Key takeaways:

- Xiaomi said last week that its Indian operations have been ‘effectively halted’ after a court declined to unlock $676 million worth of its assets frozen in a local tax dispute

- Chinese smartphone makers have dominated the Indian market in recent years, but are in growing clashes with local authorities amid geopolitical tensions between Delhi and Beijing

By Jose Qian

It’s been a tough year for Chinese smartphone makers in India as they try to stay above fraying political ties between Beijing and Delhi.

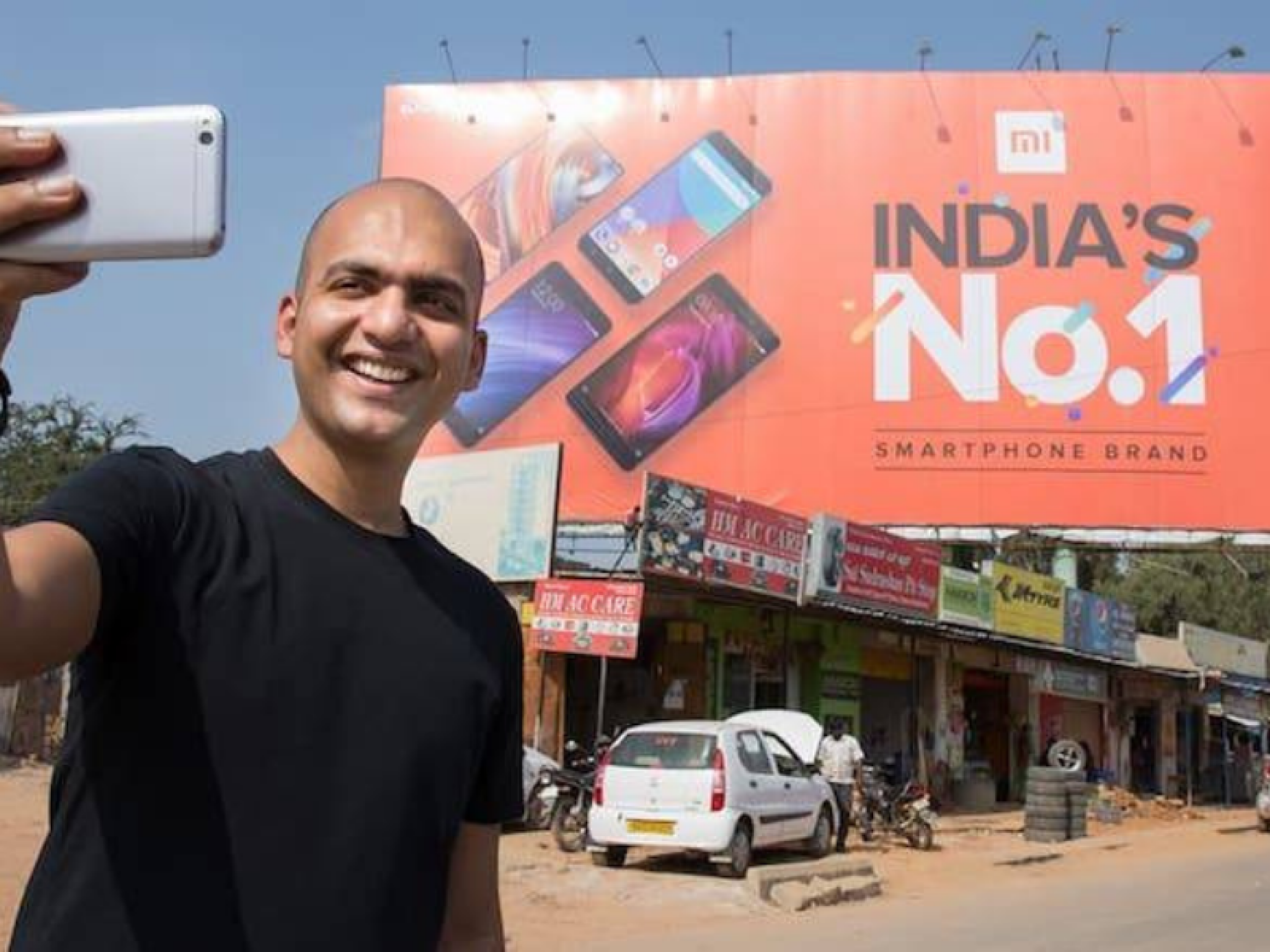

The increasingly difficult operating environment is encapsulated in market leader Xiaomi Corp. (1810.HK), which has been locked in a dispute with India’s tax man for much of this year. That tussle reached a new high last week, when Xiaomi said an Indian court’s refusal to lift a freeze on $676 million worth of its local assets had “effectively halted” its operations in the country.

India’s Enforcement Directorate (ED), its federal financial crime agency, froze Xiaomi’s assets in April, alleging the company made illegal remittances to foreign entities by passing them off as royalty payments. Xiaomi said that over 84% of the assets seized by the ED were the equivalent of royalty payments made to leading U.S. smartphone chipmaker Qualcomm (NASDAQ:QCOM).

While the dispute looks company-specific, it comes as Chinese tech companies face an increasingly hostile operating environment in the market. While Indian consumers have embraced Chinese smartphones and other high-tech products, analysts say, Delhi may worry about the rapid domination of its market by Chinese brands. Delhi has also expressed growing national security concerns about the safety of Chinese products, similar to those seen in the U.S.

As those tensions grow, the Chinese brands could face an uphill road in the market in the years ahead, with tighter scrutiny resulting in more similar clashes.

Xiaomi has denied any wrongdoing in the tax dispute, and challenged the ED’s asset freeze in court, calling the move “severely disproportionate.” The company sought relief, but the court said Xiaomi must first provide bank guarantees covering the $676 million in frozen assets. But Xiaomi said doing that would make it difficult for it to function and pay salaries ahead of the Hindu festival of Diwali – a major spending time in India.

The dispute has taken a toll on Xiaomi’s Hong Kong-traded stock, which has lost more than half of its value so far this year – far more than a 30% decline for the broader Hang Seng Index.

Xiaomi became one of the earliest Chinese smartphone makers to discover India in 2014 when the market was still relatively underdeveloped. It now manufactures 99% of its smartphones and 100% of its TVs locally, and counts the market as one of its most lucrative after China.

India is already the world’s second largest smartphone market behind China and remains full of potential. Its revenue passed $38 billion last year, up 27% from 2020, according to Counterpoint Research. Chinese smartphone brands accounted for 76% of the market, led by Xiaomi at 24%.

Chinese vendors have may have attracted attention from Indian regulators because they grew too quickly, according to some analysts. They add that India is trying to gain more clarity on how Chinese firms do their business there, which has resulted in closer scrutiny.

Broader trend

The Xiaomi case is part of that broader trend of similar disputes, said Atul Pandey, partner at Khaitan & Co., who follows cross-border investment and regulatory matters. “The Indian government banned access to a number of (Chinese) apps which were allegedly engaged in surreptitiously transferring personal data outside India in 2020-21,” he said, referencing a case that saw big names like TikTok and WeChat banned in India. “Subsequently, the government has been closely scrutinizing royalty and license payments to overseas shareholders.”

While scrutinizing Xiaomi’s business practices, the ED found the company’s Indian subsidiary started remitting foreign currency a year after it began its local operations on instructions from its parent in China. The ED determined the amount remitted was “for the ultimate benefit of the Xiaomi Group entities,” and that Xiaomi India did not receive any services from the three foreign entities that received the remittances. It also found Xiaomi India provided misleading information to banks while remitting the money abroad.

Despite the difficulties, Xiaomi has denied that it plans to leave India and move its local operations to Pakistan, calling a report by local media South Asia Index “false and baseless.”

Xiaomi and other Chinese smartphone makers have a massive market in India, especially in smaller cities, Pandey said, “It would not be a commercially prudent move for such smartphone makers to leave the Indian market.”

Most other Chinese smartphone makers have faced similar actions, including accusations of tax evasion against Oppo worth 44 billion rupees ($535 million). Huawei was also found to have remitted 7.3 billion rupees to its Chinese units despite making severe losses in the local market. As a result, its Indian CEO Li Xiongwei was detained while trying to leave the country and later released on bail.

In September, Indian media Business Today reported that Vivo, another major Chinese player in the market, remitted half of its total revenue of 624.7 billion rupees to Chinese companies to avoid paying local taxes. An investigation by the Indian tax department found that Vivo India was suspected of evading taxes totaling 22.1 billion rupees and subsequently froze 4.65 billion rupees worth of the company’s Indian assets.

Much of the tight scrutiny of Chinese companies has come since political tensions flared between the two countries following a border clash in 2020. India has cited security concerns in banning more than 300 Chinese apps since then, and has also tightened rules for Chinese firms investing in the country.

In a statement early July, China’s embassy in India said that probes were disrupting “normal business activities” for Chinese companies and chilling “the confidence and willingness of market entities from other countries, including Chinese enterprises, to invest and operate in India.”

India accounted for 17% of global Chinese smartphone shipments in 2021, according to Counterpoint, behind 31% that went to mainland China. But while China’s smartphone market has been weak in recent years, India’s has been much stronger, making it difficult for the Chinese brands to give up there.

While anti-China sentiment flared in the country following the border clash in 2020, India’s love for Chinese smartphones transcends any political tensions, mainly because they are seen as great value in a highly price-sensitive market, analysts said.

Indian manufacturers have tried to tap into the big demand for affordable smartphones at home in the past few years, with Mukesh Ambani, the billionaire head of sprawling Indian conglomerate Reliance, developing one such model in partnership with Google. But those have yet to make much of a splash among consumers.

“If you compare the features, Chinese smartphones offer a lot more, and cost only a little bit more,” said Kiranjeet Kaur, an associate research director at IDC.