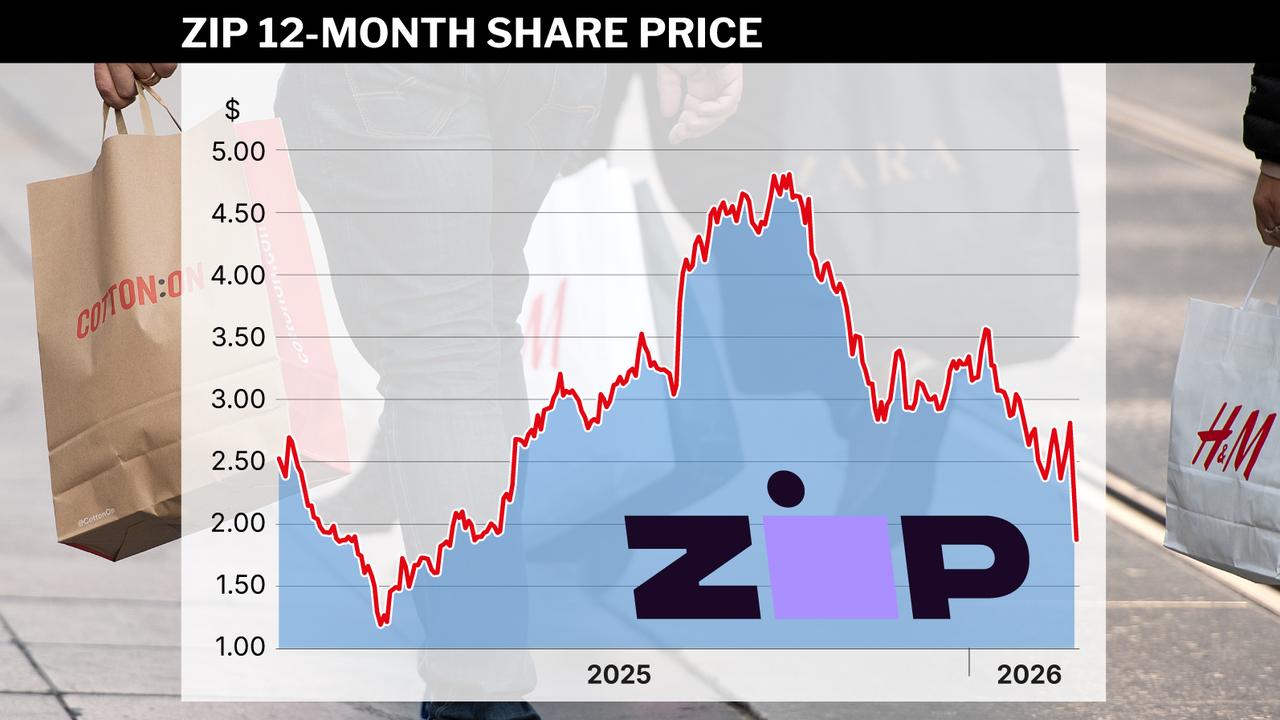

An Australian buy now, pay later company has had more than a third of its value wiped in a single day, after shareholders dumped the stock in the face of rising bad debts and an earnings miss.

Zip Co's share price tumbled almost 40 per cent on Thursday, despite cash earnings soaring to a best-ever $124.3 million in the six months to December 2025, up more than 85 per cent on the equivalent half.

The fintech narrowed its losses to 34 per cent by the end of the day's trading to close at $1.85.

The earnings figure and a record transaction volume of $8.4 billion (up 34 per cent) were overshadowed by $19.2 million in bad debts, representing 1.7 per cent of total volumes which was higher than UBS estimates of 1.37 per cent.

Net bad debts remained comfortably within management targets, chief executive and managing director Cynthia Scott said.

"Arrears rates, a leading indicator of future bad debts, continues to perform well, down 21 basis points year on year," Ms Scott told shareholders at a briefing.

"With portfolio yield remaining healthy, the business is well positioned to continue to deliver profitable growth."

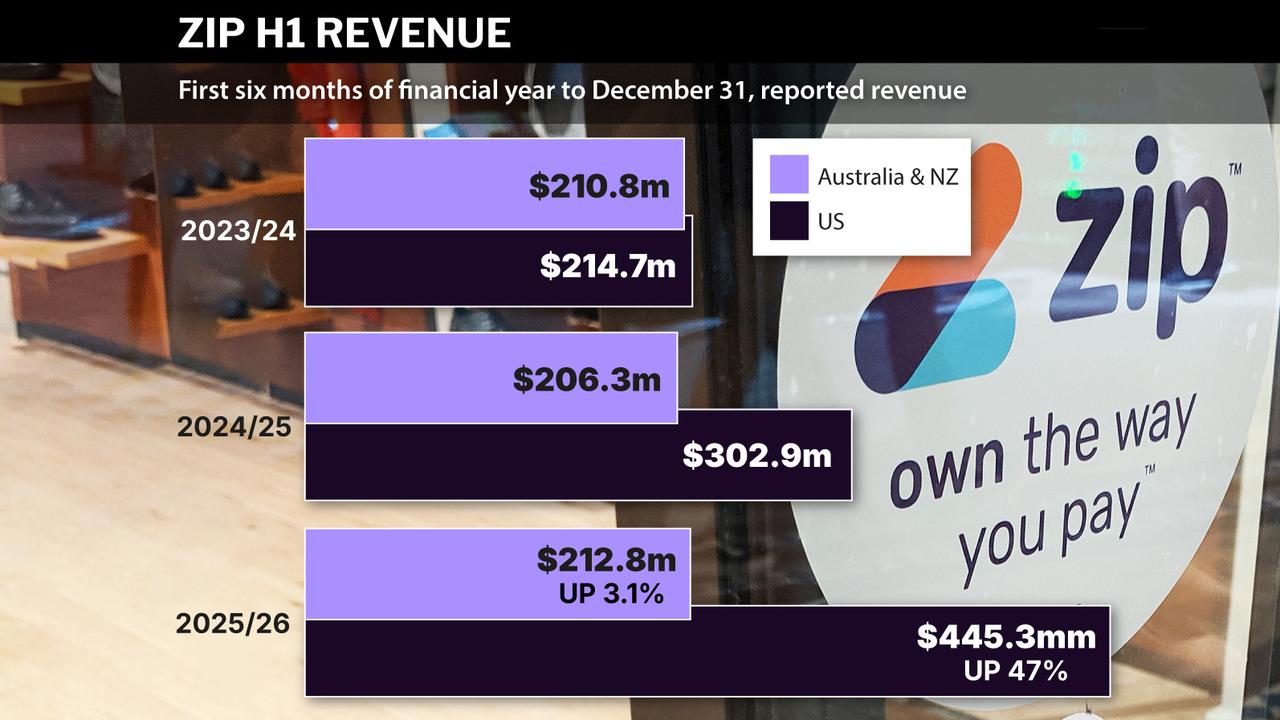

Growth in Zip's US business eclipsed movement in its original Australian-New Zealand market, prompting Ms Scott to announce her relocation to the US in the second half of 2026.

"This move reflects our growing presence and significant growth opportunity in the US market, our primary earnings driver," Ms Scott told shareholders at an earnings briefing.

"I look forward to deepening engagement with key us stakeholders, including our customers, merchants, strategic partners and investors."

Zip's active customer base increased 4.1 per cent to 6.6 million people, while the number of people using the company for essential spending also rose.

"Consistent with our increasing frequency, we're seeing strong growth in everyday spend categories such as groceries, healthcare, education and utilities," Ms Scott said.

"We're also seeing higher spend across all age cohorts, with the strongest growth amongst more mature customers, including in discretionary categories such as restaurants, travel and entertainment."

Zip was confident bad debts would remain in the upper half of the targeted range in the second half, US chief executive Joe Heck said.

"We see a tremendous opportunity to lean further into everyday, non-discretionary spend, given the mismatch between the income structures and the rising essential costs everyday Americans are facing," Mr Heck told shareholders.

Zip's leadership is still weighing up a dual listing in the US, but said it would only consider it "when in the best interests of shareholders".