Gold's meteoric rally is powering a new wave of momentum for miners, with three select stocks joining the top decile of momentum rankings just as the price of gold nears the $4,000 mark. However, experts say that the rally is just the beginning as the gold mining stocks are still heavily undervalued.

3 Gold Mining Stocks Supercharge With Momentum Gains

This exuberant surge in Galiano Gold Inc. (NYSE:GAU), McEwen Inc. (NYSE:MUX), and Seabridge Gold Inc.‘s (NYSE:SA) momentum reflects much more than short-term trading.

Galiano Gold

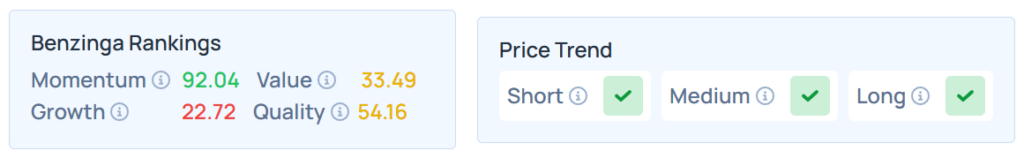

- According to momentum percentile data for the past week, GAU moved from a score of 88.5 to 92.04, a gain of 3.54 points.

- The stock has jumped by 92.37% year-to-date and 82.61% over a year.

- It maintains a stronger price trend over the short, medium, and long term, with a moderate quality ranking. Additional performance details are available here.

McEwen

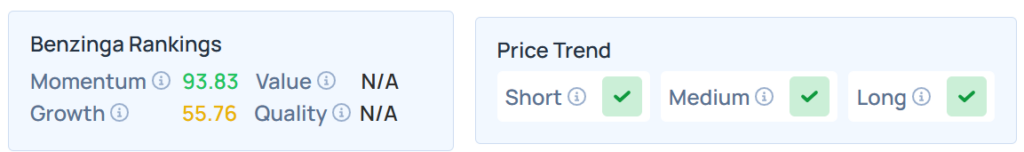

- MUX climbed from 89.91 to the 93.83th momentum percentile, a rise of 3.92 points.

- The stock was lower by 121.55% YTD and 87.69% in a year.

- This stock maintained a stronger price trend over the short, medium, and long terms with a moderate growth ranking. Additional performance details are available here.

Seabridge Gold

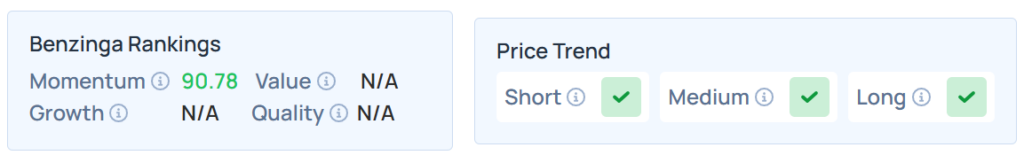

- SA surged from 86.57 to 90.78, a rise of 4.21 points.

- Higher by 105.32% YTD, the stock was up 48.38% over the year.

- It had a stronger price trend in the short, medium, and long terms. Additional performance details are available here.

Momentum Rank Insights

Benzinga Edge Stock Rankings‘ momentum metric, as measured in percentile terms, captures the relative strength of a stock's price performance and volatility compared against its peers.

Gold Miners Remain Undervalued

Economist Peter Schiff, known for his bullish stance on precious metals, points out that despite the ongoing rally, gold mining stocks remain largely underappreciated by general equity investors.

Schiff observes that while mining stocks have climbed about 140% so far this year, their valuation metrics—especially price-to-earnings ratios—continue to shrink, indicating that earnings are outpacing share prices. “Buy the miners before they do,” he urges, underlining the sector’s latent value and earnings growth.

Gold Miners Set To Post ‘Highest Profit Margins’ In History

Otavio Costa, macro strategist at Crescat Capital, echoes and extends this perspective. He finds that despite stellar gains—some miners approaching 200% year-to-date—their price-to-earnings ratios have actually contracted.

Costa's analysis demonstrates that sector-wide earnings have surged faster than stock prices, resulting in increasingly attractive valuations. He predicts that if gold prices remain elevated, gold miners are positioned to post the highest profit margins in industry history, further sweetening their investment profile.

Price Action

Gold Spot US Dollar fell 0.29% to hover around $3,949.46 per ounce. Its last record high stood at $3,977.45 per ounce.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, advanced on Monday. The SPY was up 0.36% at $671.61, while the QQQ rose 0.75% to $607.71, according to Benzinga Pro data.

The futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were lower on Tuesday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock