While the technology sector is gradually showing some signs of recuperation — particularly with the cryptocurrency ecosystem finding recent momentum — skepticism remains a major source of anxiety. One name that has apparently aroused suspicion is Microsoft Corp (NASDAQ:MSFT). Ordinarily, dips in MSFT stock would be viewed as a buying opportunity. However, with fears that the bubble in artificial intelligence may pop soon, market makers seem to have braced for the pessimism.

How can I be so sure? Obviously, I'm at a complete loss as to what the market really thinks. To claim otherwise would be the height of unhinged arrogance. But what I can say is that for the 495/500 bull call spread expiring Jan. 16, 2026, the maximum payout for hitting the second-leg strike ($500) at expiration would currently come out to more than 108%.

Nominally, this transaction involves traders simultaneously buying the $495 call and selling the $500 call on a single ticket or execution, being charged $240 for the (net) contract. The breakeven threshold comes in at $497.40.

Overall, this trade appears to be rather generous. Basically, MSFT stock has 51 calendar days to rise through the $500 strike, which translates to about 2.7%. That seems very doable as the security is up 2% today. Of course, the market is a stochastic, entropic mess — meaning a lot could happen in those 51 days. Still, a 108% payout if a less-than-3% move materializes in a top-tier tech stock seems enticing.

In my opinion, market makers are placing more weight on the pessimistic narrative of an AI bubble popping (specifically by reacting to order flow dynamics). As such, they need to incentivize the bullish position by making upside-focused trades cheaper, thus attracting offsetting flow to balance the books.

Ultimately, then, my opinion is that you should consider taking this wager — and I'm going to show you the math for why an options trade makes sense.

Diving Into The Deep End For MSFT Stock

When navigating a stochastic, reflexive and ultimately heteroskedastic (meaning clustered volatility dynamics) environment, it's vital — absolutely vital — for an underlying analytical system or methodology to be rigorous enough to accommodate such characteristics. Linear, assumption-driven spreadsheet models are simply incapable of truly representing the stock market.

That's not a pugnacious statement; it's a structural, mathematical reality.

In order to better capture the complexities behind MSFT stock (or any other security), we must treat probability as a physical object rather than an abstract concept. Imagine that you're tasked with installing a giant TV on your wall. You wouldn't just put it anywhere. Instead, you would nail in the holding frame into the studs to ensure enough stability and support.

In the same manner, you would apply the trigger strike price or the profitability threshold onto the studs of the probabilistic object. You wouldn't put it on the drywall because the support would simply not physically exist.

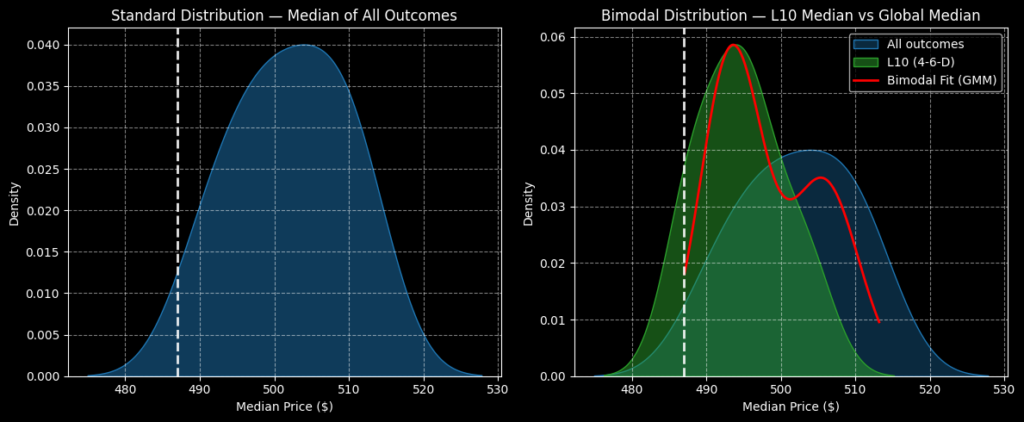

Of course, the problem with treating the probability of MSFT stock as a physical object is that the security's pricing represents a singular journey across time. Therefore, we must change our dataset from a continuous, scalar format into a discretized, iterative format. In other words, we take MSFT's price action and break it apart into identical rolling segments.

Personally, I prefer using rolling 10-week sequences. The important point is not necessarily the sequence size but its consistency in the model.

Taking these two radical paradigm shifts (reification and iteration), we run the data through a Kolmogorov-Markov framework layered with kernel density estimations (KM-KDE). The idea here is that through multiple iterations, patterns start to emerge. Specifically, we’re looking for the golden metric called probability density.

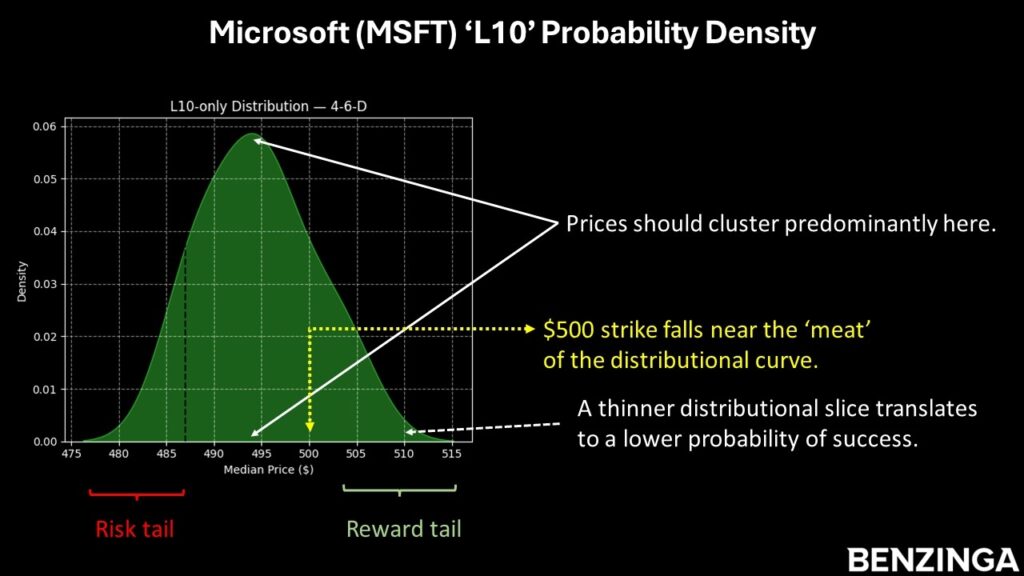

Probability density refers to the price level where the target security tends to cluster the most over a given time period. So, if we're being logical, it behooves us to consider options strategies that give us the best chance of success while also providing an adequate reward.

What makes MSFT stock so unusual is that, under 4-6-D conditions — where the security printed four up weeks and six down weeks, with an overall downward slope — clustering occurs at around $494 as opposed to approximately $505 under baseline conditions. That's a negative variance of 2.18% and I normally wouldn't highlight such ideas.

However, with the market offering a triple-digit payout for reaching $500 — roughly in between these two clusters — the deal is arguably attractive.

Trading Strictly On The Math

As a species, homo sapiens are genetically wired toward recognizing patterns in low-dimensional problems. This bias reflects an efficient, evolutionary strategy for survival and cognitive function, allowing humans to generalize situations from limited samples.

When encountering high-dimensional stochastic surfaces — such as the stock market — we tend to hallucinate structure in noise. That's why technical analysts see cups, handles and sea dragons, among other manifestations. But because every day someone has identified a bullish wedged giraffe in the price charts, at some point, one of these wild chart patterns will coincidentally be prescient.

That's not evidence that the methodology works. That's survivorship bias.

Instead, the real edge in the market is not found in fundamental or technical analysis, neither of which is actual analysis. Instead, they are infantile, post-hoc rationalizations that are structurally divorced from the mathematical realities of the environment they purport to explain.

If you want to succeed in the Wild West shootout that is the options market, you cannot show up with a butter knife. I'm here to arm you with the absolute best insight I can possibly give — and even that might not be enough.

Still, I'm a firm believer that by following the numbers — such as what happened recently in Oscar Health Inc (NYSE:OSCR) — you'll come out ahead more often than not in the long run.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

Image: Shutterstock