Three Bitcoin (CRYPTO: BTC) treasury companies, MARA Holdings Inc. (NASDAQ:MARA), Rumble Inc. (NASDAQ:RUM), and BTC Digital Ltd. (NASDAQ:BTCT), have all seen notable changes in their momentum rankings, marking a dynamic phase for investors watching price trends among digital asset treasury stocks.

Momentum Ranking Shifts For These Crypto-Linked Firms

MARA Holdings

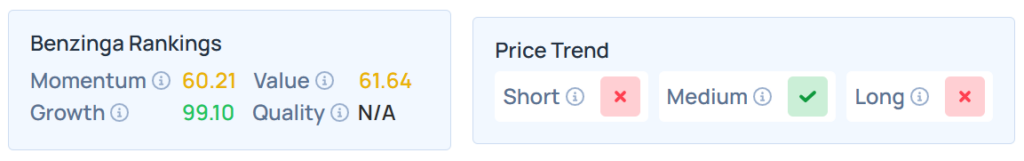

- Recent data show that MARA Holdings, a prominent Bitcoin miner and treasury, has seen its momentum percentile score surge from 29.92 to 60.21, a remarkable 30.29-point jump in the last period.

- With a business strategy closely mirroring that of Strategy Inc. (NASDAQ:MSTR), aggressively accumulating Bitcoin, MARA's upward momentum ranking suggests growing investor confidence, supported by fundamental performance and operational expansion.

- The stock has tumbled 7.15% year-to-date but is up 4.72% over a year.

- It maintains a stronger price trend over the medium term but a weaker trend over the short and long terms, with a solid growth ranking. Additional performance details are available here.

Rumble

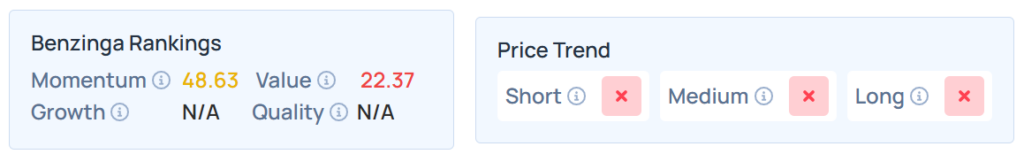

- RUM has experienced an upgrade in its momentum ranking from 34.5 to 48.63, up 14.13 points.

- Having recently allocated up to $20 million of treasury reserves into Bitcoin, Rumble is clearly committed to leveraging digital assets as part of its longer-term strategic and financial blueprint.

- Lower by 41.21% in the YTD, the stock was up 32.79% over the year.

- With a poor value ranking, this stock maintained a weaker price trend over the short, medium, and long terms. Additional performance details are available here.

BTC Digital

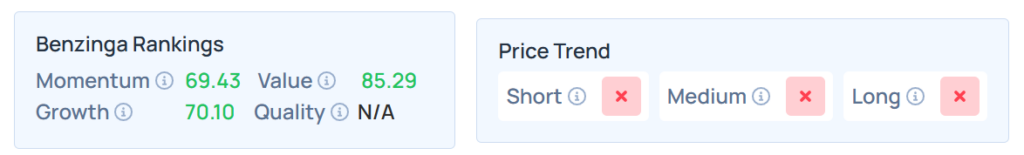

- BTCT, while still engaged in blockchain technologies and Bitcoin mining, stands out for its strategic pivot. Its momentum score has vaulted from 38.0 to 69.43—a 31.43 increase, despite its July 2025 exit from Bitcoin treasury holdings in favor of Ethereum.

- The move suggests that although technical price momentum remains strong, investor interest is increasingly driven by speculative positioning around its Ethereum-based model, focusing on DeFi, staking, and new asset tokenization, which opens BTC Digital to a greater diversity of blockchain opportunities.

- The stock declined 52.94% YTD; however, it was 76.55% higher over the year.

- While this stock had a good growth ranking, it had a weak price trend in the short, medium, and long terms. Additional performance details are available here.

What Does The Momentum Rankings Reveal?

Momentum percentile rankings synthesize price movement and volatility across multiple timeframes, benchmarking each firm against thousands of listed stocks.

Strong upward changes for MARA, RUM, and BTCT place these stocks solidly above the market's median, demonstrating relative strength and attracting additional institutional and retail attention.

For investors, momentum ranking improvements typically suggest an environment favoring further short-term price appreciation, especially when paired with robust operational performance or transformative strategic shifts such as treasury asset re-allocation.

Price Action

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell on Friday. The SPY was down 0.60% at $645.05, while the QQQ declined 1.16% to $570.40, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock