Almost 30 years ago a busload of Hunter coal miners descended on Parliament House, Canberra, for a protest campaign called Survival '92.

Record low prices for the Hunter's main product - thermal coal for power stations - had led to mass layoffs and mine closures.

Hence the "survival" branding.

Still, the market recovered soon enough and since then the NSW and Queensland black coal industries have been through half a dozen price cycles.

Nowadays, every dip is predicted as "the death of the coal industry".

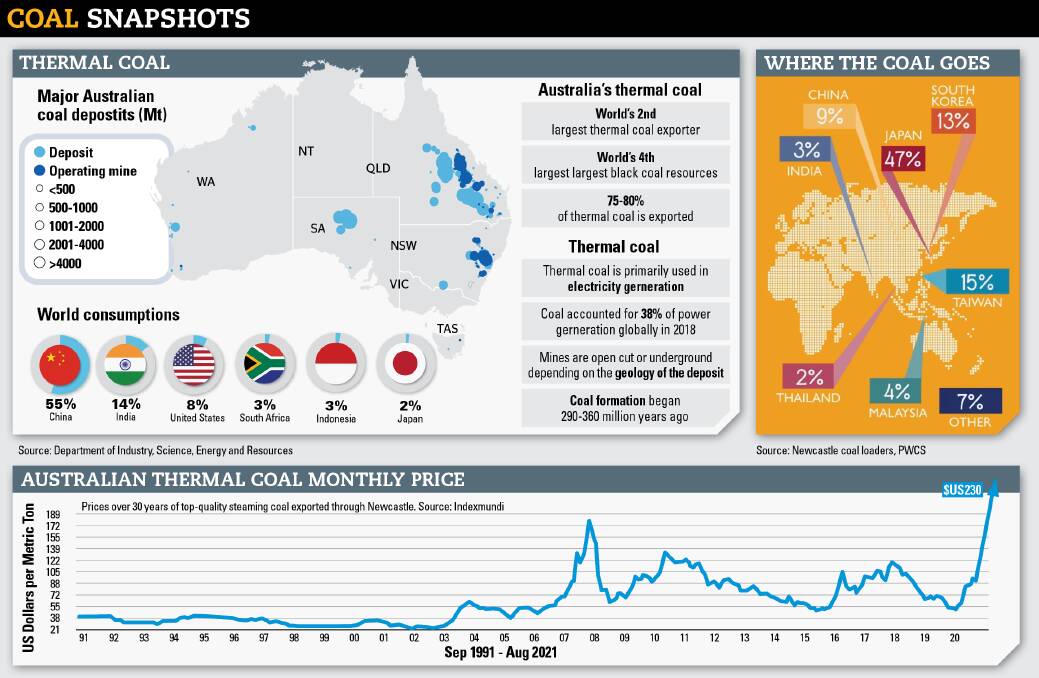

But now, on the eve of the Glasgow COP26 conference, export coal out of Newcastle has hit another all-time high of $US230 ($307) a tonne, or 4.5 times the $US49 a tonne of the same coal was fetching last September, according to the weekly industry journal, Australian Coal Report.

So what is happening?

To start with, not all coal is equal.

The market has two main branches: "thermal" or "steaming" coal for electricity generation and "coking" or "metallurgical" coal used in steelmaking.

Read more:

- Ag methane not part of 2050 goal despite what plan says: Joyce

- Agricultural carbon sinks at heart of 2050 net-zero plan

- 'Most rural Aussies in the middle' MP says as Nats agrees to 2050

Coal itself is divided into four main types: anthracite, bituminous, sub-bituminous and lignite. Lignite is Victoria's brown coal, used domestically only.

Most Australian export coal - steaming and coking - is bituminous.

Indonesian steaming coal, by contrast, is sub-bituminous, with lower heating value than bituminous products.

Globally, steaming coal faces more climate pressure than coking coal, mainly because there are other ways of generating electricity, while the steel industry still needs coking coal.

But we are also working towards a COP26 target of "zero net emissions by 2050".

As difficult as such targets have been for the Coalition, it is worth remembering that "net zero" does not mean zero.

In theory, Australia can even lift its coal exports and still reach net zero provided it had sufficient "offsets" to create the "net" effect.

Mathematically, any number minus itself gives you a "net" figure of zero.

And as carbon offsets - the numbers after the minus sign - can be traded internationally, Australia may even go offshore to get some of its offsets.

Eventually, however, Australia will adopt a target more or less in line with other developed countries. But that is unlikely to mean the end of coal.

Consider this.

Renewable technologies - primarily solar, wind and hydro - can continue to provide ever-increasing amounts of electricity.

All methods, however, are subject to some form of intermittency, even if it's predictable as night and day. Inescapably, a renewable grid needs extra capacity to generate electricity that can be stored for use later.

To get through a single night, a solar grid has to produce 24 hours worth of electricity in 12 hours (on average), with the night-time power stored in batteries or pumped hydro.

To show how much storage would be needed, South Australia's "big battery", the country's largest, could run the Tomago aluminium smelter near Newcastle for about 12 minutes.

Yes, Australia will install more battery capacity and other storage methods, such as super-capacitors, will be commercialised and developed.

But on present storage capacity, Australia cannot do without baseload coal or gas-fired "peaking" or "firming" power stations, which may themselves end up being used in quasi-baseload capacities.

And that is before the demands on the Australian electricity grid become even greater, with the concurrent climate-driven push to replace conventional cars and trucks with electric vehicles.

The sheer - and as yet largely unacknowledged - increase in demand that millions of electric vehicles would impose on the National Electricity Market is beyond the scope of this article.

Suffice to say, the demand for electricity is increasing and the old ways of producing it are politically unacceptable.

But the size of the replacement task is vast, and a number of the key technologies being touted as if they were fait accompli are a long way from maturity.

Even so, coal-fired power stations will close in Australia. Domestic demand for steaming coal will drop.

But there is every indication that international demand for Australian steaming coal could continue almost unabated for decades to come, unless climate concerns led to some sort of export controls to turn off the tap.

Steven Galilee, chief executive of the industry body the NSW Minerals Council, says coal exported from Newcastle and Port Kembla goes to 18 countries, most of them in Asia.

Coal-fired power stations burn coal to heat water to make steam to spin turbines that generate electricity.

Mr Galilee says many of these countries have installed and are installing new coal-fired power stations known as "HELE" - for "high efficiency, low emissions" - which operate at higher temperatures and air pressures to more rapidly convert water to steam.

Existing Australian power-stations are classified, technically, as "subcritical", with energy efficiencies of up to 38 per cent.

HELE plants are "supercritical" or above and can have efficiencies of 45 per cent to 50 per cent, and more if carbon capture, use or storage (CCUS) technologies can be widely commercialised.

Mr Galilee says there are hundreds of these plants across Asia, and that demand for Australia's high-quality coal is a key reason why coal prices have been at record levels for the past six years.

Even so, the rapid spike in coal prices caught many by surprise.

Industry watchers say there are various factors at play.

Some are specific to coal, but it is worth noting that the prices of oil and gas are also heading north, because of what is being seen as the northern hemisphere heads into winter, as a global energy shortage.

Energy demand has returned after almost two years of COVID suppression but as consumption is simply returning to pre-pandemic levels, grids worldwide should have the capacity to supply existing needs.

But coal-fired and nuclear power stations have been closed in various countries, meaning there is less reserve power able to brought online to meet the need.

Then there's China.

Not for the first time, coal has become the rope in a Sino-Australian tug-of-war, although after an initial flurry of concern over stranded cargoes, Australia has found new markets, and China is experiencing power shortages.

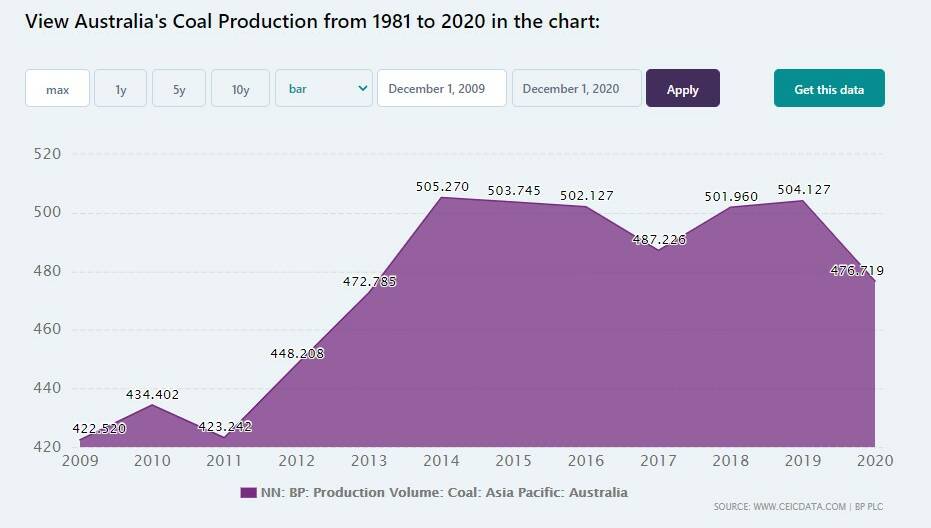

Even if Australian coal exports have dropped by about 10 per cent in volume since 2019, we will still export almost 400 million tonnes this year, about 55 per cent steaming coal and 45 per cent coking.

All up, Australia exports about 90 per cent of what it produces.

China, on the other hand, imports just 10 per cent of its needs.

Its problems this year have had more to do with cold weather and the mandated closure of dozens of power stations and steel mills to meet pollution and climate change targets than the Australian ban.

And even at its peak, China only ever accounted for 15 to 20 per cent of the Newcastle market - long dominated by Japan, followed by South Korea and Taiwan.

In the short term, the federal Department of Resources and Energy is predicting modest tonnage increases out to 2026 for both steaming and coking coal exports.

Even if the politics of climate change continue to harden, the state of the world's various power grids will be the ultimate speedometer.

In Australia, neither side of politics would allow the serious instability that a failing electricity grid would mean.

Nor would they necessarily constrain the coal industry if the markets were there and the product remained internationally legal.

There is no limit to the amount of electricity a burgeoning industry of solar installations and wind farms could produce, but the storage technology is nowhere near mature enough to "firm" a fully renewable grid.

Similarly, the idea of a hydrogen industry has been around for the best part of a century, but splitting water (H20) into its two atoms of hydrogen and one of oxygen requires so much energy that it's only practicable - in terms of price and energy footprint - when renewable electricity is the source.

Barring a major breakthrough, well beyond the renewable technologies of today, fossil fuels will be a practical necessity for decades to come, to 2050 and beyond.

And as no country will willingly allow itself to slide into energy uncertainty, it may well be that the biggest impact of a worldwide commitment to "net zero" is as much about offsetting continued fossil fuel use as it is about the reduction of coal, oil and gas.

Start the day with all the big news in agriculture! Sign up below to receive our daily FarmOnline newsletter.