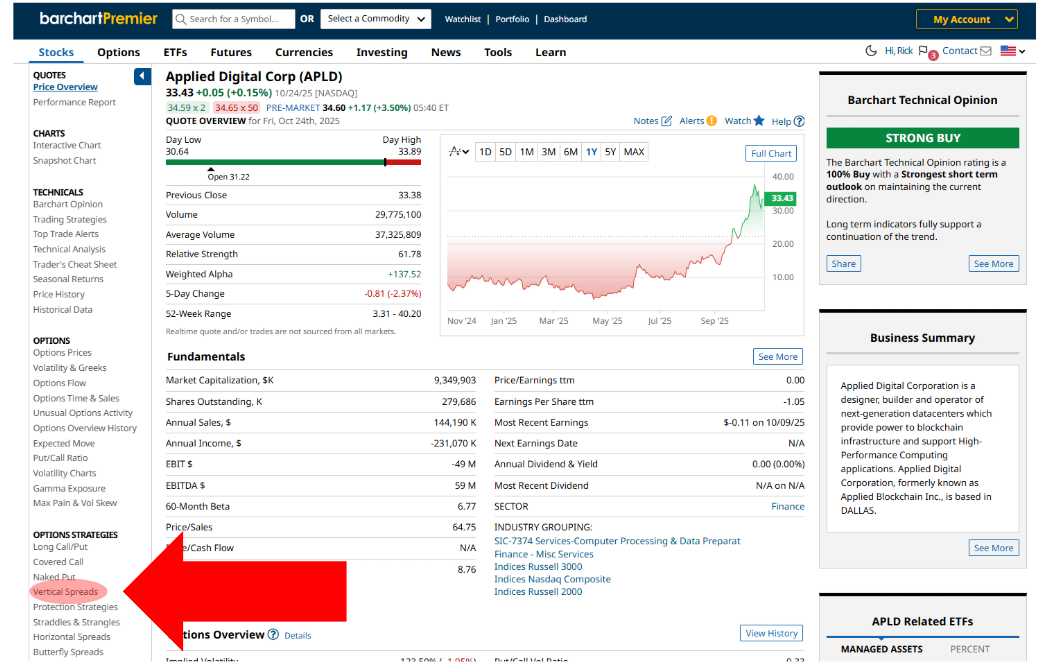

Applied Digital is having a great year. After trading below $10 for most of the first half of 2025, the stock went sky-high, reaching $40.20 in intraday trading on October 16 before pulling back to around $33 at the recent close. Overall, the stock is up over 337% year-to-date and 306% in the last 52 weeks.

Back in August, Wall Street set a high target price of $24 for APLD. Today, it’s $56, backed by a Strong Buy consensus. So, it’s fair to say that the market is extremely bullish on Applied Digital’s prospects.

But how do you capitalize on this bull run without being long on the stock? Well, I have two option strategies for you: one for the adventurous trader, and one for the more conservative investor. Let’s get into it.

Adventurous Trader: Deep ITM LEAPS Long Call

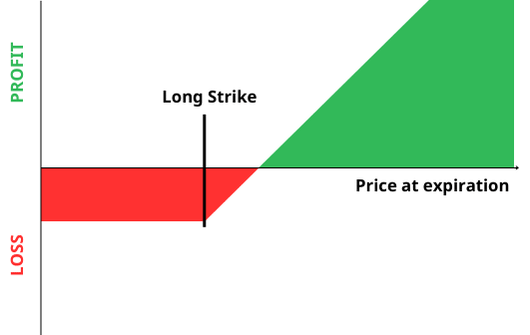

A long call is an options contract that gives the buyer the right to buy the underlying asset at a specific strike price at or before a specified expiration date. It’s popularly used to speculate on the stock’s upside potential within the option’s “lifespan.”

Long-Term Equity Anticipation Securities (LEAPS) are options that expire in 1 year or more, while deep in-the-money (ITM) call options have strike prices that are significantly below the current trading price, giving the trade immediate intrinsic value.

Merged together, a deep ITM LEAPS long call gives the trader stock-like upside exposure, more time for the trade to work out, less overall value loss during the option’s active dates (theta or time decay) than short-dated options, and unlimited potential upside. The objective is for the stock to trade above the strike price at expiration.

However, deep ITM LEAPS calls can be expensive and tie up significant capital right at the outset.

Trade Example

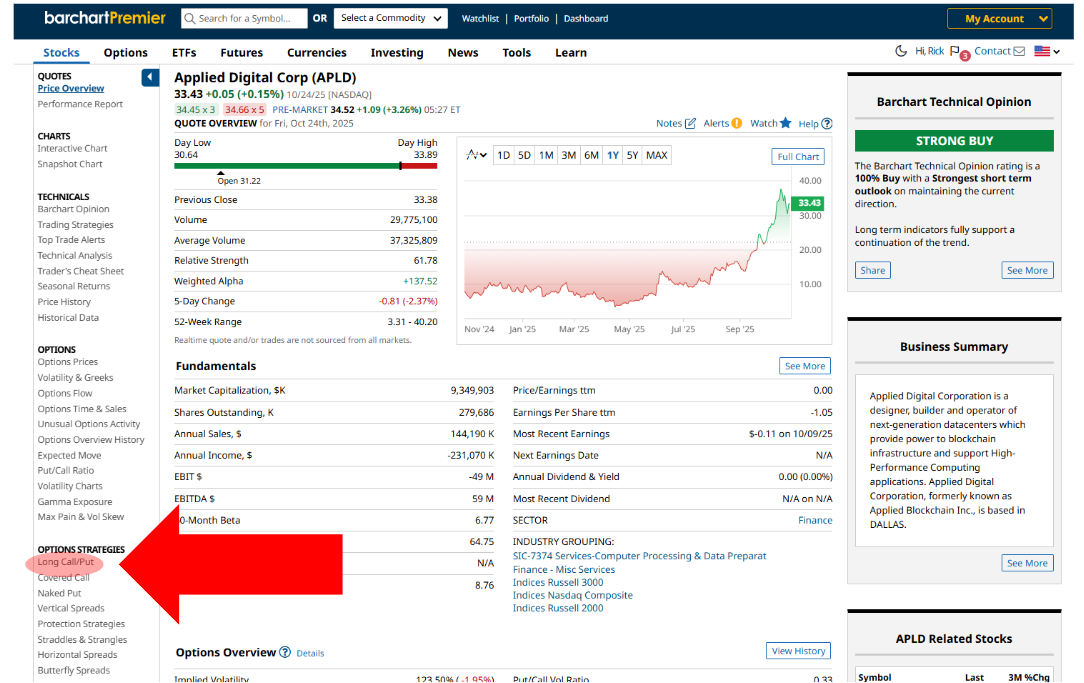

You can quickly find the Long Call Option Screener section from Applied Digital’s stock profile page on Barchart right here.

From there, I switched the expiration date to January 15, 2027, 447 days away from now, and chose this trade:

According to the options chain, you can buy a 20-strike long call on APLD that expires on January 15, 2027. This trade costs $21.20 per share or $2,120 per contract. Your breakeven price will be $41.20, and the trade has a delta of 85.

Delta is the options Greek that indicates the relationship between the option premium and the stock price. A long call with a delta close to 100 suggests that the option will move almost in step with the stock.

Potential Results

Now, if APLD reaches $56 before January 2027, your long call will be ITM and have $36 in intrinsic value, calculated by subtracting the trading price from the strike price.

However, since options also have extrinsic value - the portion of the premium that accounts for implied volatility, time left to expiration, interest rates, etc - your 20-strike APLD will likely cost more than $36. You can sell the option on the market to maximize your returns.

If, however, APLD trades below your $20 strike price at expiration, your trade will end at the maximum loss. The maximum loss is limited to the entire premium you paid, so that’s $2,120.

Conservative Investor: Bull Put/Put Credit Spread

Now, let’s switch gears to the bull put strategy.

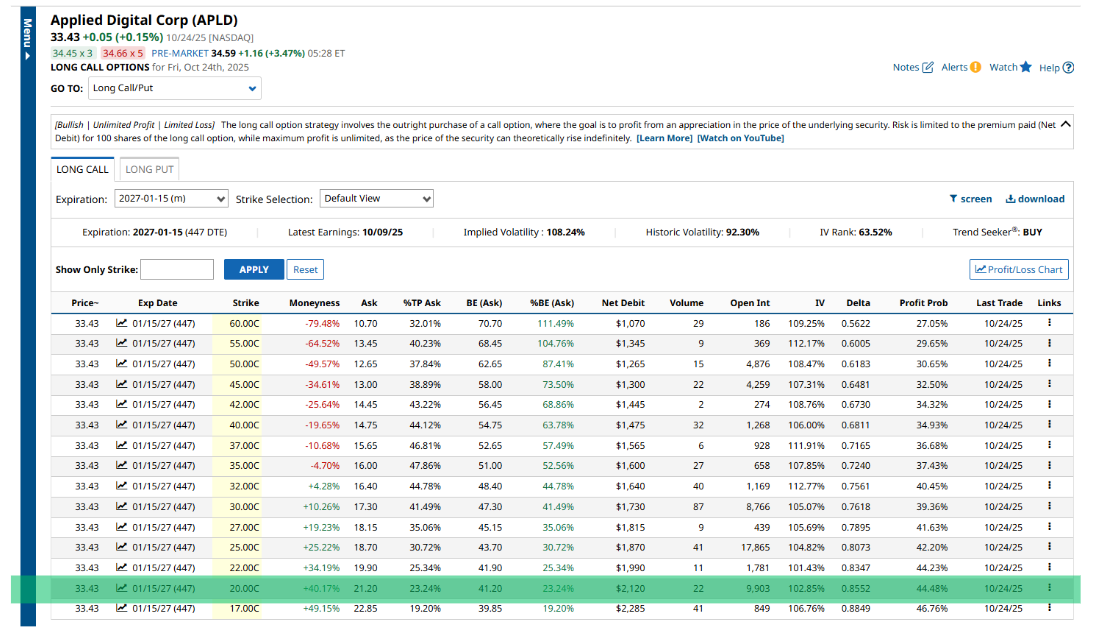

A bull put spread, also known as a put credit spread, is a vertical options strategy that involves selling an out-of-the-money (OTM) put option that’s close to or at the money, while simultaneously buying a put option with a lower strike price on the same underlying asset and expiration date.

The long put sets a floor on the trade and results in a net credit, since the premium received from selling the higher strike put is greater than the premium paid for the lower strike put. The objective is for the stock to remain above the short put strike at expiration. If that happens, both options expire worthless, and you keep the full net credit.

Like the deep ITM LEAPS long call, a bull put benefits from rising stock prices. However, unlike ITM LEAPS long calls, bull put spreads have limited upside, as profits are capped at the credit received.

The Bull Put Screener can be accessed through Vertical Spreads under Option Strategies right here:

For this example, I’ll look at bull puts with around 30 days to expiration (DTE).

Trade Example

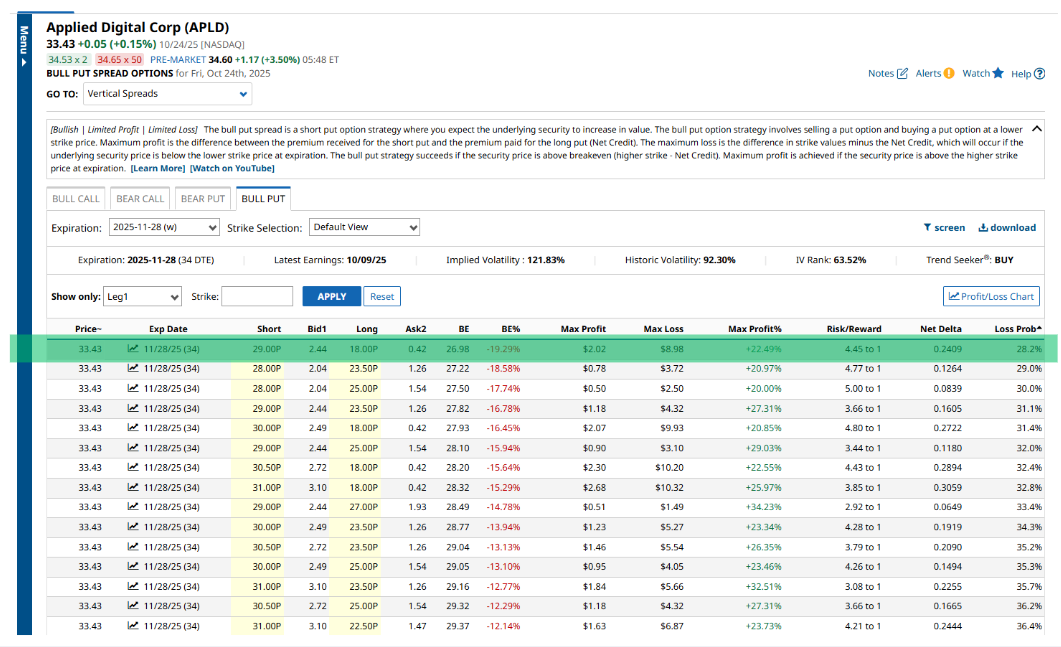

I’ll be using this trade as an example:

So, according to the screener results, you can sell an OTM bull put spread on APLD by selling a 29-strike put for $2.44 and buying an 18-strike put for 42 cents per share, bringing your total net credit to $2.02 per share or $202 per contract.

Your maximum potential loss is $8.98 per contract, which is calculated by taking the difference between the strike prices or the width of the spread ($29 - $18 = $11) and subtracting the net debit ($11 - $2.02 = $8.98). The trade expires in 34 days on November 28, 2025.

Potential Results

As long as APLD stock trades above $29 per share by November 28, your bull put will expire OTM or worthless, meaning you keep the $202 net credit. This is your maximum profit, no matter how high APLD goes.

However, if APLD trades below $18 long put strike, your trade will be in the money, which means your trade will end with a $898 total loss. Even if APLD goes to $0, that’s all you lose.

Final Thoughts

Both strategies I’ve covered are bullish, but deep ITM LEAPS long calls offer unlimited upside but require significant capital, which makes them suitable for traders with higher risk appetites.

On the other hand, OTM bull puts start with a credit, have limited losses, but also have capped profits, making them ideal for more conservative investors.

At the end of the day, your strategy choice will always depend on your risk appetite. However, it’s also essential to consider factors like market outlook, time horizon, theta decay, and market volatility. Always do your due diligence so you won’t get caught up in hype cycles and FOMO.