XRP (CRYPTO: XRP) is up 1.5% on Friday, consolidating within a tightening triangle as investors assessed Ripple's leadership shakeup, Japan's institutional lending push and approaching U.S. ETF deadlines.

XRP Price Squeezes Into Triangle Ahead Of $3 Breakout

XRP Key Technical Levels (Source: TradingView)

XRP is holding near $3.02 after September's volatility repeatedly tested both trendline resistance and ascending support.

The daily chart shows the token compressing within a symmetrical triangle, with the 200-day EMA at $2.62 and the 20/50 EMA cluster around $2.92–$2.93 acting as key pivots.

A decisive break above $3.15 would confirm a bullish reversal, opening the door to higher levels, while a loss of support at $2.85 risks a move back toward the 200-day EMA.

Exchange Outflows Hint At Quiet XRP Accumulation

XRP Netflows (Source: Coinglass)

On-chain data from Coinglass shows $18.03 million in net outflows on Friday, suggesting traders continue to shift XRP into cold wallets rather than exchanges.

That trend aligns with the token's ability to hold the $2.90 support zone despite broader volatility.

While netflows have alternated between inflows and outflows through the year, the recent absence of inflow spikes lowers immediate sell pressure and leaves the market more sensitive to a breakout.

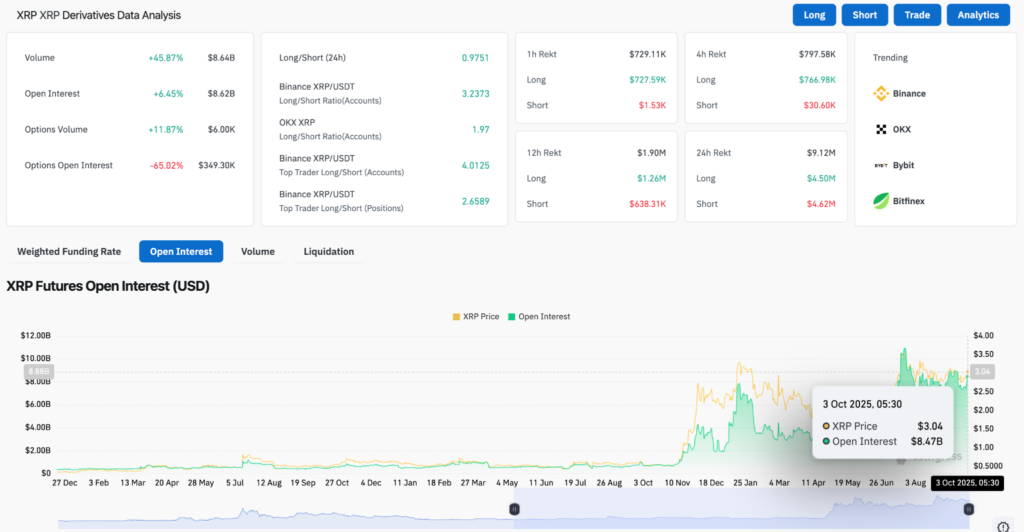

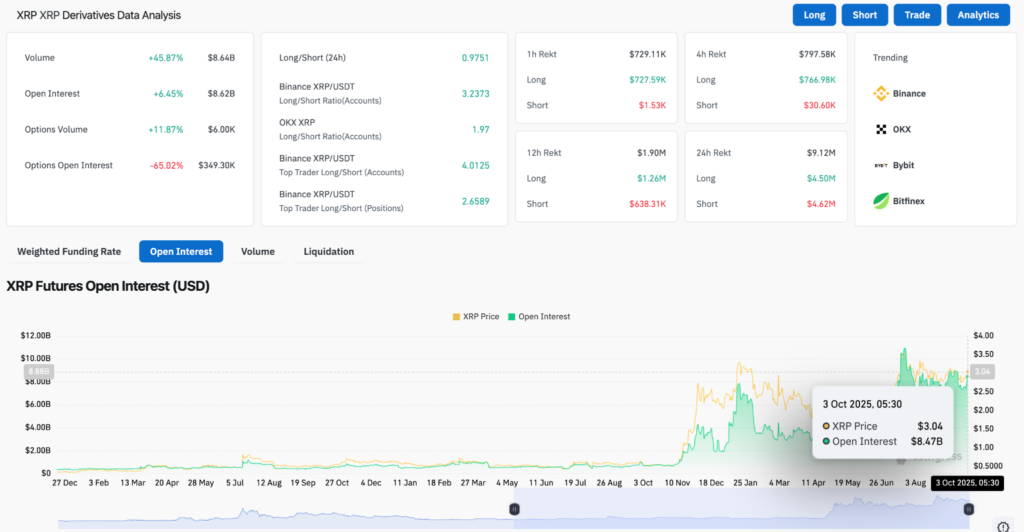

Derivatives Market Signals Rising Speculation

XRP Derivative Analysis (Source: Coinglass)

Futures open interest climbed 6.45% to $8.62 billion, its highest since July, with 24-hour trading volume jumping nearly 46% to $8.64 billion.

Binance's trader ratio shows a heavy tilt toward longs, highlighting optimism for an upside move.

Liquidations totaled $9.12 million in the past day, split evenly between longs and shorts.

Funding rates remain neutral, which suggests leverage is building without traders being overextended.

Ripple Shakeup And ETF Race Put XRP In Global Spotlight

XRP is trading at a rare intersection of market structure and institutional milestones.

Leadership changes at Ripple collide with Japan's SBI Holdings push to embed XRP in institutional lending markets.

At the same time, U.S. regulators face seven spot XRP ETF applications, with the first SEC rulings due on Oct. 18.

These filings, paired with Japan's expansion, highlight how XRP is being positioned across both Eastern finance and Western regulatory pipelines.

Read Next:

Image Shutterstock