/Zebra%20Technologies%20Corp_%20logo%20on%20building-by%20Michael%20Vi%20via%20Shutterstock.jpg)

Lincolnshire, Illinois-based Zebra Technologies Corporation (ZBRA) provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide. Valued at $16.2 billion by market cap, Zebra operates through the Asset Intelligence & Tracking and Enterprise Visibility & Mobility segments.

Companies worth $10 billion or more are generally referred to as “large-cap stocks.” Zebra Technologies fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the tech space.

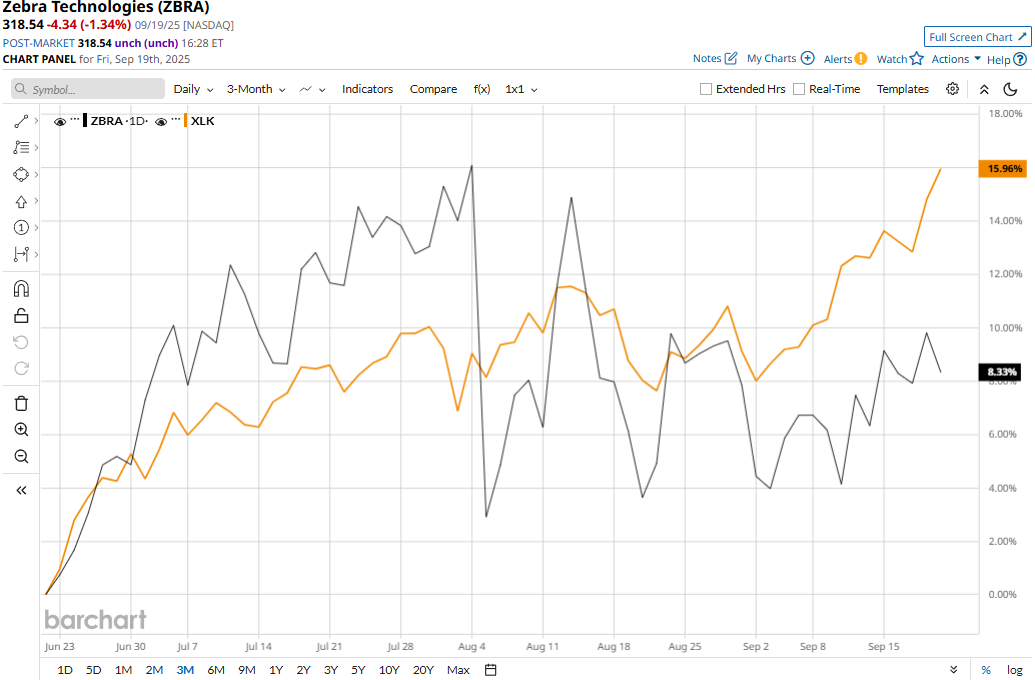

Despite its notable strengths, Zebra’s stock prices have dropped 25.5% from its three-year high of $427.76 touched on Jan. 22. Meanwhile, ZBRA stock has gained 9.2% over the past three months, but underperformed the Technology Select Sector SPDR Fund’s (XLK) 15.4% surge during the same time frame.

Zebra’s performance has remained much grimmer over the longer term. ZBRA stock has plunged 17.5% on a YTD basis and 12.4% over the past 52 weeks, significantly underperforming XLK’s 20% surge in 2025 and 24.7% gains over the past year.

ZBRA stock has remained consistently below its 200-day moving average since mid-February and mostly above its 50-day moving average since early May, with some fluctuations, underscoring its previous bearish movement and recent upturn.

Despite reporting better-than-expected results, Zebra Technologies’ stock prices plummeted 11.4% in the trading session following the release of its Q2 results on Aug. 5. Driven by the lower-than-expected impact of tariffs and solid demand, the company’s overall net sales for the quarter increased 6.2% year-over-year to $1.3 billion, beating the Street expectations by a small margin. Meanwhile, its non-GAAP EPS increased by an impressive 13.5% year-over-year to $3.61, surpassing the consensus estimates by 9.1%.

The drop in stock prices is primarily attributable to the market’s reaction to Zebra’s announcement of entering into an acquisition agreement to buy Elo Touch Solutions for $1.3 billion.

When compared to its peer, Zebra has also underperformed Hewlett Packard Enterprise Company’s (HPE) 17.1% uptick in 2025 and 32.6% surge over the past 52 weeks.

Nevertheless, among the 17 analysts covering the ZBRA stock, the consensus rating is a “Moderate Buy.” Its mean price target of $362.50 suggests a 13.8% upside potential.