Yum! Brands (YUM) has been on fire lately. While the stock is up just 1% on Friday, a gain today would cement the stock’s seventh straight daily gain.

In that stretch, the stock is currently up 10%, as it made a very nice double-bottom in the $108 to $110 zone.

Foodies may be talking about whether Taco Bell, a branch under the Yum umbrella, will stop selling its Mexican Pizza. But we’re over here talking about the chart.

This isn’t the only fast-food chain in the news, either.

Wendy’s (WEN) was a hot topic this week as Nelson Peltz’s Trian Partners contemplates a takeover bid.

The chart is also holding a key level as well. Can Yum! Brands stock continue to hold up after the recent run? Let’s look.

Trading Yum Stock

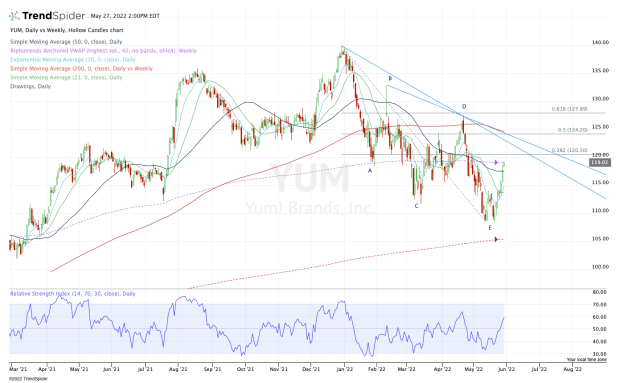

Chart courtesy of TrendSpider.com

It’s been a choppy ride in Yum stock, but the nice lift out of the $108 area shows promise. At the very least, it gives bulls a level to measure against.

If this level breaks and the stock closes below $108, that likely opens the door down to the 200-week moving average and potentially the $100 area.

As it stands now though, I’d love to see the stock find support in the $114 to $115 area. That takes a little momentum out of the stock, but keeps the overall trend intact for the bulls.

It also keeps it above the 10-day and 21-day moving averages.

The stock may not be going gangbusters on Friday, but its rally is enough to push Yum! Brands up through the 50-day moving average. As it hovers at the monthly high, it leaves open the possibility that we get a more meaningful rotation in June — a monthly-up rotation.

For the moment, bulls are likely keeping a keen eye on the weekly VWAP reading, which is halting today’s rally in its tracks.

If the stock dips, $114 to $115 is key. If it doesn’t and Yum! Brands can power through, the $120 area is of immediate interest. That’s where we find the 38.2% retracement.

Above that and $124 to $125 is on the table. There we find various downtrends (blue lines), as well as the 50% retracement.

In short, let’s see how it handles this current VWAP measure. If we dip, buyers can look for support nearby. If it pushes through, they have their next upside targets handy.