The situation in growth stocks has been harrowing lately. In the case of Zoom Video (ZM), the stock suffered an 80% peak-to-trough decline before the recent bounce.

It’s not alone, either. Many companies have now seen their stock prices decline by 60%, 70% and even 80% from the highs.

Many of these companies are high-quality holdings as well, not the fly-by-night, flash-in-the-pan type holdings either.

For Zoom, the timeline has been a bit different. Shares were struggling ahead of the Covid-19 outbreak, but the business was always rather strong. Zoom boasted robust revenue growth and was profitable and free cash flow positive.

When the pandemic hit, the share price exploded almost instantly, as the stock ran from sub-$100 to more than $500 in just a few months.

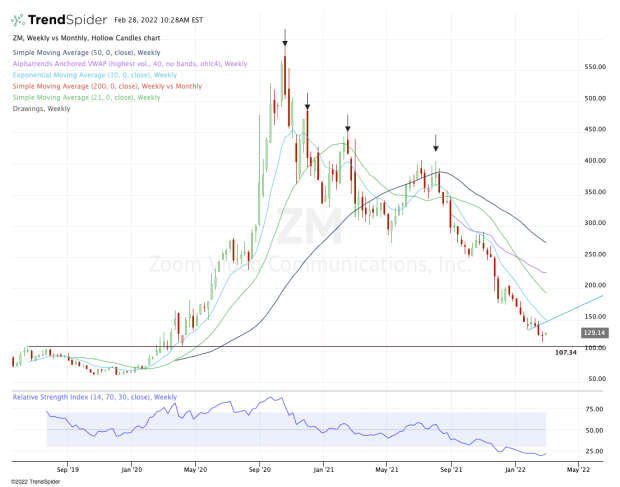

Since topping out the fourth quarter of 2020 though, it’s been one higher low after another.

So what can investors expect when the company reports earnings tonight?

Trading Zoom Video Stock

Chart courtesy of TrendSpider.com

Some reactions to earnings have been good and others have been bad.

Roku (ROKU) and Shopify (SHOP) have been buried on earnings. So has PayPal (PYPL). Other reports have been good, as Upstart Holdings (UPST) and The Trade Desk (TTD) have rallied.

As it pertains to Zoom stock, we have a doji candle on the weekly chart above.

Without earnings on deck, one may look at this candle — often interpreted as an “indecision candle” that could come near an inflection point — and then look for a weekly-doji-up rotation over last week’s high of $130.78.

In fact, I don’t hate that trade either, as it could open up the stock for a nice upside rotation.

However, earnings blur the potential for a trade on the long side at the moment. The binary event could go either way, jolting Zoom stock higher or sending it plunging lower. We've seen this play out both ways with growth stocks this quarter.

If it’s the former, I want to see how it handles the $150 area and the declining 10-week moving average. Above these marks could open up the stock to a run toward $175 and the declining 21-day moving average.

On the downside, keep an eye on last week’s low of $114.26, which is also this year’s current low and the lowest price for Zoom stock since April 2020.

It’s possible we see some sort of undercut of that level and a reclaim of it. Absent a reclaim of this level, the $100 to $107 breakout area becomes a must-watch zone for Zoom Video stock.