High-profile partnerships with actor and fashion icon Zendaya and luxury brand LOEWE have propelled On Holding AG‘s (NYSE:ONON) apparel business to a remarkable 75.5% growth rate on a constant currency basis, according to the company's second quarter 2025 earnings call.

Check out ONON’s stock price over here.

What Happened: This success, coupled with the brand's over-indexing with Gen Z consumers, highlights a “tipping point” in the company’s journey to becoming a premium holistic sportswear brand.

During the call, CEO and CFO Martin Hoffmann emphasized the company’s ability to reinforce its position at the intersection of sport and lifestyle. "Our brand record shows we are the only brand growing our connection with both performance and lifestyle simultaneously," Hoffmann stated.

“This is also evident in our outsized growth with the 18- to 34-year-old segment.” The earnings call also revealed that apparel sales in the first half of the year were so strong they surpassed those of one of ON’s most successful footwear franchises, the Cloudtilt.

Co-Founder and Executive Co-Chairman David Allemann underscored the importance of these collaborations in building brand relevance. He noted that the hugely successful partnership with LOEWE on the Cloudtilt, which retailed at $590 and sold out almost entirely within days, “perfectly illustrates this intersection” of sport and fashion.

He also highlighted the new apparel launched with Zendaya and a training capsule collection with FKA twigs as key drivers of brand awareness and a broader audience.

The company’s momentum with Gen Z consumers is particularly strong, with brand awareness more than doubling in a single year in the U.S. “Our brand strength is over-indexing with Gen Z consumers,” Allemann said. “They love the Soft Wins campaign with Elmo for the Cloudsurfer.”

See Also: AST SpaceMobile Secures 8 US Government Contracts, Plans 45-60 Satellite Deployment By 2026

Why It Matters: The company with tennis player Roger Federer as a 3% owner is confident that this “consumer resilience” across diverse demographics is setting the stage for sustained long-term growth.

ON’s second-quarter adjusted EBITDA came in at 17.9% above consensus estimates, driven by net sales growth of 32% year-over-year, versus expectations of 24.2%.

Management raised its 2025 guidance to at least 31% sales growth in constant currency, up from its previous projection of at least 28%.

Price Action: The stock rose 8.95% on Tuesday and 0.20% in after-hours. It has fallen by 10.04% year-to-date but is up 20.69% over the past year.

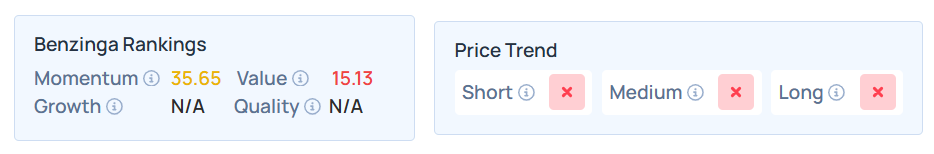

Benzinga's Edge Stock Rankings indicate that ONON maintains a weaker price trend in the short, medium, and long terms. Furthermore, the stock scores poorly on value rankings. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, closed higher on Tuesday. The SPY was up 1.06% at $642.69, while the QQQ advanced 1.26% to $580.05, according to Benzinga Pro data.

On Wednesday, the futures of the S&P 500, Dow Jones and Nasdaq 100 indices were mixed.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: DFree / Shutterstock.com