In the fourth quarter of 2025, the inverse relationship between Japanese yen futures and stock index futures takes center stage, driven by distinct seasonal patterns. Historical data show that the Yen often faces selling pressure in Q4, weakening against major currencies. At the same time, stock indexes like the S&P 500 typically see seasonal buying, fueled by portfolio rebalancing and year-end optimism. This dynamic creates a bullish tailwind for stock index futures, as a declining yen boosts Japanese export competitiveness and global risk appetite, lifting equity markets. Understanding the mechanics of yen futures contracts is key to capitalizing on this interplay—read on to uncover how these moves unfold and why they matter for your trading strategy.

The Japanese Yen So Far for 2025

The rally in Japanese yen futures in early 2025 was primarily driven by a narrowing interest rate differential between the United States and Japan, and a reversal of the "yen carry trade" that began in August 2024. Key factors included a rate hike by the Bank of Japan and shifting expectations for U.S. monetary policy.

Bank of Japan (BOJ) policy shifts

- January 2025 rate hike: The BOJ hiked interest rates to a 17-year high of 0.5% in January 2025, reinforcing the view among investors that more hikes would follow. This was a significant shift from the bank's long history of ultra-loose monetary policy and negative interest rates.

- Rising inflation and wage growth: The BOJ's decision was supported by stronger-than-expected inflation and solid wage growth in Japan, which indicated underlying price pressures were becoming more sustained.

- Anticipation of further tightening: Statements from BOJ officials suggested the central bank was prepared to continue normalizing monetary policy, making the Yen more attractive to investors.

U.S. Economic and Monetary Policy Changes

- Falling U.S. yields: In late 2024 and early 2025, U.S. Treasury yields dipped due to weaker-than-expected economic data, such as a soft U.S. CPI print in December 2024 and a weaker non-farm payrolls report.

- Shifting Fed expectations: The softer U.S. data raised market expectations that the Federal Reserve would soon cut interest rates. This reduced the yield advantage of the U.S. dollar, making the Yen relatively more appealing.

Reversal of the "Yen Carry Trade"

- Unwinding positions: For years, traders had profited from the carry trade by borrowing Yen at low Japanese interest rates and investing in higher-yielding assets, such as U.S. bonds.

- Profit-taking and unwinding: The narrowing interest rate differential made this trade less profitable. As the Yen began to strengthen, many speculators rapidly unwound their prominent short positions, which put further pressure on its value.

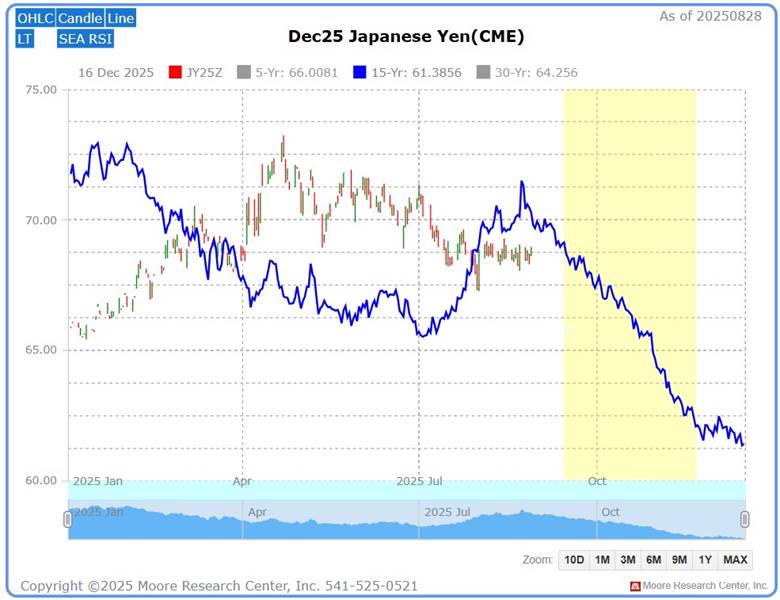

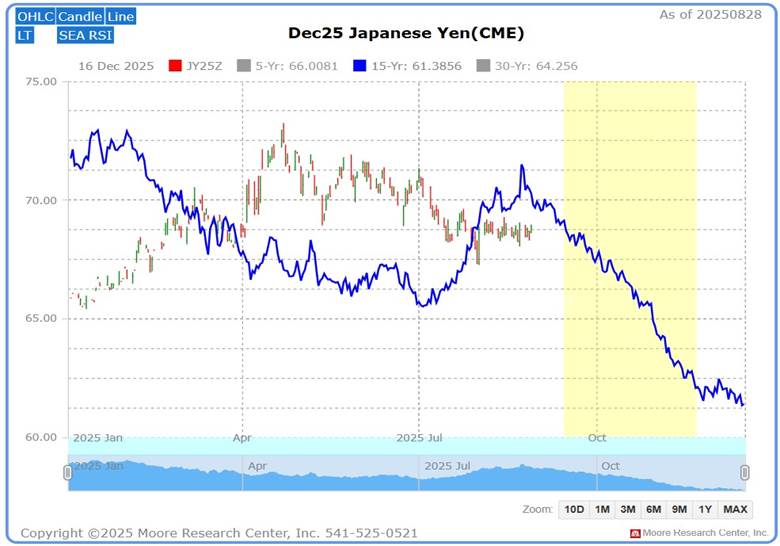

Source: Moore Research Center, Inc. (MRCI)

The 15-year seasonal high (blue line) has traditionally come in January. In 2025, the above events drove Yen futures prices higher until April. For example, the Yen interest rate increase was the first time in 17 years. The seasonal pattern is for 15 years. At times, fundamental events that occur during the year are outliers and can skew historical seasonal patterns.

Japanese Yen Market Drivers for the 4th Quarter

Market Drivers

- Monetary policy divergence: The significant interest rate gap between the Federal Reserve and the Bank of Japan (BOJ) has been a primary driver of yen weakness. The Federal Reserve is anticipated to continue a path of gradual rate cuts through 2025, while the BOJ is gradually normalizing its policy and is expected to enact a 25 basis point rate hike in Q4. A narrowing interest rate differential would support a stronger yen.

- Carry trade unwind: The "carry trade" strategy, which involves borrowing low-yielding Yen to invest in higher-yielding currencies like the U.S. dollar, has put downward pressure on the Yen. As interest rate differentials narrow, the appeal of this trade diminishes, which could lead to a stronger yen.

- Safe-haven status: The Yen is traditionally considered a safe-haven currency that gains strength during global instability. However, its effectiveness in this role has been inconsistent in 2025 due to the persistent monetary policy divergence. The interplay between risk-on and risk-off sentiment will influence its value in Q4.

The 4th quarter for Yen traders looks like the fundamentals "could" shift and result in some strength for the Yen. I mentioned these items only as events that traders should be aware of and pay attention to any shifts away from a bearish Yen position. Fundamentals can change market trends. However, as traders, we don't try to pick the time when a market will change direction. If we follow the market trend's technical picture, we are trading what we see, not what we think will happen.

Additionally, the S&P 500 has a 15-year pattern of finishing strong in the 4th quarter, reducing the demand for flight to quality Yen purchases. Compare this to the weak finish the Yen futures traditionally have during the same period.

Source: MRCI

Technical Picture

Source: Barchart

Technically, the daily chart for the Yen futures topped out in April 2025. Prices have been making lower highs and lower lows. The 50 simple moving average (SMA) has confirmed the downtrend of lower closing prices.

Significant Inverse Market Correlations

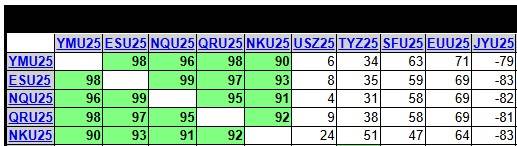

Source: MRCI

Over the last 90 days, the Japanese Yen futures have had inverse relationships (last column) to all major stock indexes, including the Nikkei index. The inversion supports the technical downtrend and the upcoming seasonal Yen sale.

Seasonal Patterns

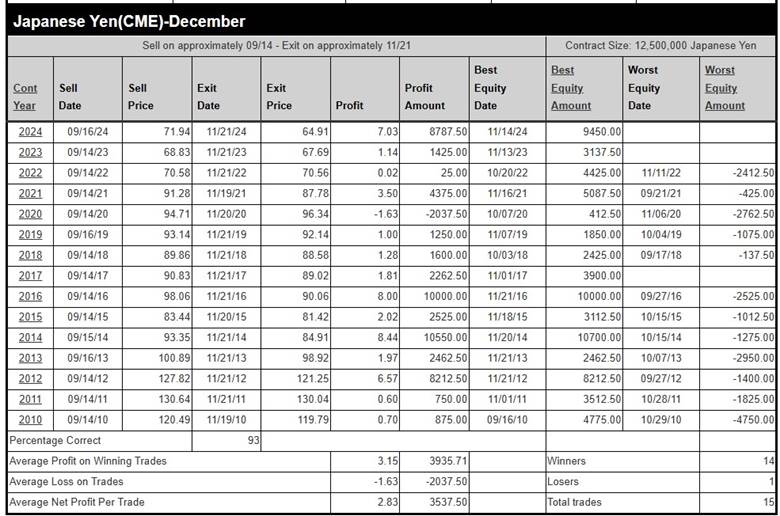

Source: MRCI

The seasonal sell window (yellow box) is quickly approaching as the futures prices of the Yen continue to grind lower. MRCI research has uncovered a seasonal window that has revealed the Japanese Yen futures have closed lower on about November 21 than on September 14 for 14 of the past 15 years, a 93% occurrence. During this period, three years without a daily closing drawdown.

Source: MRCI

As a crucial reminder, while seasonal patterns can provide valuable insights, they should not be the basis for trading decisions. Traders must consider various technical and fundamental indicators, risk management strategies, and market conditions to make informed and balanced trading decisions.

Assets to Trade the Japanese Yen

Futures traders can trade standard Yen futures (J6) or the micro-size (J1U25). Spot Forex traders can trade the U.S. dollar-paired Yen market (USDJPY).

In closing….

As Q4 2025 unfolds, the Japanese yen futures' seasonal downtrend, backed by a 93% historical tendency to close lower by late November, aligns with the bullish surge in stock index futures, driven by the S&P 500's robust year-end pattern. Yet, professional traders must stay vigilant: fundamentals like the narrowing U.S.-Japan interest rate differential, potential BOJ rate hikes, and an unwinding carry trade could spark unexpected yen strength, disrupting the bearish trend. While the technical picture—lower highs and lows confirmed by the 50 SMA—supports selling the Yen, these shifting fundamentals could unleash havoc, making it critical to monitor policy shifts and risk sentiment closely. Stay sharp, as the Yen's next move could redefine your trading edge.

On the date of publication, Don Dawson did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.