/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

Artificial intelligence (AI) is reshaping everything at a rapid pace, and some companies are standing out by combining innovation, scale, and profitability. With strong financials, cutting-edge innovation, and massive growth potential ahead, here are three reasons why Amazon (AMZN) deserves a spot in your portfolio.

1. AWS Is Powering a New AI Supercycle

Once known only as a “retail giant,” Amazon now has AI woven into every corner of its business. While its e-commerce business remains a big revenue generator, the cloud computing division via Amazon Web Services (AWS) remains the most profitable.

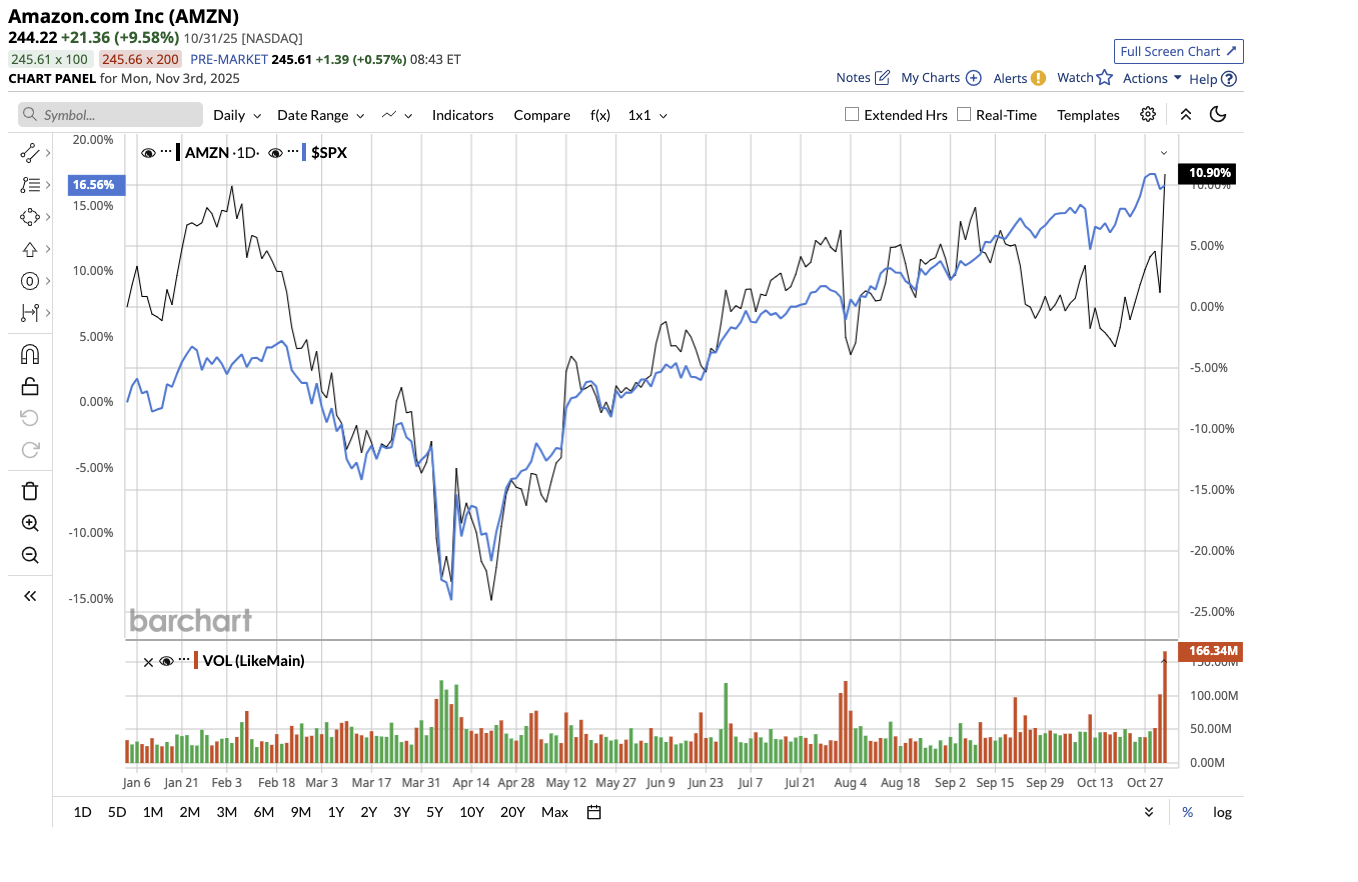

Amazon released its third-quarter earnings on Oct. 30. While Amazon stock has gained 10.9% year-to-date, it is up 29% over the past 52 weeks. In Q3, AWS sales increased 20.2% year on year, marking its strongest growth in 11 quarters and reaffirming Amazon’s leadership in cloud computing.

But what is truly remarkable is not only AWS's growth but also its scale. AWS is now running at an annualized revenue rate of $132 billion, with a $200 billion backlog that doesn’t yet include major deals signed in October. AWS's strength is its deep, broad platform, which developers, startups, and organizations use to create everything from apps to enormous AI systems. During the Q3 earnings call, management put a spotlight on how AWS has been named the Gartner Magic Quadrant leader for 15 consecutive years, reflecting its unmatched infrastructure and innovation.

2. Building the World’s Most Powerful AI Infrastructure

To meet rising AI demand, AWS has doubled its power capacity since 2022, adding 3.8 gigawatts in the last year alone, more than any other cloud provider. The company expects to double it again by 2027. Furthermore, Amazon’s trainium chip family has already become a “multibillion-dollar business,” growing 150% quarter-over-quarter. With roughly 500,000 Trainium2 chips deployed in its new Project Rainier cluster and partnerships with firms such as Anthropic, AWS is outpacing the competition in terms of AI infrastructure scaling.

AWS intends to add more clients to Trainium3. Partnerships with Nvidia (NVDA), Advanced Micro Devices (AMD), and Intel (INTC) remain critical, as Amazon continues to obtain huge chip orders to maintain its pace.

3. Core Retail Business is Flying High with AI, Signaling Long-Term Strength

Amazon’s retail operations are stronger than ever. The North America segment generated $106.3 billion in revenue, up 11% year-over-year. Meanwhile, the International segment recorded $40.9 billion in revenue, a 10% YOY increase. The company reported $180.2 billion in total revenue, a 12% increase YoY, with $17.4 billion in operating income. It continues to dominate in selection, price, and delivery, including record Prime Day sales, 3-hour delivery rollouts, and a $4 billion investment to expand rural delivery.

The company uses AI across its supply chain, routing, and delivery systems, giving it unique operational data and efficiency. Amazon's AI-powered shopping assistant Rufus is proving to be a significant sales driver. With 250 million active consumers this year, monthly users up 140%, and interactions up 210%, Rufus users are 60% more likely to make a purchase. The tool is on track to generate more than $10 billion in incremental annualized sales.

Amazon is investing heavily, with $34.2 billion in capital expenditures in Q3 alone, nearly $90 billion year-to-date (YTD), and a projected $125 billion in 2025. These expenditures are mostly aimed at AWS infrastructure and AI innovation. Amazon is leveraging AI to provide faster, smarter, and more profitable consumer experiences in retail, logistics, entertainment, and devices.

Nonetheless, Amazon has struck an appropriate balance between profitability and long-term investment. In the quarter, net income per share increased 36.4% to $1.95, and trailing 12-month free cash flow stood at $14.8 billion. Analysts expect that Amazon's earnings will climb by 27% and 11% during the next two years. However, management believes AI will be a multi-decade growth engine.

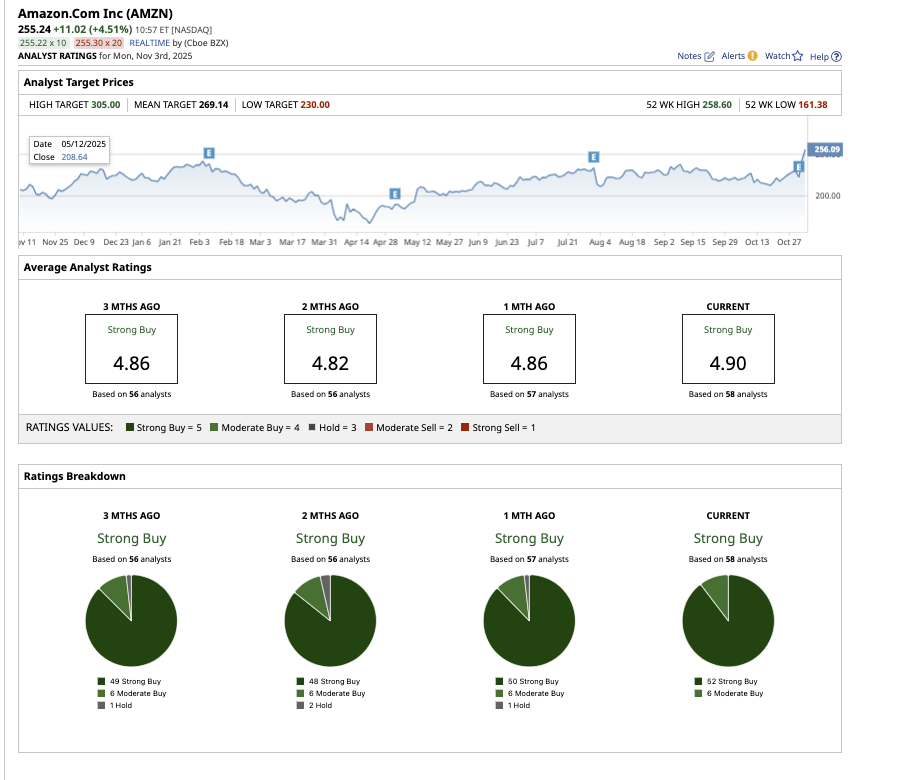

What Is Wall Street Saying About Amazon Stock?

Overall, Amazon stock has earned a “Strong Buy” rating. Of the 58 analysts covering the stock, 52 have given it a “Strong Buy” rating and six recommend a “Moderate Buy.” The average target price is $269.14, indicating a potential upside of 5.4% from its current price. Additionally, the highest target price of $305 suggests the stock could rise by as much as 19.5% over the next 12 months.