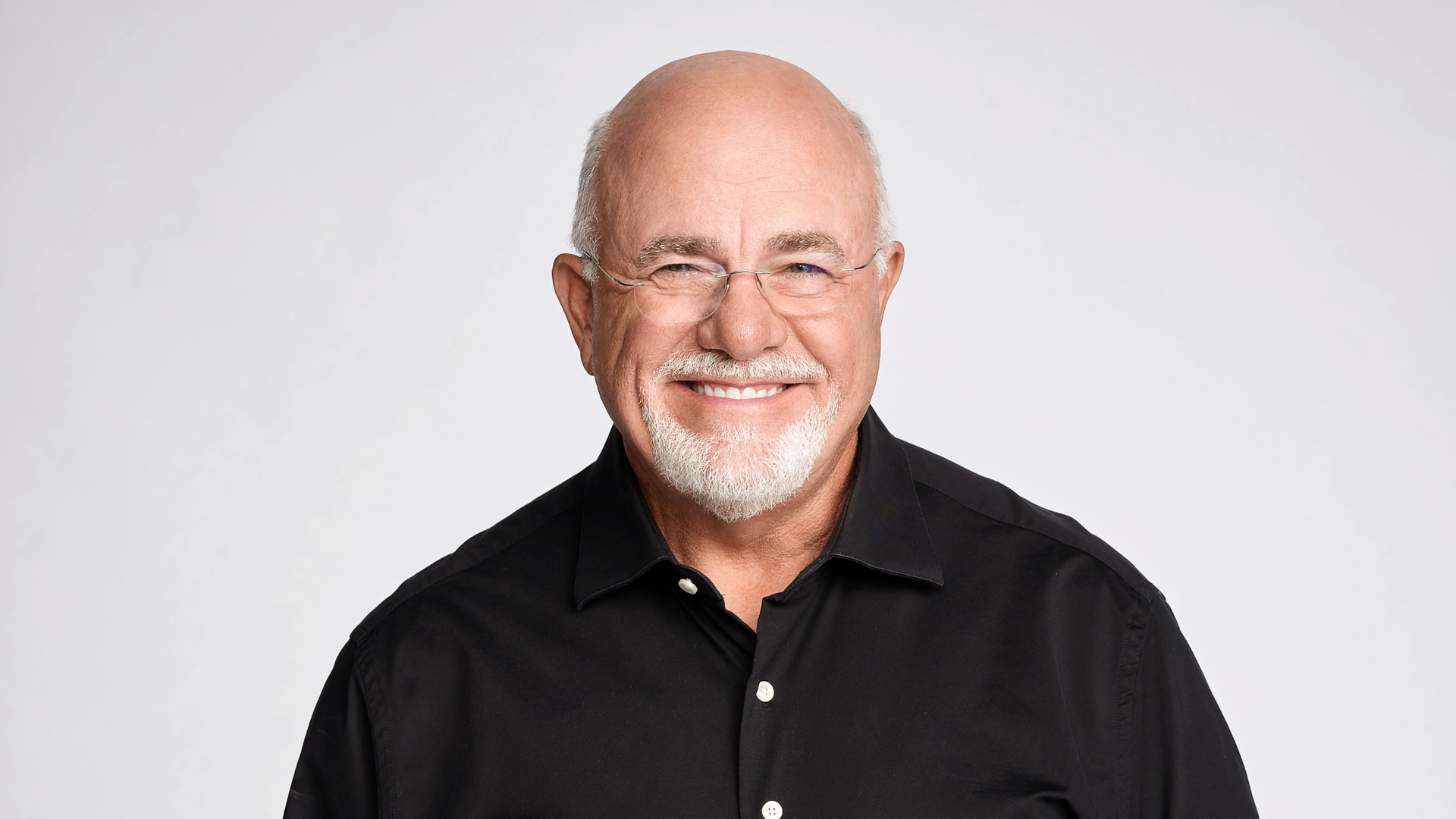

President Donald Trump’s Big Beautiful Bill, which was signed into law on Jul. 4, is still the topic of discussion among financial experts. And personal finance guru Dave Ramsey is one of them.

Discover More: Here’s How Much Every Tax Bracket Would Gain — or Lose — Under Trump’s ‘Big, Beautiful Bill’

Check Out: The 5 Car Brands Named the Least Reliable of 2025

In a clip from “The Dave Ramsey Show” posted on X, Ramsey breaks down some of his favorite, and not-so-favorite, provisions in the BBB. Here are three things Ramsey likes about the bill.

Increased Standard Deduction

One of the biggest and most anticipated provisions was the extension, modification and codification of the 2017 Tax Cuts and Jobs Act (TCJA).

A standout among the TCJA was the increased standard deduction, Ramsey pointed out, noting that a majority of Americans typically take the standard deduction every tax season. The standard deduction is a fixed dollar amount that taxpayers subtract from their income to lower the amount of income on which they are taxed.

Try This: 8 Ways Trump’s ‘One Big Beautiful Bill’ Could Offer Tax Relief

Between 2017 and 2018, the TCJA increased the standard deduction from $6,500 to $12,000 for individual filers and from $13,000 to $24,000 for joint returns. The amounts were also indexed for inflation.

For 2025, the BBB increased the standard deduction to $15,750 for single taxpayers and $31,500 for married couples filing jointly.

While the increased standard deduction is generally viewed as a positive that has simplified the tax code for millions of Americans, the Tax Foundation reported that the added standard deduction for seniors — $2,000 for singles and heads of household and $1,600 for married filing jointly or separately — violates basic tax principles of treating taxpayers equally.

No Taxes on Tips and Overtime

Another provision that Ramsey liked was no taxes on tips and overtime.

Between 2025 and 2028, employees who “customarily and regularly” receive tips can deduct up to $25,000 in qualified tips from their taxable income. Workers earning time-and-a-half for hours worked beyond the 40-hour work week can deduct up to $12,500 or $25,000 on a joint tax return.

For both, eligibility begins to phase out for individuals making more than $150,000 per year, or $300,000 for joint returns. The deduction reduces by $100 for every $1,000 earned above the limit.

However, the Tax Foundation said this new law further complicates the tax code with new rules and compliance laws that may outweigh potential tax benefits. No taxes on tips and overtime come with conditions and guardrails that will likely require hundreds of pages of IRS guidance to interpret, the tax policy research and education think tank added.

R&D Tax Credits

The research and development (R&D) tax credits are incentives that reward businesses for investing in innovation, product development and process improvements. This means that if a business spends money on developing new products or improving software, it may be able to claim the credit to reduce its tax bill.

The tax credit is available for the 2025 tax year for businesses with less than $31 million in gross receipts. Businesses with over $31 million won’t be able to take advantage of this tax break immediately.

“That had been in place for like 75 years and went away two years ago because they didn’t renew it,” Ramsey said. “So small businesses were getting slammed because they lost a huge depreciation issue on R&D. I know I did.”

More From GOBankingRates

- I'm a Realtor: This Is Why No One Wants To See Your Home

- 3 Things Retirees Should Stop Buying To Save Money Amid Tariffs

- 4 Affordable Car Brands You Won't Regret Buying in 2025

- How Far $750K Plus Social Security Goes in Retirement in Every US Region

This article originally appeared on GOBankingRates.com: 3 Things Dave Ramsey Likes About Trump’s Big Beautiful Bill