Nvidia (NVDA) shares moved higher in late Friday trading, but remain well shy of their late March peak, as investors glean clues on AI demand from a major chipmaker ahead of the group's first quarter earnings later this month.

Taiwan Semiconductor (TSM) , the world's biggest contract chipmaker, posted a bigger-than-expected 60% surge in April sales, which topped $7.3 billion, while declaring a quarterly dividend.

The surprise April gains followed last month's muted first quarter earnings report from TSMC, which held its capital spending plans in place and trimmed its 2024 chip revenue forecast to just under 10% in U.S. dollar terms.

Related: Single Best Trade: Wall Street veteran picks Palantir stock

TSMC's spending plans form a key element for Nvidia's revenue potential as the market leader in so-called chip-on-wafer-on-substrate, often called CoWoS.

The high-end packing technology enables better performance on a smaller form factor and is a crucial component in the rollout of artificial-intelligence-focused processors.

TSMC has warned its clients that CoWoS demand has far outpaced supply and it expects that imbalance to continue well into next year.

Another key Nvidia supplier, South Korea-based SK Hynix, posted its best quarterly profit in nearly two years last month, adding that AI demand was driving the memory-chip market into a "full recovery cycle."

SK Hynix makes so-called high bandwidth memory chips, or HBM3s, which boost AI performance while reducing the overall power that the Nvidia-made GPUs require.

The group said all its HBM chips are effectively sold for this year and nearly sold out for the whole of 2025.

Key capacity issues in AI rollouts

"The HBM market is expected to continue to grow as data and (AI) model sizes increase," SK Hynix CEO Kwak Noh-Jung told investors last month. "Annual demand growth is expected to be about 60% in the mid- to long term."

Nvidia is scheduled to post its first quarter earnings after the close of trading on May 22, with analysts looking for overall profit to rise more than fivefold from a year earlier to $5.55 a share.

The group is also expected see revenues more than triple, to $24.5 billion, with quarterly sales ultimately topping the $30 billion mark by the end of its current financial year.

Related: Nvidia set to capture billions as big tech boosts AI spending

That tally could improve as well following big increases in capital-spending plans from companies like Meta Platforms (META) , Google parent Alphabet (GOOG) and Amazon (AMZN) as they accelerate their AI rollouts.

"Many of our customers that we have already spoken with talked about the designs, talked about the specs, have provided us their demand desires," Nvidia's finance chief, Colette Kress, told investors at the group's GTC conference last month.

"And that has been very helpful for us to begin our supply chain work, to begin our volumes and what we're going to do."

Nvidia revenue forecast in focus

That forecasts echoes a bullish outlook on IT spending from Wedbush analyst Dan Ives. He sees AI and related purchases taking up between 8% and 10% of overall IT budgets this year, a huge increase from the 1% they comprised in 2023.

"This will be a massive growth catalyst in this 'initial wave of AI software growth,'" Ives said, noting that Nvidia and Microsoft are set to capture the bulk of the early gains.

More AI Stocks:

- Analyst unveils eye-popping Palantir stock price target after Oracle deal

- Veteran analyst delivers blunt warning about Nvidia's stock

- Analysts revamp Microsoft stock price target amid OpenAI reports

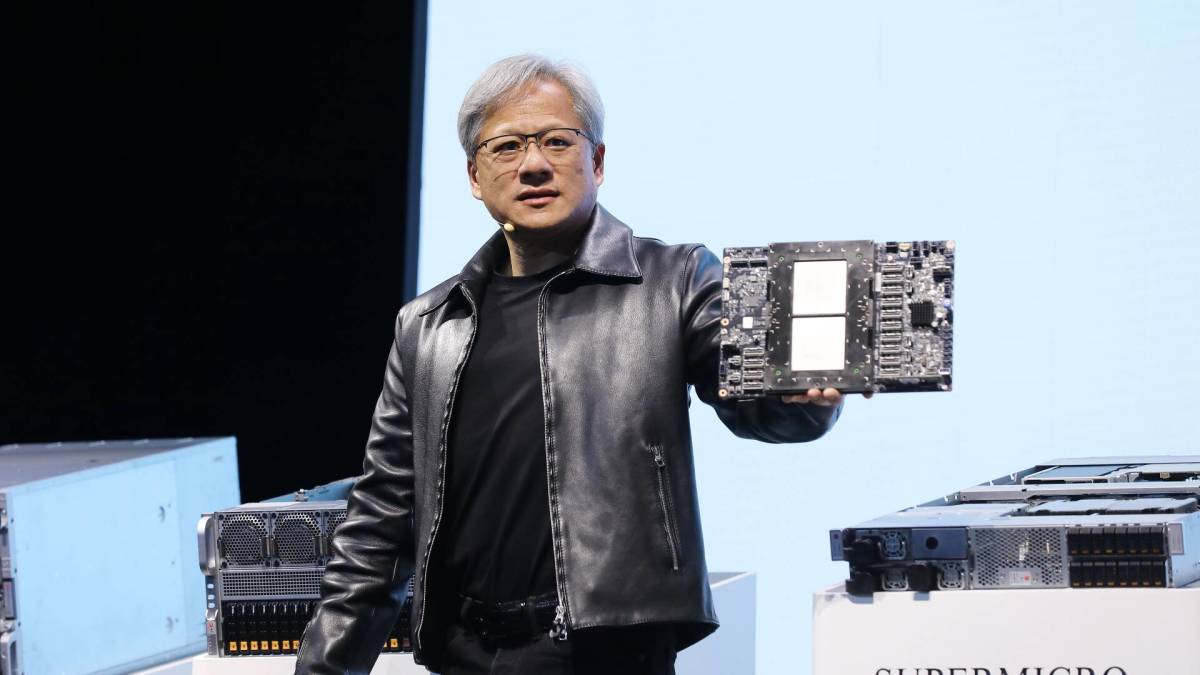

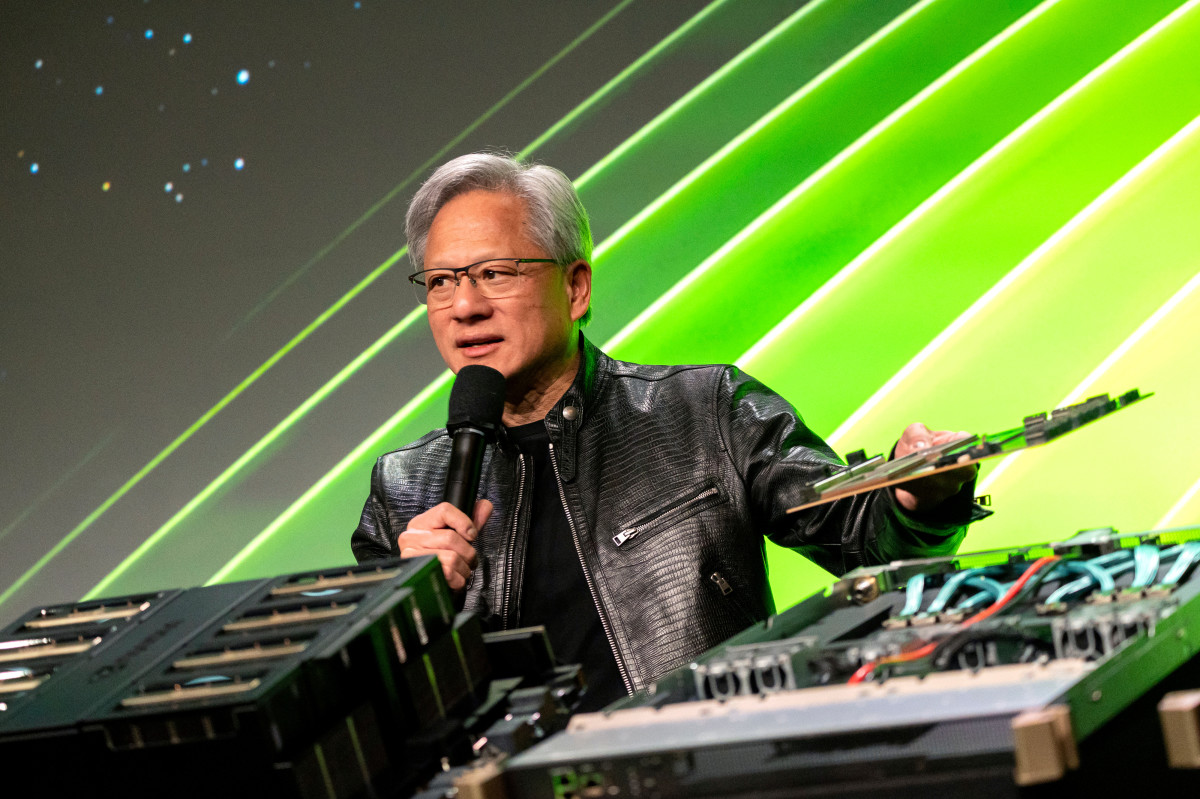

Nvidia CEO Jensen Huang told investors last month that he saw the data-center market growing at $250 billion a year – on top of an installed base he estimates is already valued at $1 trillion – as companies like IBM (IBM) and Alibaba Cloud (BABA) mount nascent challenges to their larger rivals like Meta and Alphabet.

Related: Analysts revamp Nvidia price targets as Blackwell tightens AI market grip

"We sell an entire data center in parts, and so our percentage of that $250 billion per year is likely a lot, lot, lot higher than somebody who sells a chip," Huang told investors during the GTC conference in San Jose, Calif.

Nvidia shares were marked 1.12% higher in Friday afternoon trading and changing hands at $898.66 each, extending their six-month gain to around 85%.

The stock hit an all-time high of $974 on March 25, and has added more than $1 trillion in market value since the start of the year.

Related: Veteran fund manager picks favorite stocks for 2024