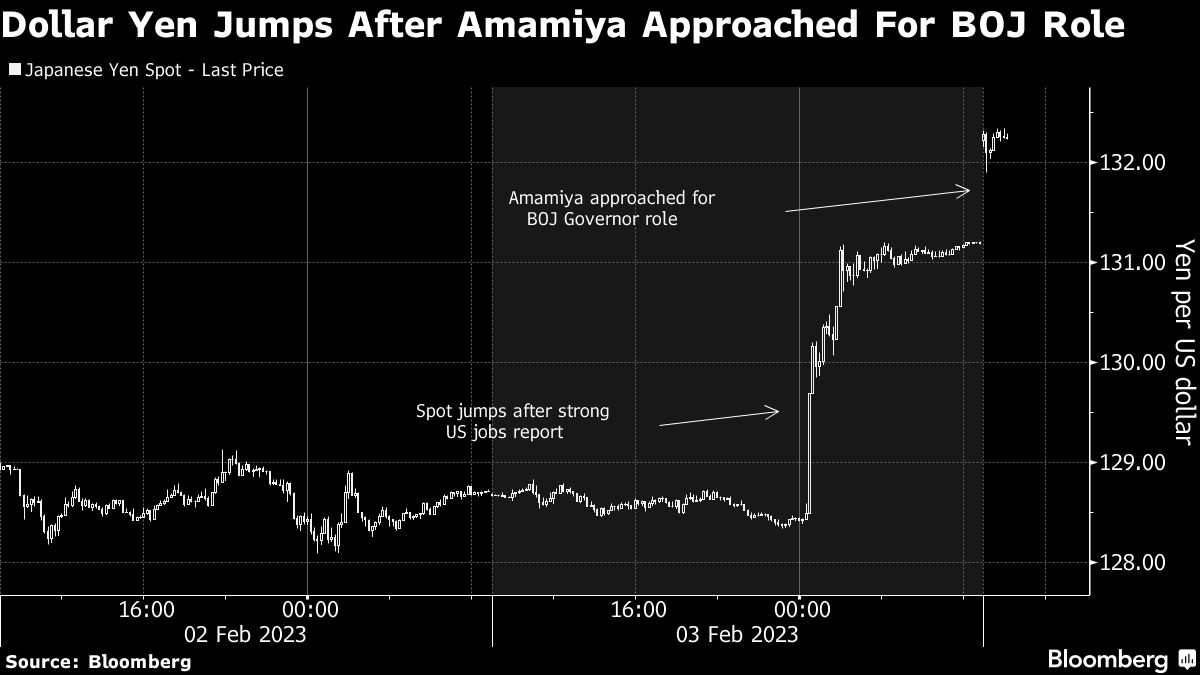

The yen slumped after Nikkei reported that Masayoshi Amamiya was approached by the government for the role of Bank of Japan governor, a choice that would be seen as likely to extend the current incumbent’s ultra-easy policy.

The Japanese currency fell as much as 1% to around the 132.50 per dollar level in early Monday trading, its lowest since Jan. 12.

According to the report, officials from the government and ruling coalition have held discussions with Amamiya, the current deputy governor whose flexibility and resourcefulness have seen him emerge as favorite to succeed Haruhiko Kuroda. Kuroda’s decade-long stint at the helm of the central bank comes to an end in April. Nikkei said a BOJ representative declined to comment.

“If this news is correct and Amamiya accepts the position, foreign investors will need to readjust their expectations of the BOJ abandoning its ultra loose policy soon,” said Dane Cekov, a senior strategist at Nordea Bank ABP in Oslo. “Some have hoped that the government would pick someone from the more hawkish camp,” he said in written comments.

The yen had already finished Friday trading almost 2% lower, after the dollar soared on strong US employment data.

Known as “Mr. BOJ,” Amamiya is perhaps unfairly seen as a continuity candidate. Prime Minister Fumio Kishida has said the announcement of Kuroda’s successor will come in February.

Investors have been weighing the perceived policy bias of the various candidates to gauge how quickly the BOJ will move away from its stimulus measures, if at all. Speculation increased that a shift was in the offing after tweaks to yield-curve control in December, with commentators saying new leadership would be an ideal catalyst for a policy change.

A close aide to Japanese Prime Minister Fumio Kishida on Sunday stressed the need to have stable gains in prices. “The important thing is to have an economy in which prices will rise stably and sustainably,” Deputy Chief Cabinet Secretary Seiji Kihara said on public broadcaster NHK.

BOJ Veterans Remain Best Picks for Post-Kuroda as Decision Looms

The BOJ’s shock December decision to double its ceiling for 10-year yields illustrated the shockwaves that any hint of policy change can trigger, both at home and abroad. That move sent the yen and Japanese yields soaring, Treasuries lower and touched everything from US equity futures to the Australian dollar and gold.

--With assistance from Matthew Burgess.

©2023 Bloomberg L.P.