Lucid Group Inc (NASDAQ:LCID) stock hit a new all-time low Monday morning, extending a sell-off as negative news erodes investor confidence. The stock’s new low continues a volatile slide from last week.

- LCID is testing critical support. Stay ahead of the curve here.

What To Know: The sell-off was initially triggered by Lucid’s disappointing third-quarter financial results reported on Nov. 5. The luxury EV maker posted an adjusted loss of $2.65 per share, wider than the consensus estimate of a $2.27 loss. Revenue also fell short of forecasts at $336.6 million, with only 4,078 vehicles delivered.

Adding to the downward pressure, Lucid announced an $875 million convertible senior note offering due 2031. While intended to retire 2026 debt, markets reacted negatively to the immediate potential for shareholder dilution.

Compounding these financial worries was a corporate reorganization that included the departure of Eric Bach, Senior Vice President of Product and Chief Engineer.

Despite management bolstering the company’s total liquidity position to $5.5 billion, the lack of an updated 2025 production forecast has left investors wary, driving the stock to its new record low.

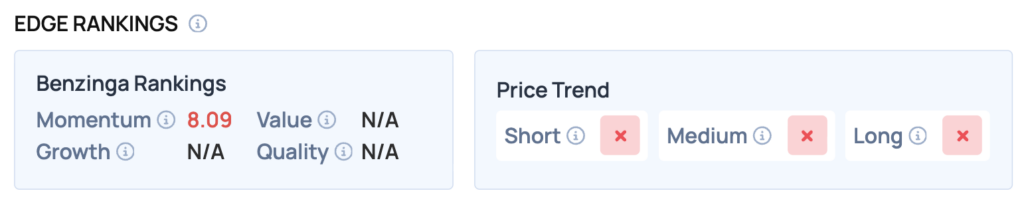

Benzinga Edge Rankings: Reflecting this sharp sell-off, Benzinga Edge Rankings show the stock’s price trend as negative across short, medium and long-term outlooks.

LCID Price Action: Lucid Group shares were down 6.48% at $13.28 at the time of publication on Monday, according to Benzinga Pro data.

How To Buy LCID Stock

By now you're likely curious about how to participate in the market for Lucid Group – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of Lucid Group, which is trading at $13.28 as of publishing time, $100 would buy you 7.53 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock