While investors chase the usual market darlings, a few underappreciated businesses are quietly gaining traction by generating actual revenue growth, expanding margins, and setting themselves up for long-term success through promising pipelines. As the market seeks profitable innovation in healthcare and biotech, Ardelyx (ARDX) and TScan Therapeutics (TCRX) could be among 2025's most underrated and possibly rewarding stocks.

Stock #1: Ardelyx (ARDX)

Ardelyx may not yet be a household name on Wall Street, but this small-cap biotech business is quietly building momentum through disciplined execution and rapidly expanding commercial performance. Valued at $1.17 billion, Ardelyx focuses on identifying, developing, and commercializing drugs that predominantly work in the gastrointestinal (GI) tract, with little absorption into the rest of the body. Two of its commercial medications, IBSRELA and XPHOZAH, have begun to generate substantial revenue.

Nonetheless, the stock has dipped 1% year-to-date (YTD), underperforming the broader market gain.

Ardelyx reported $97.7 million in total revenue in the second quarter, up 33% year-on-year (YoY) and 32% sequentially. That increase came from its two primary medications, IBSRELA and XPHOZAH, both based on its proprietary molecule, tenapanor. Notably, IBSRELA, which treats irritable bowel syndrome with constipation (IBS-C) in adults, generated $65 million in net sales, reflecting an 84% YoY increase. The drug had its best quarter ever, thanks to record-high new and refill prescriptions, increased prescriber adoption, and consistent execution on commercial priorities.

With this rapid growth, Ardelyx increased its 2025 IBSRELA sales projection to $250 million to $260 million, demonstrating management's growing confidence in the product's long-term prospects. XPHOZAH, its second important asset, is used to reduce serum phosphate (phosphorus) levels in individuals with chronic kidney disease (CKD) on dialysis who have hyperphosphatemia, a condition characterized by an excess of phosphate in the blood. XPHOZAH is gaining appeal among nephrologists, boasting net sales of $25 million in the second quarter.

Beyond the U.S., partners such as Kyowa Kirin in Japan and Fosun Pharma in China are commercializing or planning to commercialize tenapanor, broadening its reach worldwide. Ardelyx is still in the development stage. Hence, it posted a net loss of $19.1 million, or $0.08 per share. It ended the quarter with $238.5 million in cash, cash equivalents, and investments, allowing it the flexibility to develop its pipeline.

Ardelyx may still be overlooked by much of the market, but its fundamentals are starting to shine through. With double-digit revenue growth, rising margins, and two distinct medicines finding real-world momentum, the firm is quietly transitioning from a clinical-stage biotech to a commercial-stage growth story.

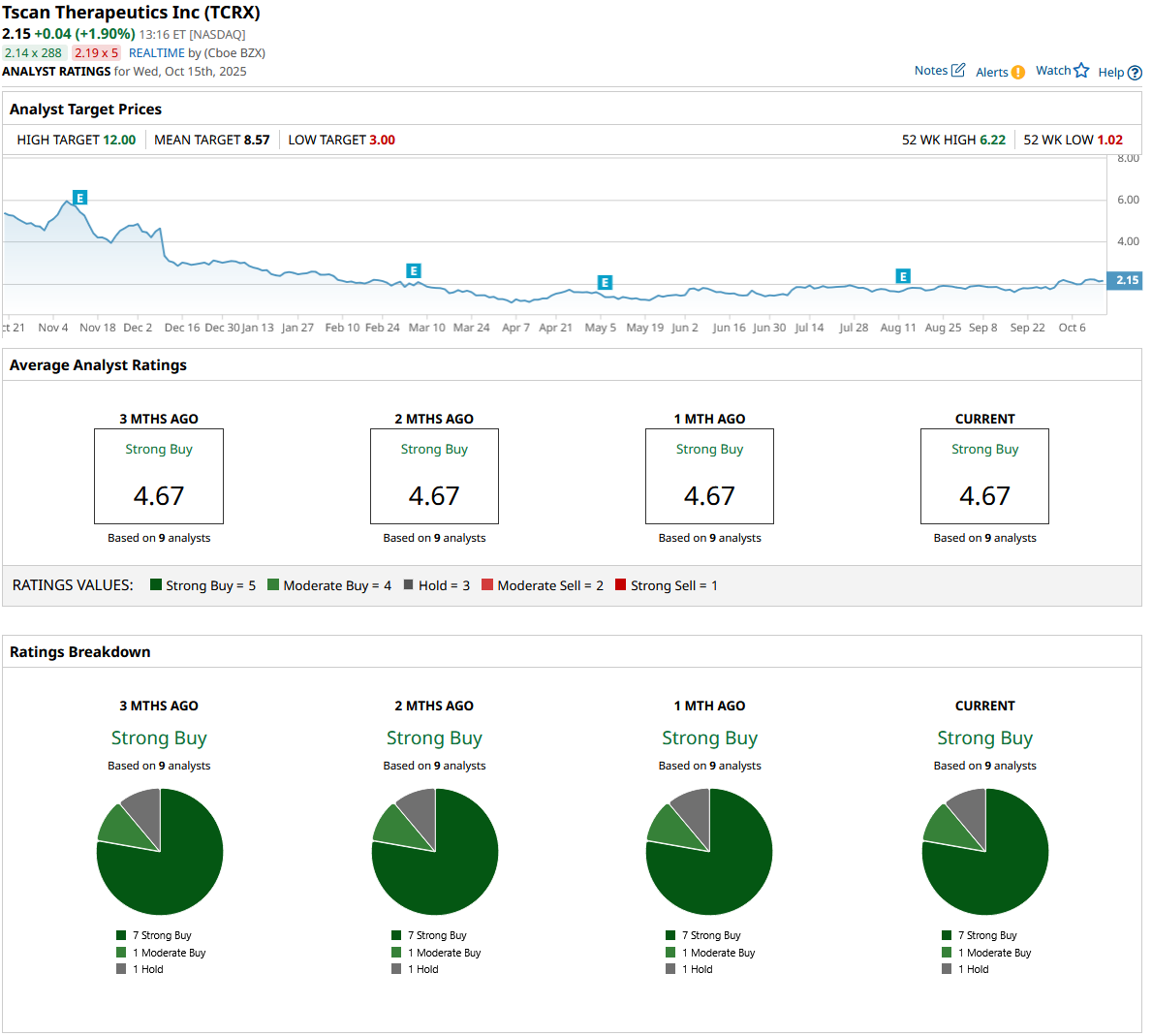

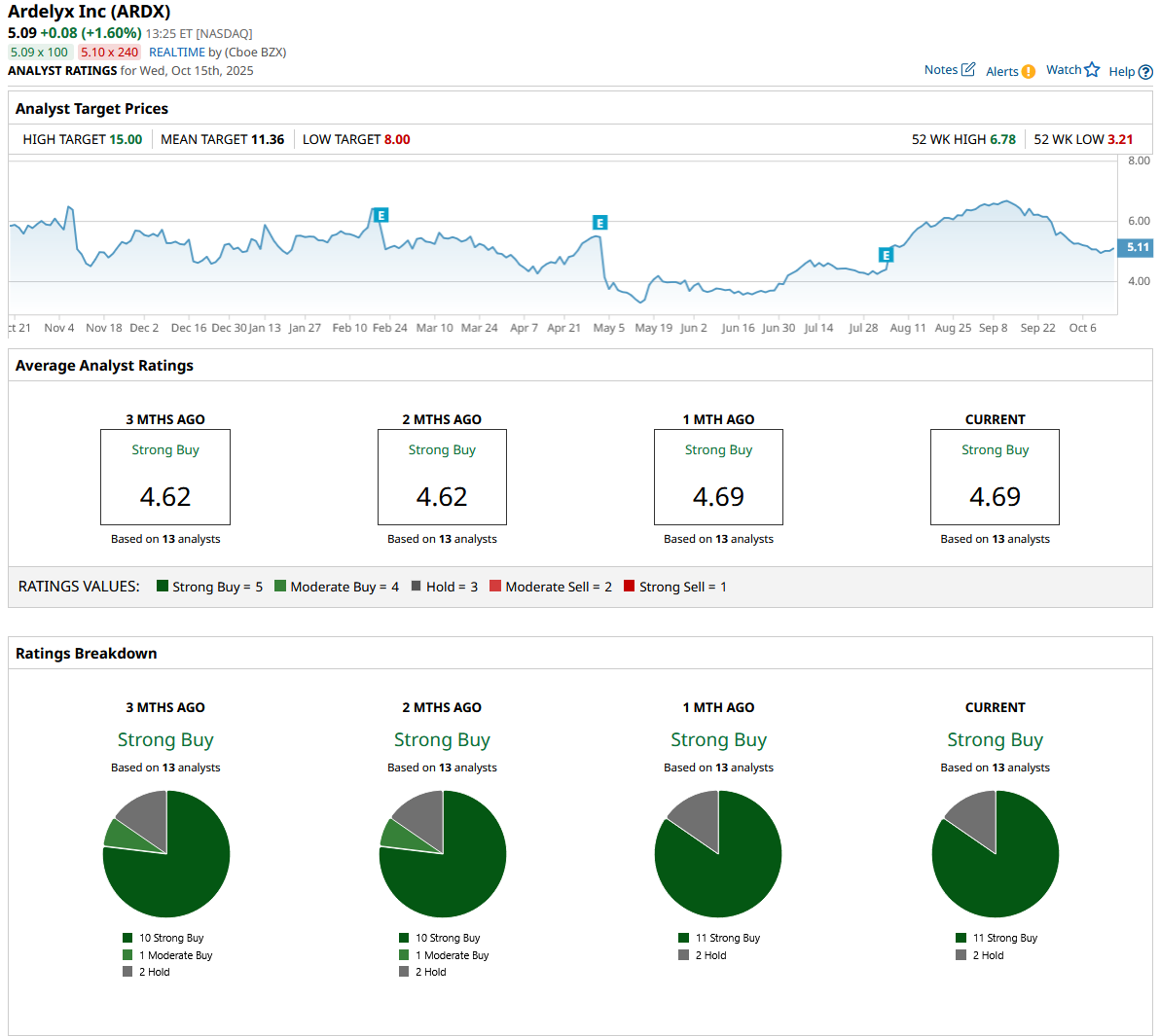

Overall, Wall Street rates Ardelyx stock a consensus “Strong Buy.” Out of the 13 analysts who cover ARDX, 11 recommend a “Strong Buy,” and two recommend a “Hold.” The average analyst price target of $11.36 represents a potential 123% increase from current levels. Furthermore, the high price estimate of $15 implies an upside potential of 194% over the next 12 months.

Stock #2: TScan Therapeutics (TCRX)

Valued at $119.4 million, TScan Therapeutics, a clinical-stage biotech company, is quietly advancing one of oncology's most promising developments: modified T cell receptor (TCR-T) therapies. This strategy uses a patient's immune system to target and remove cancer cells. TScan stock has lost over 28% YTD, lagging the overall market. While the stock stays under the radar, its clinical and financial development in 2025 implies that this biotech has long-term prospects.

The company presently has two active programs. The first is the ALLOHATrial, which is investigating TSC-101, its lead candidate, to treat blood malignancies such as acute myeloid leukemia (AML), acute lymphoblastic leukemia (ALL), and myelodysplastic syndrome (MDS) after stem cell transplantation. TSC-101 is intended to treat residual disease and prevent relapses in post-transplant patients. TScan plans to present two-year relapse results from its ALLOHA Phase 1 trial before the end of the year. This report could validate the company's strategy.

Depending on regulatory feedback, the company plans to conduct a registrational study for TSC-101 in the second half of 2025.

The second current project is the PLEXI-T Trial, which aims to treat solid tumors with multiplex TCR-T treatment, which targets numerous cancer-associated antigens at once. The company intends to administer multiplex TCR-T treatment to its first solid tumor patients in the third quarter of 2025, with trial results expected to be shared by the first quarter of 2026.

Management stressed that TScan's goal is to develop a scalable, commercial-ready method for its therapies that decreases manufacturing time and costs, thereby boosting the company's long-term outlook. The company made $3.1 million in sales in the second quarter, primarily from its ongoing collaboration with Amgen. Net loss stood at $37 million, given its accelerated clinical activity. With a cash balance of $218 million, TScan has sufficient liquidity to fund operations until the first quarter of 2027.

If its ALLOHA Phase 1 findings indicate lower relapse rates in blood cancers, and its PLEXI-T solid tumor trial shows early efficacy, TScan could become a key player in the next wave of immuno-oncology innovation. With a strong balance sheet, a burgeoning clinical pipeline, and many catalysts on the way, this underappreciated biotech stock could be one of the most important under-the-radar stories in healthcare this year.

Overall, Wall Street analysts rate TCRX stock a consensus “Strong Buy.” Of the nine analysts covering the stock, seven rate it a “Strong Buy,” while one recommends a “Moderate Buy” and one suggests a “Hold.” The stock’s average analyst target price of $8.57 suggests upside potential of about 300% over the next 12 months. The high price target estimate stands at $12, which suggests the stock can climb as much as 460% from current levels.