For savvy investors looking for long-term businesses that not only dominate their industries today but also have the innovation engine to continue leading tomorrow, two stocks stand out to me.

For long-term investors looking to diversify their portfolio, two consistent cash-generating businesses, Alphabet (GOOGL) and Eli Lilly (LLY), are the best bets this month.

Why Google Stock Deserves a Spot in Your Portfolio

The first on my list is Google’s parent company, Alphabet. With a market cap of $2.5 trillion, Alphabet is a tech giant with dominance across search, advertising, video, and cloud computing. Now, the company is also reinventing itself at the heart of the artificial intelligence (AI) revolution.

GOOGL stock is up 7.3% year-to-date, underperforming the tech-led Nasdaq Composite Index’s ($NASX) gain of 11.8%.

In the second quarter, total revenue hit $96.4 billion, up 14% year-over-year. Earnings rose 22% year-over-year to $2.31 per share. Search remains Alphabet’s most important business and its largest revenue driver, and it is thriving in the AI era. Search revenue jumped 11.7% to $54.2 billion. Another highlight of Q2 was Google Cloud's performance driven by AI. Cloud revenue jumped 32% year-over-year to $13.6 billion, with the backlog reaching $106 billion, up 38% year-over-year. Both new customers and existing enterprises are trusting Google’s differentiated AI-first cloud offering. Additionally, YouTube's revenue increased by 13% year over year, fueled by both brand advertising and direct response.

Alphabet is increasing capital expenditures to $85 billion in 2025, mostly in servers and data centers, to meet the rapidly increasing demand for cloud and AI. Despite significant investments in technical infrastructure, free cash flow over the past 12 months totalled $66.7 billion. Alphabet returned $13.6 billion through share repurchases and $2.5 billion in dividends in Q2 alone, rewarding investors while maintaining $100 billion in cash and equivalents. Thanks to this financial firepower, it can continue to make significant investments in AI and provide value to shareholders.

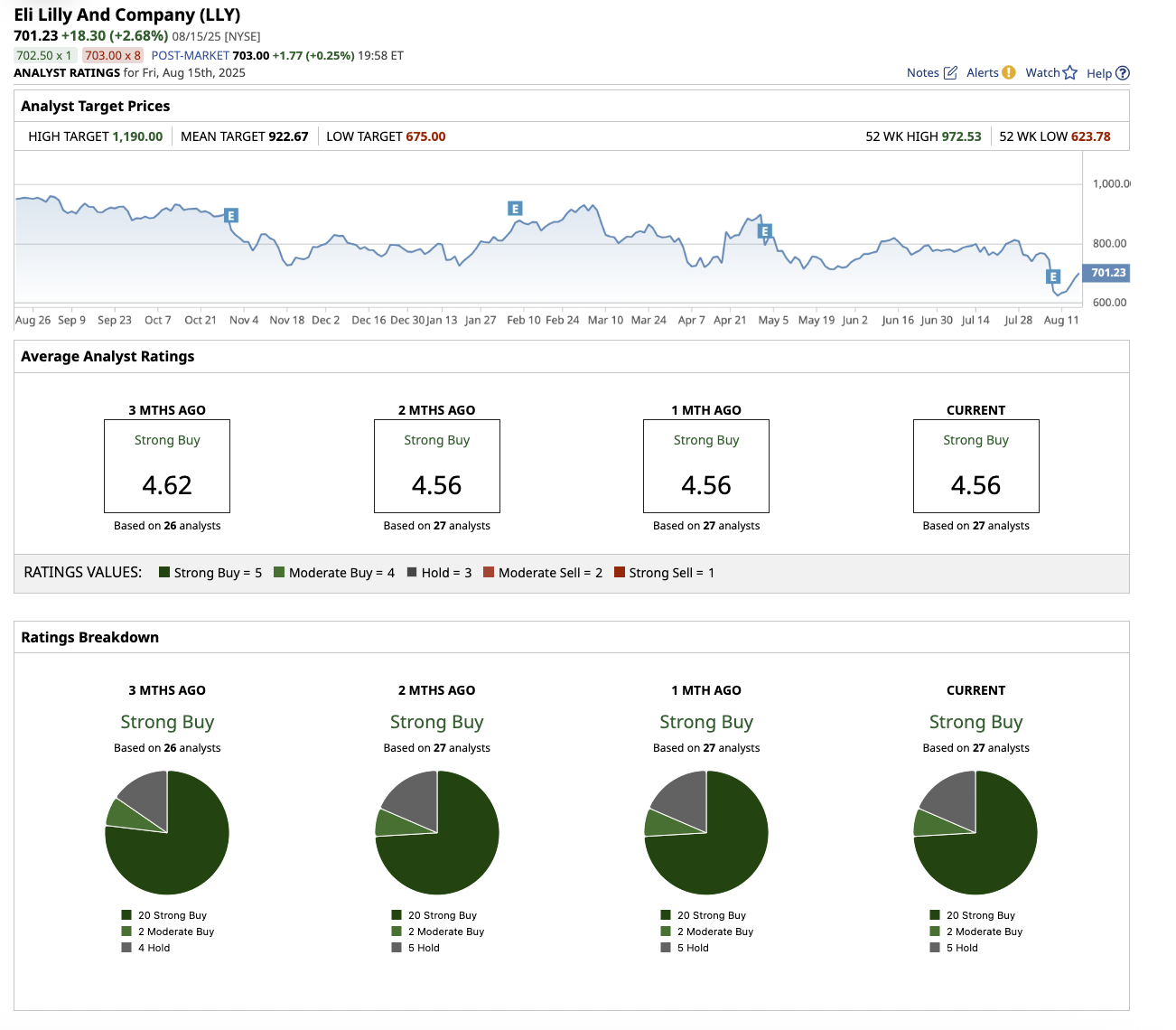

Overall, on Wall Street, GOOGL stock is a “Strong Buy.” Of the 54 analysts covering the stock, 41 rate it a “Strong Buy,” four say it is a “Moderate Buy,” and nine rate it a “Hold.” The average target price of $220.92 implies the stock can climb by 8.4% from current levels. Plus, its high price estimate of $250 suggests the stock has an upside potential of 24% over the next 12 months.

Alphabet has strong moats thanks to its double-digit growth in Search, accelerating momentum in YouTube, and a thriving Google Cloud business. Furthermore, new growth bets on autonomous driving and a full-stack AI strategy position the company as one of the most attractive opportunities in big tech right now.

Why Eli Lilly Stock Deserves a Spot in Your Portfolio

The second stock on my list is Eli Lilly, a global pharmaceutical powerhouse, valued at $663 billion. Aside from its leadership in the booming market for weight-loss and diabetes therapies, the company is developing ground-breaking treatments in oncology, neuroscience, and autoimmune diseases, among other areas.

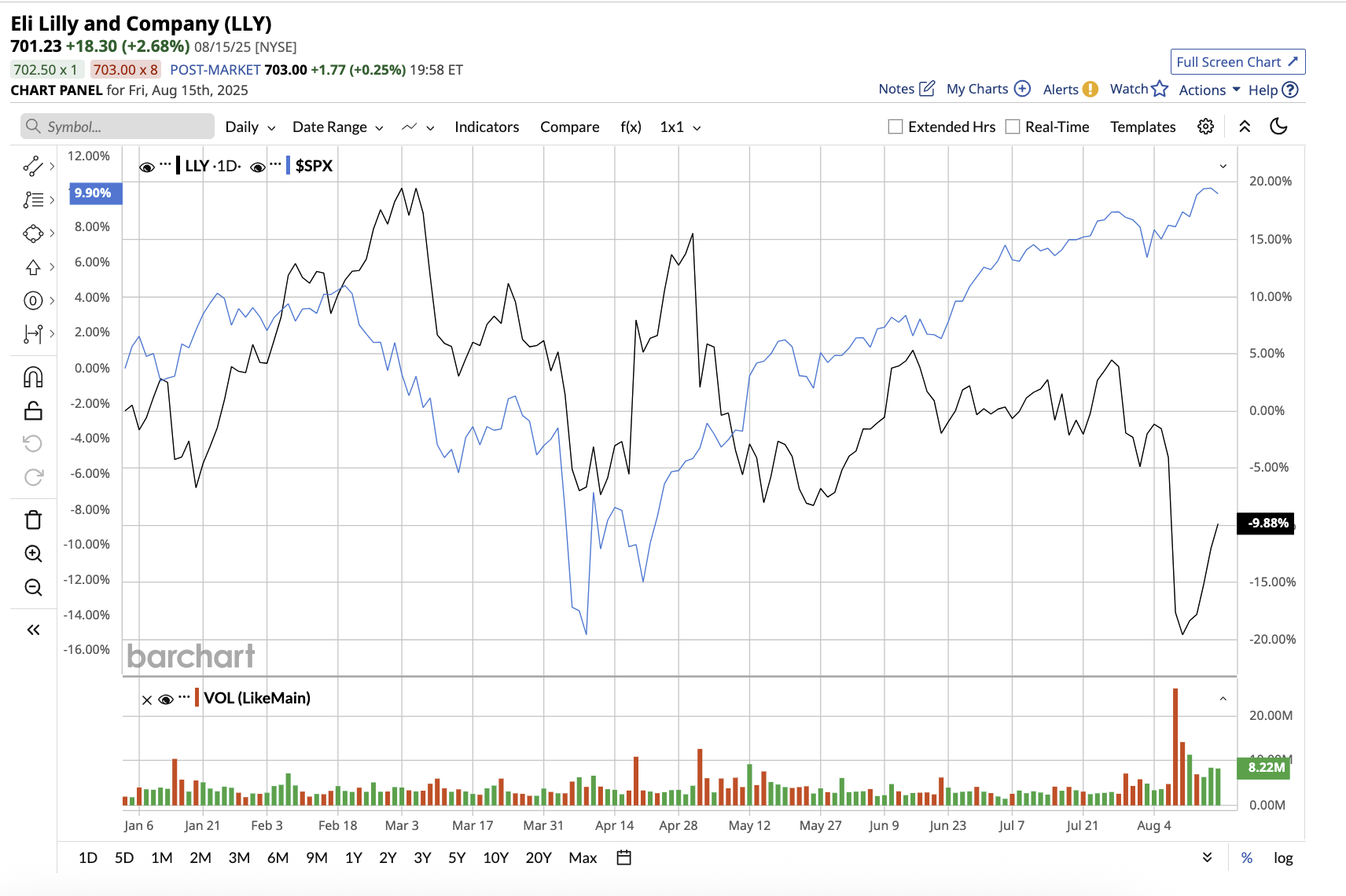

LLY stock has fallen 9.3% year-to-date, compared to the S&P 500 Index’s ($SPX) gain of 9.6%.

Lilly’s current blockbuster products are already driving record sales. Mounjaro, which is used to treat both type-2 diabetes and obesity, has risen to the top of the total incretin prescription market in the U.S., according to management. Meanwhile, Zepbound maintains its dominance in the branded obesity drug market, accounting for two-thirds of all patients in this category. Mounjaro generated $5.2 billion in global sales in the second quarter alone, while Zepbound contributed $3.4 billion.

Total revenue increased 38% year over year, gross margin rose to 85%, and earnings per share increased 61% to $6.31. These results were driven by significant volume growth in its flagship products. While incretin-based therapies dominate headlines, Lilly’s portfolio is diverse and extensive. In oncology, the company is developing drugs such as Jaypirca and Verzenio. In neuroscience, Kisunla, a treatment for Alzheimer’s disease, is gaining traction. Furthermore, Lilly is expanding into next-generation cardiovascular and genetic therapies through acquisitions such as Verve Therapeutics and SiteOne Therapeutics.

Importantly, Lilly is aggressively reinvesting to ensure its long-term growth prospects. R&D spending increased by 23%, boosting both late-stage trials and early stage research in oncology, neuroscience, and cardiovascular health. Eli Lilly not only reinvests in growth, but it also rewards shareholders along the way. In Q2, the company paid out $1.3 billion in dividends and repurchased $700 million of stock.

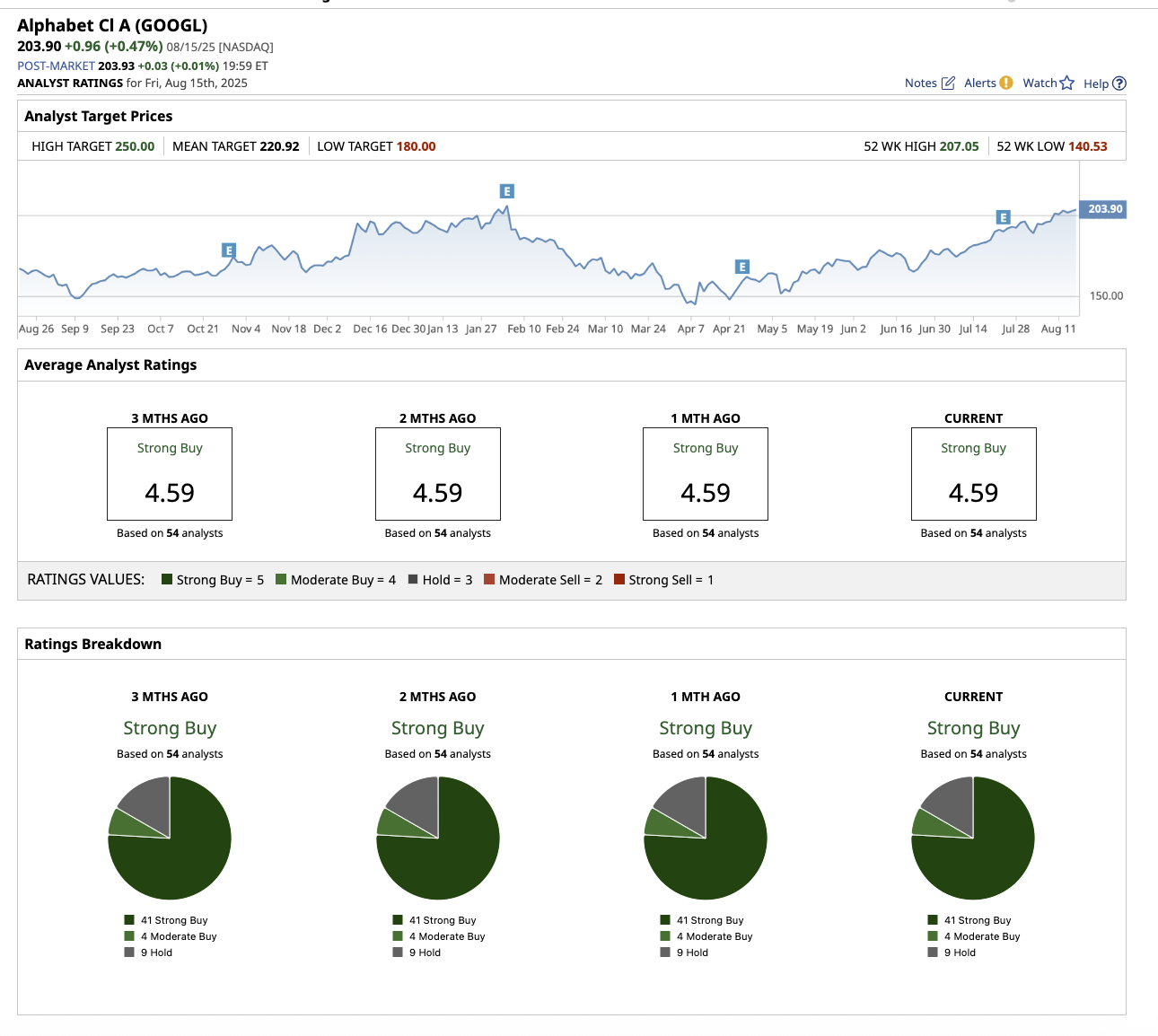

On Wall Street, Eli Lilly has earned an overall “Strong Buy” rating. Of the 27 analysts who cover the stock, 20 rate it a “Strong Buy,” two a “Moderate Buy,” and five recommend a “Hold.” The average analyst price target of $922.67 suggests a 32% increase from current levels. Furthermore, the Street-high estimate of $1,190 implies that the stock could rally by up to 70% over the next year.

Eli Lilly offers a great combination of explosive short-term growth and durable long-term potential. Its dominance in obesity and diabetes, breakthrough results in oral GLP-1 therapy, expanding oncology and neuroscience portfolio, and disciplined financial strategy all point toward sustained outperformance.