As trade markets near all-time highs, savvy investors searching for undervalued opportunities should turn their attention to the oil and gas sector. Recent value ranking data highlights three standout companies that have surged into the top 10th percentile of value performers this week.

3 Undervalued Oil & Gas Stocks

According to Benzinga’s Edge Stock Rankings value-ranking methodology, such stocks are attractive because they trade at lower valuations relative to key financial fundamentals like earnings, sales, and assets compared to their peers.

Crescent Energy

- Crescent Energy Co. (NYSE:CRGY), an integrated oil and gas operator, inched very close to the elite top decile of value-ranked stocks with a current score of 88.97—up from 88.86 just a week ago.

- The stock has tumbled 33.47% year-to-date and 13.54% over a year.

- It maintains a stronger price trend over the short and medium terms but a weaker trend over the long term, with a moderate growth ranking. Additional performance details are available here.

Plains All American Pipeline

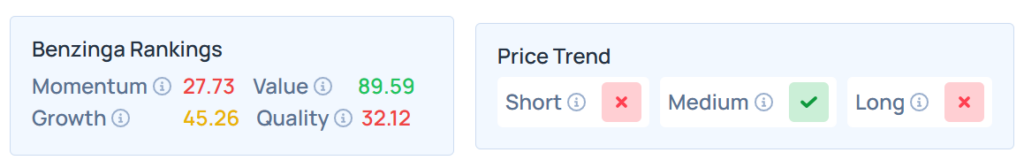

- Pipeline and midstream specialist Plains All American Pipeline LP (NASDAQ:PAA), similarly pushed near the top 10% of value performers, now sitting at a value score of 89.59.

- Higher by 2.14% in the YTD, the stock was up just 0.40% over the year.

- With a poor quality and momentum ranking, this stock maintained a weaker price trend over the short and long terms but a strong trend in the medium term. Additional performance details are available here.

See Also: 3 Bitcoin Treasury Firms Show Improving Price Trends, Strong Momentum Signals

YPF

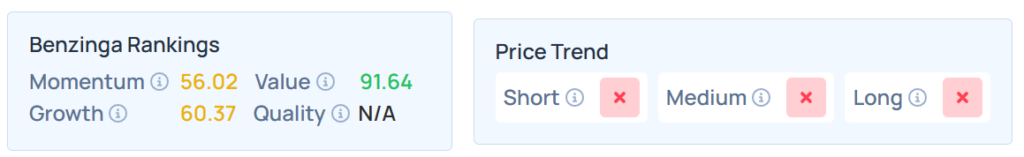

- Argentina's oil and gas powerhouse YPF SA (NYSE:YPF) is also making waves among value hounds. Sporting a jump in its value ranking score to 91.64 from 89.22, YPF demonstrates that international energy stocks can remain overlooked even as markets break records.

- The stock declined 31.88% YTD; however, it was 30.67% higher over the year.

- While this stock had a moderate growth ranking, it had a weak price trend in the short, medium, and long terms. Additional performance details are available here.

Why Value Investors Should Watch These Names

The percentile-based Benzinga Edge value rankings reveal more than just low price-to-earnings or price-to-book ratios—they reflect a composite picture of fundamental strength relative to market valuation.

As Crescent Energy, Plains All American, and YPF climb close to the value top decile, their improving scores signal they are not only fundamentally robust but also likely undervalued versus peers as the market trades at premium levels.

Price Action

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Wednesday. The SPY was up 0.50% at $643.45, while the QQQ advanced 0.71% to $569.64, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock