U.S. stock futures rose on Monday after Friday’s advances. Futures of major benchmark indices were higher.

Optimism among investors is rising following New York Fed President John Williams‘ indication that a rate cut in December is still on the table.

He said in a speech on Friday that “I still see room for a further adjustment in the near term to the target range for the federal funds rate to move the stance of policy closer to the range of neutral.”

Meanwhile, investors await earnings from Dell Technologies Inc. (NYSE:DELL), HP Inc. (NYSE:HPQ), Deere & Co. (NYSE:DE), Li Auto Inc. (NASDAQ:LI), and others in this Thanksgiving holiday-shortened week.

The 10-year Treasury bond yielded 4.05% and the two-year bond was at 3.51%. The CME Group's FedWatch tool‘s projections show markets pricing a 73.5% likelihood of the Federal Reserve cutting the current interest rates during its December meeting.

| Futures | Change (+/-) |

| Dow Jones | 0.03% |

| S&P 500 | 0.30% |

| Nasdaq 100 | 0.51% |

| Russell 2000 | 0.20% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Monday. The SPY was up 0.19% at $660.28, while the QQQ advanced 0.37% to $592.25, according to Benzinga Pro data.

Stocks In Focus

Pony AI

- Pony AI Inc. (NASDAQ:PONY) rose 2.59% in premarket on Monday as it announced a partnership with ride-hailing platform Sunshine Mobility to build a large-scale autonomous driving fleet.

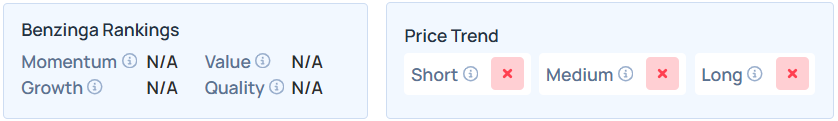

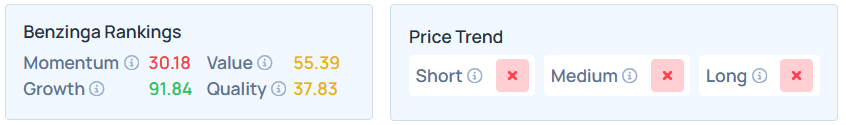

- Benzinga’s Edge Stock Rankings indicate that PONY maintains a weaker price trend over the short, long, and medium terms. Additional performance details are available here.

WeRide

- WeRide Inc. (NASDAQ:WRD) jumped 7.92% as its revenue grew 144.3% year-over-year to $24.0 million and gross profit rose 1,123.9% YoY to $7.9 million in the third quarter.

- WRD maintained a weaker price trend over the short, long, and medium terms. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Alphabet

- Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) gained 2.38% after it surpassed Microsoft Corp. (NASDAQ:MSFT) in market value on Friday, following the launch of Gemini 3 and Nano Banana last week.

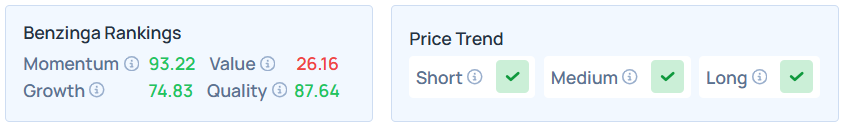

- Benzinga’s Edge Stock Rankings shows that GOOG maintains a stronger price trend over the short, medium, and long terms, with a strong quality ranking. Additional information is available here.

Zoom Communications

- Zoom Communications Inc. (NASDAQ:ZM) was 0.52% higher ahead of its earnings expected to be released after the closing bell. Wall Street expects earnings of $1.21 per share on revenue of $1.21 billion.

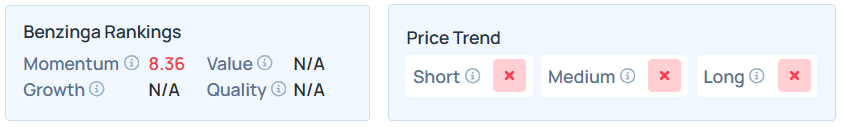

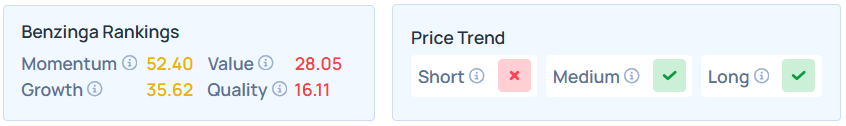

- It maintained a weaker price trend over the short, medium, and long terms, with a strong growth ranking. Additional performance details, as per Benzinga's Edge Stock Rankings, are available here.

Keysight Technologies

- Keysight Technologies Inc. (NYSE:KEYS) was up 0.45% as analysts expect it to report earnings of $1.77 per share on revenue of $1.39 billion after the closing bell.

- KEYS maintained a weaker price trend over the short term but a strong trend in the medium and long terms, with a poor value ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Cues From Last Session

Communication services, health care, materials, consumer discretionary, and real estate sectors led the gains on Friday as all sectors ended in green.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | 0.88% | 22,273.08 |

| S&P 500 | 0.98% | 6,602.99 |

| Dow Jones | 1.08% | 46,245.41 |

| Russell 2000 | 2.80% | 2,369.59 |

Insights From Analysts

Prominent economic and market voices are sounding alarms regarding U.S. stability, highlighting risks from market concentration and policy choices.

Investor Ruchir Sharma argues that “American exceptionalism” is peaking, warning that “America is now one big bet on AI.” With AI capital expenditure driving 40% of growth, Sharma contends this “maniacal focus” conceals deep fiscal vulnerabilities.

He observes that while investors currently offer a “free pass” on deficits, the market represents “a good story that’s gone too far.” He cautions that “If the AI boom was not happening, the economy would be weaker,” advising diversification as the “gap of outperformance” closes.

Compounding these structural risks, Moody's Chief Economist Mark Zandi warns of a “serious affordability crisis.” He argues that specific policies, specifically tariffs and immigration restrictions, are “juicing” inflation.

Zandi notes that “It didn't have to be this way,” but protectionist measures have “upended that outlook,” pointing toward “even higher inflation dead-ahead.”

While Sharma fears a bubble burst, Zandi emphasizes the burden on consumers, predicting that “tough financial times” will persist for the “foreseeable future.”

See Also: How to Trade Futures

Upcoming Economic Data

Here's what investors will be keeping an eye on this week;

- No data is scheduled to be released on Monday.

- On Tuesday, September’s delayed U.S. retail sales, and headline and core PPI will be out by 8:30 a.m. ET.

- September’s S&P Case-Shiller home price index for 20 cities will be released by 9:00 a.m., August’s delayed business inventories data, November’s consumer confidence data, and October’s pending home sales data will be out by 10:00 a.m. ET.

- On Wednesday, the initial jobless claims data for the week ending Nov. 22 and September’s delayed durable-goods orders data will be announced by 8:30 a.m. ET.

- No data is scheduled to be released for the Thanksgiving holiday on Thursday.

- On Friday, November’s Chicago Business Barometer (PMI) will be released by 9:45 a.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading lower in the early New York session by 0.43% to hover around $57.56 per barrel.

Gold Spot US Dollar rose 0.20% to hover around $4,073.96 per ounce. Its last record high stood at $4,381.6 per ounce. The U.S. Dollar Index spot was 0.04% lower at the 100.1430 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 0.57% lower at $85,875.64 per coin.

Asian markets closed lower on Monday, except Hong Kong's Hang Seng and Australia's ASX 200 indices. China’s CSI 300 index. India’s NIFTY 50, Japan's Nikkei 225, and South Korea's Kospi indices fell. European markets were mostly higher in early trade.

Read Next:

Image via Shutterstock