China’s economy has had a bumpy ride throughout 2022. More than two years into the Covid-19 pandemic, headwinds including the worst outbreaks and a prolonged property sector crisis continued to put a brake on growth.

Faced with faltering demand at home and abroad, China’s GDP has been expanding well below target this year. While policymakers, desperate to boost growth, have launched an array of fiscal and monetary stimulus, the measures have not done much to prop up sagging consumer spending or business confidence. Meanwhile, local governments’ fiscal woes have intensified as their land sales and tax revenues have slumped.

Left with few options, China embarked on a debt-fueled infrastructure investment spree to boost the economy. Meanwhile, its latest property rescue package has temporarily given the market a respite. More critically, with the zero-infection policy rapidly dismantled at the year-end, the country’s pivot to living with the virus is raising the prospect of a strong economic recovery in 2023.

Below are the highlights of China’s economic performance and challenges in 2022, and what to look out for next year as it heads to the post-Covid era.

Sluggish growth

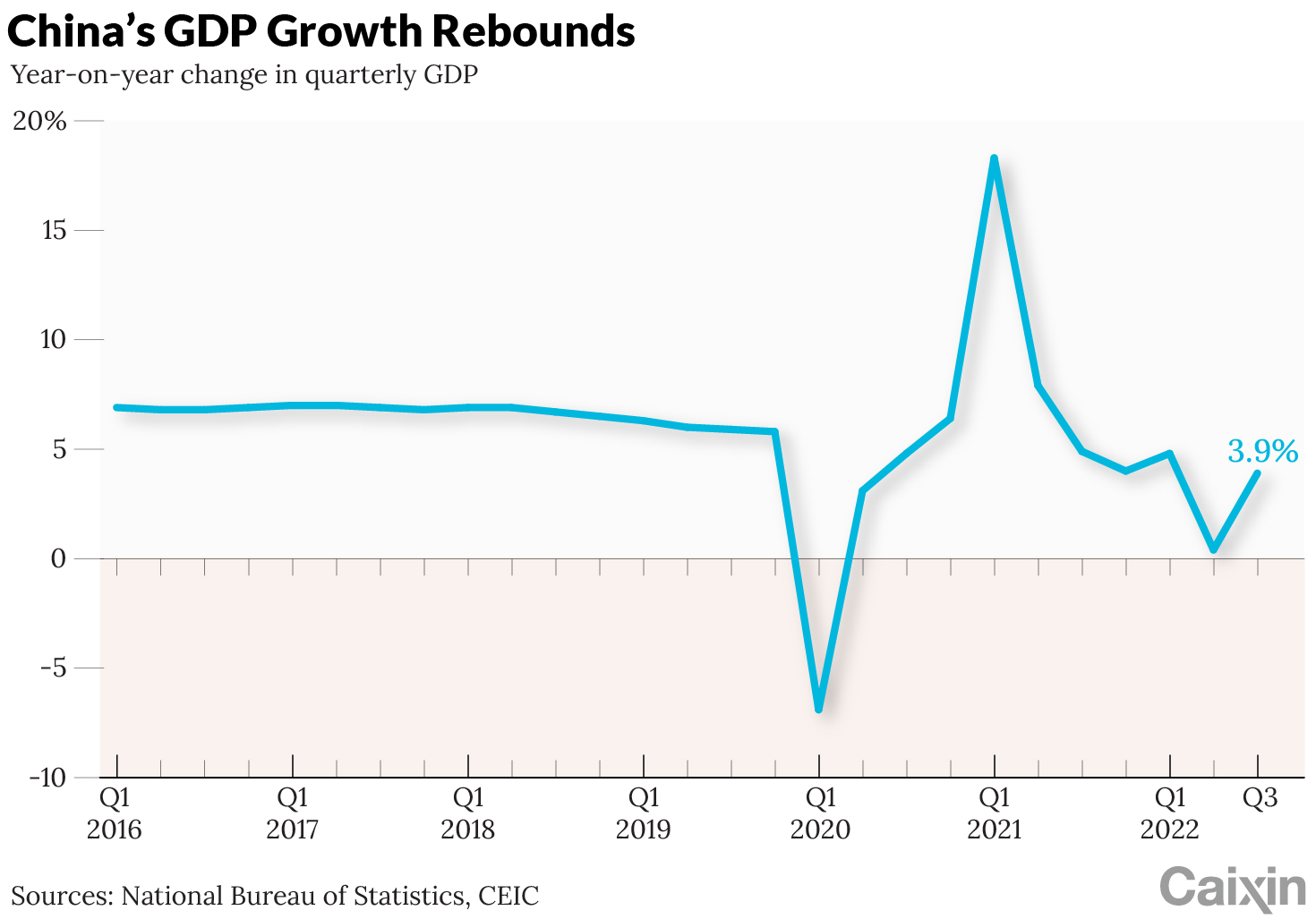

China’s GDP grew 3% year-on-year for the first three quarters of 2022, data from the National Bureau of Statistics (NBS) showed, suggesting that the nation will probably miss its full-year growth target of around 5.5% by a significant margin. Many analysts and organizations, including the International Monetary Fund and the World Bank, have cut their 2022 GDP growth projections for the country to around 3%.

On top of severe disruptions caused by Covid controls such as lockdowns, a slew of factors has added to China’s economic woes, including fading exports, crippled domestic consumption, and an ongoing housing slump.

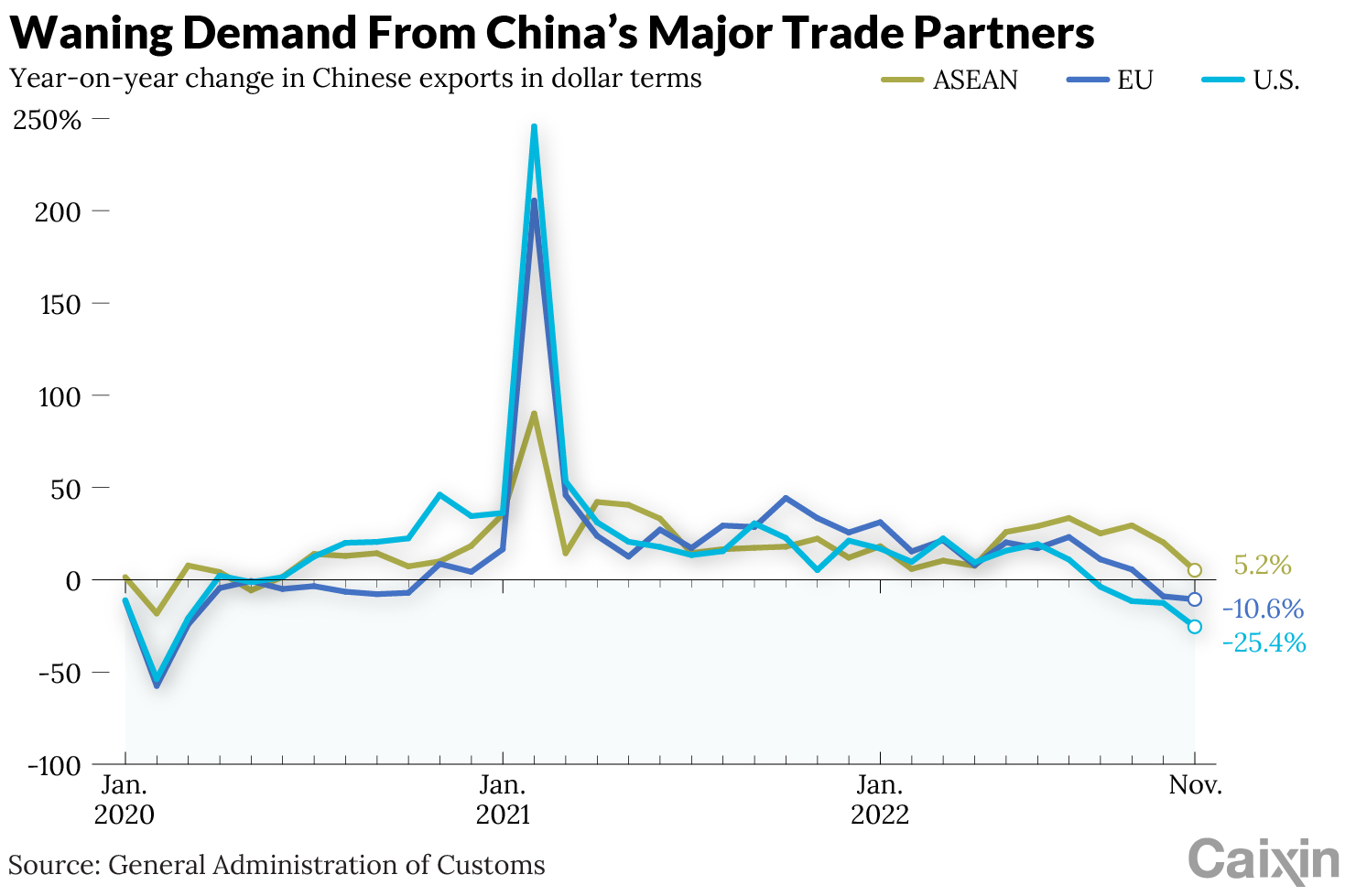

Exports used to be a major driver of China’s economic recovery, but that has been tapering off. For most of the time from July 2020 to July 2022, the country’s monthly exports rose by a range of 10% to 30% year-on-year in dollar terms, as the world shifted toward goods consumption and unleashed stimulus in response to the pandemic. But since August this year, export growth has slowed or even slipped into negative territory, as demand from the world’s three largest importers of Chinese goods, the U.S., the EU and Southeast Asia, has weakened as high inflation has weighed on consumers’ purchasing power and inventories have piled up.

Meanwhile, China’s stringent Covid controls have choked domestic consumption. Total retail sales in the country dropped 0.1% year-on-year in the first 11 months of this year, compared with 12.5% growth for the whole of 2021, according to the NBS. Businesses in almost all sectors, including hospitality, tourism, transportation, exhibitions, and entertainment, have been feeling the chill. Economists have been calling for policymakers to improve earnings of low- and middle-income households and repair their consumption willingness.

In an attempt to arrest the protracted downturn of the property market, another pillar of the world’s second-largest economy, China has rolled out measures to aid developers’ loan, bond and equity financing, and try to stimulate consumer demand. However, investor and homebuyer confidence has yet to see a significant rebound.

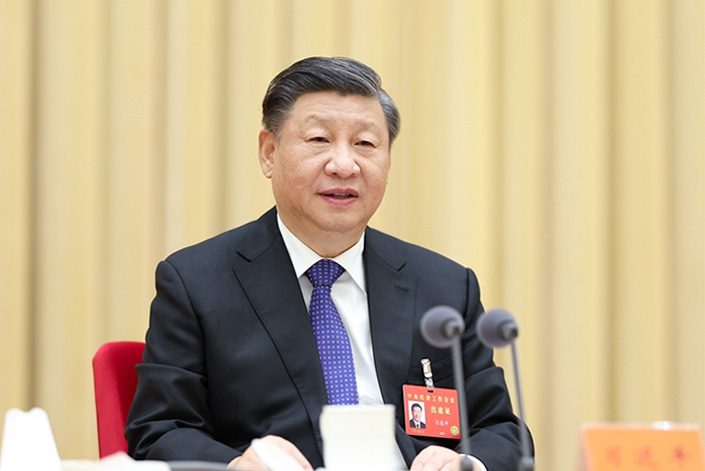

Infrastructure investment was one of the few bright spots in China’s economy. In April, President Xi Jinping called for an “all-out” infrastructure campaign. Under the directive, local governments printed special-purpose bonds to fund projects at a record pace, and policy banks were told to add more than 1.4 trillion yuan ($202 billion) in funding to chiefly support infrastructure investment. Renewable energy, technology and water management projects were among the largest beneficiaries.

Fiscal and monetary stimulus

To fight economic headwinds, China stepped up its fiscal and monetary stimulus measures in 2022.

The country’s central bank has used nearly every monetary tool trying to shore up demand for borrowing, including interest-rate cuts, subsidized loans, targeted lending facilities, and liquidity injections into the banking system. But appetite for loans has stayed low overall, underscoring sluggish confidence among businesses and consumers.

Meanwhile, China’s fiscal position has been put in the spotlight as local governments have struggled with elevated spending due to costly Covid containment measures, as well as slashed revenue resulting from diminishing land sales and a new policy that required them to hand out more tax refunds to businesses.

Unemployment and demographic challenges

While China’s headline jobless measure — the official surveyed unemployment rate for urban workers — remained stable at 5.6% on average for the first 11 months of 2022, unemployment among 16- to 24-year-olds was more than triple that at 17.6%, according to the NBS. This year, a record 10.76 million fresh college graduates needed to enter the direr-than-expected labor market.

Despite government attempts to beef up youth employment through measures such as subsidizing businesses that have hired new graduates, Covid lockdowns, among other factors, have forced millions of firms to shut their doors, and regulatory clampdowns on the tech, property and private tutoring sectors have prompted massive waves of layoffs.

Meanwhile, population aging is gathering speed in the country. Some 18.9% of China’s 1.4 billion people were aged 60 or older as of the end of 2021 — a figure expected to balloon to higher than 20% and 30% by 2025 and 2035, respectively — putting the state-run basic pension system under mounting pressure.

In response, a new personal pension system has been authorized in 2022, under which people can make voluntary contributions of as much as 12,000 yuan per year into their account and invest the money in eligible financial products of their choice. As a result, the past months have seen a scramble among financial institutions in China to develop pension offerings in preparation for what could be a new world of opportunities.

Yuan internationalization and China-U.S. standoff

China’s yuan has weakened significantly against the U.S. dollar over the year, amid aggressive interest rate hikes by the U.S. Federal Reserve.

Despite the depreciation, the Chinese currency is gaining more international traction in cross-border transactions with Russia, Southeast Asian nations and oil exporters including Saudi Arabia. Meanwhile, global demand for assets denominated in the currency, including offshore yuan bonds, is also on a surge.

The year of 2022 marked a breakthrough for resolving a long-lasting audit standoff that threatened to get Chinese stocks booted from U.S. stock markets, after U.S. authorities were granted access to Chinese audit work papers. For more than a decade, Beijing had resisted overseas inspection of local accounting firms, citing national security concerns.

Amid fears of mass delistings from U.S. exchanges, Hong Kong has become a safe haven for U.S.-traded Chinese firms seeking to hedge risks. U.S.-listed automaker Nio Inc. and Q&A platform Zhihu Inc. were among the big names that listed in Hong Kong this year.

2023 outlook

As China vows to bring the economy back on track while exiting from the “zero-Covid” policy, economists forecast that Beijing will set a growth target of above 5% for next year, while some project a higher target of above 5.5%.

Boosting consumption has been prioritized in the government’s economic agenda for 2023, as top leaders concluded the annual Central Economic Work Conference on Dec. 16, which outlined major economic and policy plans for next year. A “more forceful” fiscal policy and a precise monetary policy will be pursued, while developers’ “reasonable demand for financing” shall be fulfilled to stabilize the sector, the conference said.

But China’s economy still faces great challenges as a global recession looms. Among them, export contraction is expected to continue well into 2023, weighed on by a high comparison base and a global demand slowdown. Meanwhile, it remains to be seen whether regulatory efforts will be strong enough to boost consumer spending and reverse the property downturn.

Economists’ forecasts for GDP growth next year range from as low as 3%, an estimate from London-based Capital Economics Ltd., to as high as 5.8%, from Standard Chartered PLC, with the consensus forecast in a Bloomberg News survey standing at 4.8%.

As monetary policy has had only limited impact in boosting demand, attention is increasingly turning to the role of fiscal policy. Economists have estimated the fiscal deficit-to-GDP ratio will rise above 3% in 2023.

“As Covid policy relaxation takes place, we believe Chinese policymakers will be cautious not to ‘over-ease,’ and thus shy away from substantial easing measures in either fiscal or monetary space,” Bank of America Corp. economists led by Helen Qiao wrote in a Nov. 21 report.

Read more In Depth: What’s in Store for China GDP, Fiscal Policy in 2023

Contact reporter Zhang Ziyu (ziyuzhang@caixin.com) and editors Bertrand Teo (bertrandteo@caixin.com) and Lin Jinbing (jinbinglin@caixin.com)

Get our weekly free Must-Read newsletter.