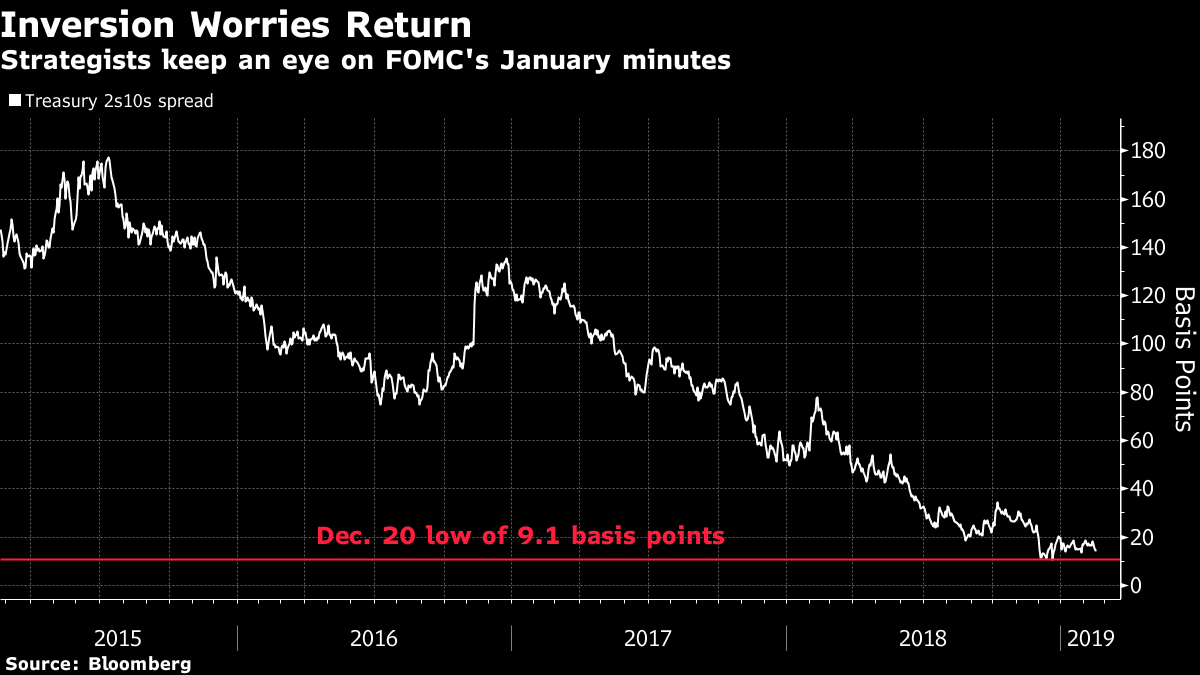

Wednesday’s release of minutes from the Federal Open Market Committee’s January meeting has the potential to send one of the most widely-followed parts of the Treasury yield curve hurtling toward inversion within a matter of weeks.

That’s the view of BMO strategist Jon Hill, who says that the gap between 2-and 10-year notes -- which bottomed out at 9.1 basis points in December and currently stands at about 14.3 basis points -- could resume its narrowing trend should the minutes tilt either of two ways: The Federal Reserve signals that another interest-rate increase may be on the horizon even without clear signs of longer-run U.S. economic improvement, or if policy makers saw the risks of a recession as greater than they’ve let on while reaffirming a preference for keeping the fed funds target rate unchanged.

“The January minutes could lay the groundwork for a possible 2s10s inversion several weeks out,” Hill said Tuesday. “Entering into such positions looks increasingly attractive.”

Three key elements to look out for in the minutes are any explanation for the Fed’s “abrupt dovish U-turn” last month, the manner in which the central bank will incorporate patience and flexibility into its reaction function, and the logistics behind a possible end to the balance-sheet runoff, Hill said. All those pieces will be “pivotal” for outright yield levels and the shape of the curve.

He says BMO is attentive to the 2s10s spread sliding to 13.2 basis points, since that would “presage a retest” of the cycle low reached Dec. 20. The bond market will be particularly sensitive to these meeting minutes given current low rate volatility and one of the most uncertain U.S. monetary policy pictures since the financial crisis, according to Hill.

Inversion “is certainly a 2019 story,” he said.

To contact the reporter on this story: Vivien Lou Chen in San Francisco at vchen1@bloomberg.net

To contact the editors responsible for this story: Benjamin Purvis at bpurvis@bloomberg.net, Boris Korby, Elizabeth Stanton

©2019 Bloomberg L.P.