Consumer confidence in America is on a slight decline due to such volatile factors as tariffs, increasing prices and a weakening job market. Despite these indicators of a softening in many Americans’ trust in their own incomes, there are a number of large cities throughout the country in which the median household earnings can still cover all costs of living and more.

Also See: Are You Rich or Middle Class? 8 Ways To Tell That Go Beyond Your Paycheck

Learn More: 3 Reasons Retired Boomers Shouldn't Give Their Kids a Living Inheritance (And 2 Reasons They Should)

GOBankingRates recently studied the top 100 cities (by population) via the U.S. Census Bureau. With that information, as well as the median household income vs. cost of living in each of those cities, GOBankingRates found the cities in each corner of America where the median income can last the longest.

In the West, your paycheck goes the furthest in Gilbert, Arizona. Check out the other Western cities where your money lasts longest.

10. Bakersfield, California

- Median household income: $77,397

- Annual cost of necessities: $52,552

- What’s left: $24,845

In Bakersfield, California, the average cost of living is $52,552 — that’s a not-insignificant 68% of the median household income for the city. However, the median household income of Bakersfield is high enough to withstand such a bite, with nearly $25,000 left over. That’s enough to both start and fund a healthy savings account every year, with enough cash left over for luxuries and extravagances.

Find More: How Paychecks Would Look in Each State If Trump Dropped Federal Income Tax

See More: Here’s the Minimum Salary Required To Be Considered Upper-Middle Class in 2025

9. Denver

- Median household income: $91,681

- Annual cost of necessities: $66,274

- What’s left: $25,407

Denver’s cost of living eats up even more of the city’s median household income than Bakersfield — specifically, 72%. Like Bakersfield, though, Denver residents also enjoy a comfortable income, with median household earnings approaching nearly $100,000. Even with Denver’s pricey cost of living, the average citizen still has a little over $25,000 annually to play with.

Discover More: What Class Do You Actually Belong To? The Income Breakdown Might Shock You

8. Henderson, Nevada

- Median household income: $88,654

- Annual cost of necessities: $61,488

- What’s left: $27,166

Henderson enjoys a close proximity to Las Vegas and its businesses, and Nevada has no state income tax — two very significant reasons Henderson has a healthy economy in which residents can afford the annual $61,488 in necessary expenses. Even with nearly 70% of their earnings going toward bills, citizens of Henderson are left with over $27,000 annually.

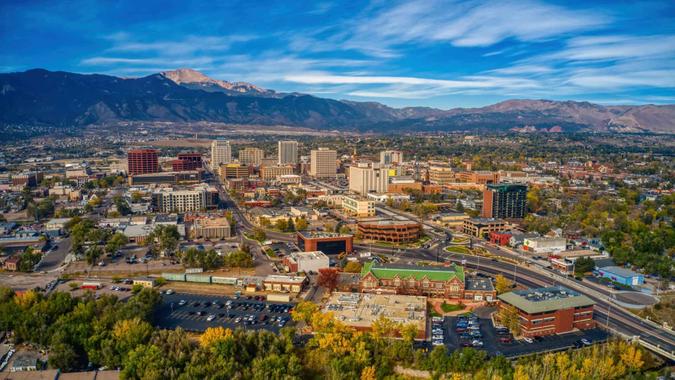

7. Colorado Springs

- Median household income: $83,198

- Annual cost of necessities: $55,336

- What’s left: $27,862

Colorado Springs has a relatively high cost living, but it also has a fairly high median household income, due to such industries as technology, aerospace and military and defense organizations. Those factors allow those living in Colorado Springs to withstand the nearly 67% of their annual income that pays the bills.

6. Seattle

- Median household income: $121,984

- Annual cost of necessities: $92,020

- What’s left: $29,894

Seattle can be an extraordinarily expensive city to live in — the annual cost of living approaches nearly $100,000. That’s far more than the median household income in most American cities. Seattle, though, also has a job market anchored by many well-paying and very successful companies — e.g., Amazon, Boeing and Microsoft. Despite spending 75% of income to keep the lights on, Seattle residents still have nearly $30,000 left over at the end of the year.

5. Fremont, California

- Median household income: $176,350

- Annual cost of necessities: $143,508

- What’s left: $32,842

Fremont is another extremely pricey city, with the annual cost of living hitting a whopping $143,508 — that’s nearly three times as expensive as Bakersfield. So, how can a paycheck go far there? Fremont is essentially a manufacturing hub for California’s incredibly lucrative Silicon Valley. As such, the median household income of $176,350 is able to withstand the 81% cost of necessities there.

Read More: Here’s the Minimum Net Worth To Be Considered Upper Class in Your 50s

4. Santa Clarita, California

- Median household income: $119,926

- Annual cost of necessities: $85,712

- What’s left: $34,214

Compared to Fremont, in which 81% of the median household income goes to annual expenses, Santa Clarita is almost cheap with its 71% cost-of-living rate. The film, manufacturing, aerospace and biomedical industries that do business in Santa Clarita keep the median household income generously high, allowing its citizens to hang onto their checks long after the dues are paid.

3. Anchorage, Alaska

- Median household income: $98,152

- Annual cost of necessities: $58,815

- What’s left: $39,337

Nearly $40,000 is left after paying the yearly bills in Anchorage. This is despite the fact that Anchorage’s cost of living is almost $60,000 annually. Those who don’t mind the chilly weather can find in Anchorage a very healthy economy driven by coal, gas and petroleum companies, as well as various mining and tourism industries — all of which keep the city’s paychecks healthy.

2. Chandler, Arizona

- Median household income: $103,691

- Annual cost of necessities: $62,312

- What’s left: $41,379

Chandler is another city with an economy buttressed by profitable tech companies and manufacturers, such as Intel. Other major entities like GM and PayPal also have hubs in Chandler. With so many booming businesses, residents of Chandler have a median household income that clears $100,000, which allows them to keep a significant amount of their paychecks — over $40,000.

1. Gilbert, Arizona

- Median household income: $121,351

- Annual cost of necessities: $65,500

- What’s left: $55,851

Agriculture, as well as technology employers such as Lockheed Martin and Tokyo Electron, have major bases of operation in Gilbert. That keeps the median income over $120,000. That rather high income level makes the $65,000 annual cost of living more than affordable, with average residents keeping nearly half their checks to themselves.

Methodology: For this study, GOBankingRates analyzed the top 100 cities by population, as sourced from the U.S. Census 2023 American Community Survey. Cost of living was sourced from Sperling’s BestPlaces, the average expenditure cost for all households was sourced from the Bureau of Labor Statistics Consumer Expenditure Survey. The average home value was sourced from Zillow Home Value Index; by assuming a 10% down payment and using the national average 30-year fixed mortgage rate, as sourced from the Federal Reserve Economic Data, the average mortgage was calculated. The average mortgage and expenditures were used to calculate the total cost of living for necessities in each location. Using the median household income, the leftover savings was calculated and sorted to show the largest savings first. All data was collected on and is up to date as of Aug. 18, 2025.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 10 Western Cities Where Your Paycheck Goes the Furthest