/Drone%20flying%20by%20Pexels%20via%20Pixabay.jpg)

ZenaTech (ZENA) shares are up more than 45% in the past five days, following Defense Secretary Pete Hegseth’s announcement that he would “unleash American drone dominance.” The elimination of regulatory roadblocks by the Pentagon should accelerate the battlefield application of unmanned air systems (UAS), and the direct beneficiaries will include companies like ZenaTech, Red Cat (RCAT), AeroVironment (AVAV), and Kratos (KTOS).

Washington’s current defense interests appear to lie in low-cost, AI-enabled drones for intelligence gathering and strike missions. ZenaTech, though still early stage, is rapidly evolving into a diversified AI and drones systems company. This means ZENA stock could be a high-risk, high-reward investment as the U.S. shifts towards drone-first doctrine.

About ZenaTech Stock

ZenaTech (ZENA) is a Vancouver-based tech firm operating in AI drone systems, drone as a service (DaaS), quantum computing, and enterprise software as a service. It has a miniscule market capitalization of $135 million.

ZENA shares have moved between the range of $1.41 and $12.43 in the past 52-week period, and the stock currently trades near $6 following the most recent breakout. That’s a 5-trading-day 47.4% increase, trouncing the S&P 500 Index ($SPX).

Despite reporting revenue of just $1.96 million for 2024, ZenaTech sports a lofty price-sales ratio of 68.4x. This, combined with a negative profit margin of 228%, means that ZENA remains a speculative micro-cap stock unfettered by fundamentals.

ZenaTech Doubles Revenue in Q1 but Swings to Loss

ZenaTech’s first quarter of 2025 saw a 92% revenue year-over-year increase, amounting to $1.13 million. Operating losses, however, continued to widen, and the net loss increased to $4.61 million compared to the prior-year period’s loss of $1.16 million.

Its drone as a service business was established through the acquisition of Weddle Surveying (Oregon) and KJM Land Surveying (Florida). The company had also acquired Othership, a United Kingdom-based workplace management software company, as part of its plans to provide AI and quantum solutions to government and enterprise customers.

Product development continues to scale rapidly. The production version of the ZenaDrone 1000 was completed in Q1, and the manufacturing process began for the IQ Square drone. ZenaTech also initiated testing of a heavy-lift gas-powered ZD 1000 drone for long-range military applications and progressed a proprietary high-density battery and communications system.

Management approved Blue UAS certification preparations to enter the U.S. military procurement pipeline. ZenaTech also reported expansions of facilities in the UAE and Turkey, employing 35 engineers and constructing a center for testing unmanned systems for beyond-line-of-sight applications.

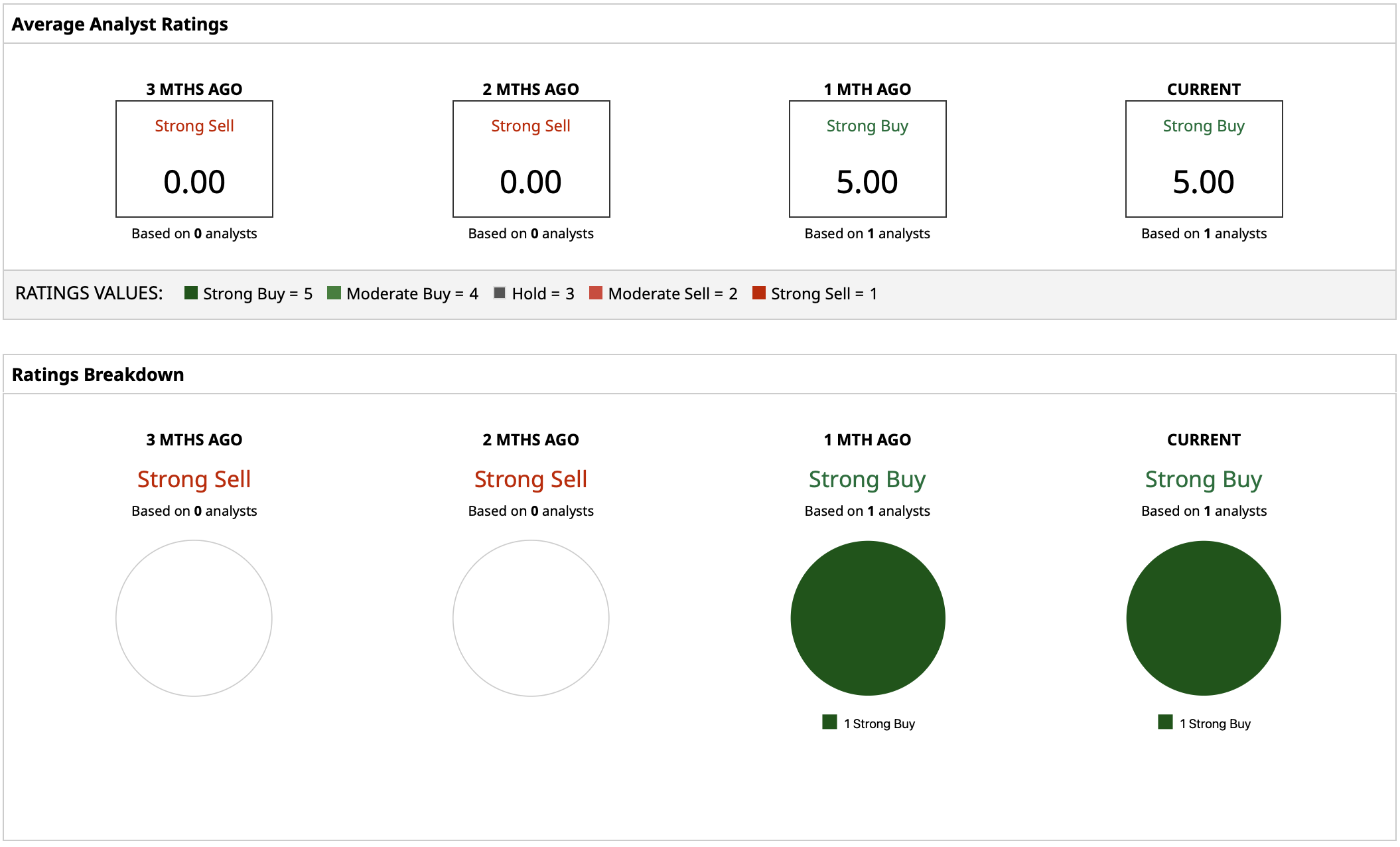

What Do Analysts Expect for ZenaTech Stock?

ZenaTech currently boasts a “Strong Buy” consensus recommendation from one analyst in coverage and a price target of $9, roughly 50% above its current price.