/Solar%20panels%20in%20nature%20sunny%20by%20Mrganso%20via%20Pixabay.jpg)

The demise of solar is greatly exaggerated.

At least that was the case on Monday as Sunrun (RUN) stock gained more than 5% after RBC Capital raised its target price by 38% to $22, above its current share price.

In addition to the solar panel installer’s stock gaining 5% on the day, RUN moved up five positions in Barchart’s Top 100 Stocks to Buy to the 68th spot.

Over the past 12 months, Sunrun’s stock has increased by 40.31%. However, its weighted alpha is 198.61, which suggests that the near-term gains it has made could continue beyond yesterday’s 5% boost.

It’s been a while since I’ve considered Sunrun’s stock. Clearly, analysts are warming up to its business. Of the 22 analysts covering its stock, 12 rate it a Buy (4.05 out of 5). Notably, three months ago, its rating was 3.70 out of 5.

Sunrun looks ready to run higher. I’ll consider three reasons why this is the case.

How’s Sunrun’s Valuation?

MarketWatch published an opinion piece by Brett Arends recently entitled Opinion: Dumbest stock market in history? It’s even worse than you imagined.

According to Arends, based on data from the BofA Securities Global Fund Managers survey, 133 of 166 money managers said that global equities are overvalued. That’s what you’d call a majority.

Arends goes on to say that the Shiller P/E ratio — the average earnings of the past 10 years, adjusted for inflation — is currently 40 times, more than double the historic average. Only once in history has it exceeded 40, and that was in the dot.com bubble in 1999 and 2000.

AI stocks may be contributing to the existing overvaluation. We’ll only know this in hindsight years down the road.

So, this brings me to Sunrun’s valuation.

Barchart data suggests the company will earn $1 a share in 2025, but only $0.11 in 2026. If that’s the case, it trades at 20.5 times 2025 EPS and 186 times 2026 EPS. That’s a tremendous gap. How this plays out is anybody’s guess.

The company reports its Q3 2025 results on Nov. 6 after the market closes. In the second quarter, its revenues increased by 9%, but more importantly, its net income was $279.8 million, representing a 101% increase over the same quarter in 2024.

One thing to keep in mind is that the net income attributable to Sunrun shareholders is calculated after deducting noncontrolling interests from investors in its investment funds.

So, in the second quarter, the GAAP net loss was $279 million. After deducting $558.8 million in net losses attributable to noncontrolling interests, the net income to Sunrun shareholders was $279.8 million.

Clearly, valuing Sunrun’s stock is challenging given that the solar industry’s future in the U.S. faces headwinds due to the One Big Beautiful Act--it aims to eliminate investment tax credits (ITC) between now and 2030--which passed into law on July 4.

So, I’ll put aside the entire capital raising function of the company for now — I’ll return to the subject below — and consider its operating losses.

For the first six months of 2025, they were $227.1 million, down from $311.2 million in the same period the previous year. Based on the first six months of Sunrun’s past five fiscal years, the latest period is the lowest operating loss of all of them, according to S&P Global Market Intelligence.

It’s going in the right direction on its pathway to profitability.

Sunrun’s Future Business Model

President Trump may have done Sunrun a favor by passing legislation to sunset ITCs for solar projects.

I’ve never understood businesses that survive based on these tax-driven investments. One of my earliest jobs after university was selling flow-through shares for oil and gas projects to affluent investors such as doctors and lawyers. The company passes the exploration and development expenses for a project to the investor, who deducts the expenses from their income.

I’m not suggesting that this type of financing is a bad thing, far from it. ITCs can lower the cost of capital for companies seeking funding for projects that often take years to mature.

The same principle applies to ITCs for solar energy. Sunrun’s customer agreements are 20 to 25 years in length, involving the installation of solar systems and battery storage equipment that aren’t cheap. Sunrun absorbs the upfront cost in exchange for stable long-term income. It’s a win/win.

I understand that you have to fund the equipment somehow. Incentivizing individuals and investors through ITCs is acceptable as long as the project's long-term profitability is attainable.

The wakeup call that is the OBBA should help Sunrun establish a business model that includes a funding structure that enables it to both grow its business and generate profits.

If a project can only exist because of ITCs, is it really a viable business or investment opportunity?

In 2025, the company’s guidance for aggregate subscriber value--defined as the present value of upfront and future cash flow per subscriber multiplied by subscriber additions in a given period--is $5.85 billion at the midpoint of its outlook.

If this $5.85 billion in cash flow isn’t profitable without ITCs, there is no point in Sunrun’s existence.

I believe that the company can find a better financing model that doesn’t rely on the whims of federal, state, and municipal governments for its success.

To me, if you’re an aggressive investor, that’s the potential upside: that Sunrun does find a better business model.

The Bottom Line on Sunrun Stock

You’ve probably read recently about the energy requirements for AI, and how it is testing our ability to produce enough power to run all the data centers required for AI computer processing.

It’s staggering.

“By 2030, the world’s data centers are on course to use more electricity than India, the world’s most populous country, Haas said. Finding ways to head off that projected tripling of energy use is paramount if artificial intelligence is going to achieve its promise, he said,” Bloomberg News contributor Ian King reported comments made by Arm Holdings Plc CEO Rene Haas in April 2024.

The need for solar power isn’t going away, whether the U.S. government wants it to disappear or not. Every possible source of energy, especially clean energy, will continue to be necessary for the success of AI.

I believe that there are enough savvy investors out there who understand that solar energy isn’t mutually exclusive to fossil fuel-generated energy. The two can and must co-exist.

Should I allocate 20% of my investment portfolio to Sunrun stock? Heck no. That said, risk-tolerant investors should view it as a high-risk/high-reward investment worthy of consideration.

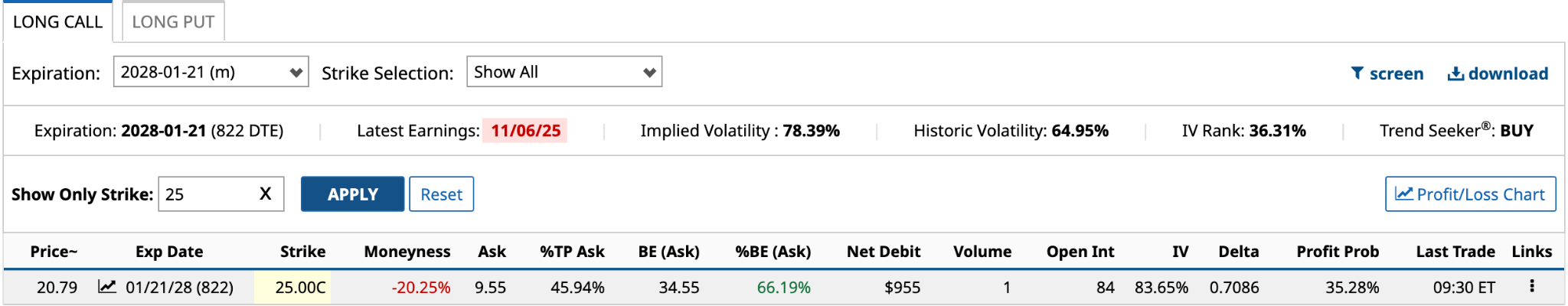

Here’s a possible call option to consider to reduce your upfront cost.

It’s only 20% out of the money and 46% away from the $34.55 breakeven. RUN stock last traded around $35 in September 2022, reducing your upfront cost by slightly more than 50% to $955.