Xero Tax is a cloud-based accounting software package that has been designed as a separate entity to Xero’s core product offering, a bit like the other apps in its range. It first appeared as a Xero product in Australia and has now become available in the UK.

However, although it has been designed as an ‘accountants only’ bundle, Xero Tax does work in harmony with the other packages in the Xero portfolio and more broadly. In fact, it’s been engineered to offer accountancy professionals and their clients a much more streamlined workflow through the accountancy and tax filing wilderness.

- Want to try Xero Tax? Check out the website here

Packed with pro-level features it comes armed and ready for the UK government’s Making Tax Digital campaign. Business owners need to be ready for if they haven't already prepared for it. Xero Tax might be specifically aimed at accountants, but it offers users a wealth of bookkeeping options. These range from handling corporation tax and producing accounts for small businesses through to more muscular tools for dealing with larger concerns with more demanding requirements.

Xero Tax Accounting: Pricing

If you’re an accountant or bookkeeping professional and enrolled in Xero’s partner program then you can get to use Xero Tax at no extra cost in the UK. In order to do that you’ll obviously need to be in the accountancy businesses and signed up to the partner program.

This is currently free to join and once you’ve enrolled as an accountancy professional you will be able to access Xero Tax from a tab that is found with the Xero HQ hub. This is the dedicated area that accountants and bookkeepers use in order to supply services to their clients.

The Tax side integrates with the rest of the platform, which is available in a number of different paid tiers: Simple (£7/month) for sole traders and landlords, Ignite (£16/month), Grow (£33/month), Comprehensive (£47/month) and Ultimate (£59/month).

If you want to add more depth to these packages, you could also opt to include bill payments (at £0.20 each), payroll (£1.50 per person), mileage expense tracking (£2.50) and CIS returns (£5 per month).

Most of what you'd need is included in the standard plans, but it's a shame to see something so simple and common as expense and mileage claiming sitting behind a paywall.

Xero Tax Accounting: Features

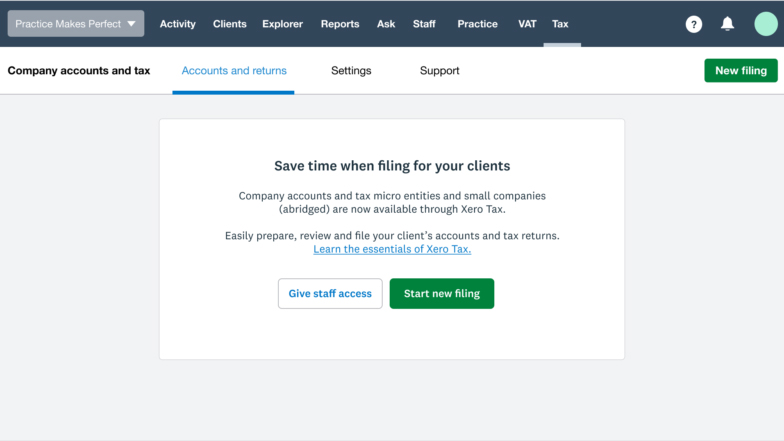

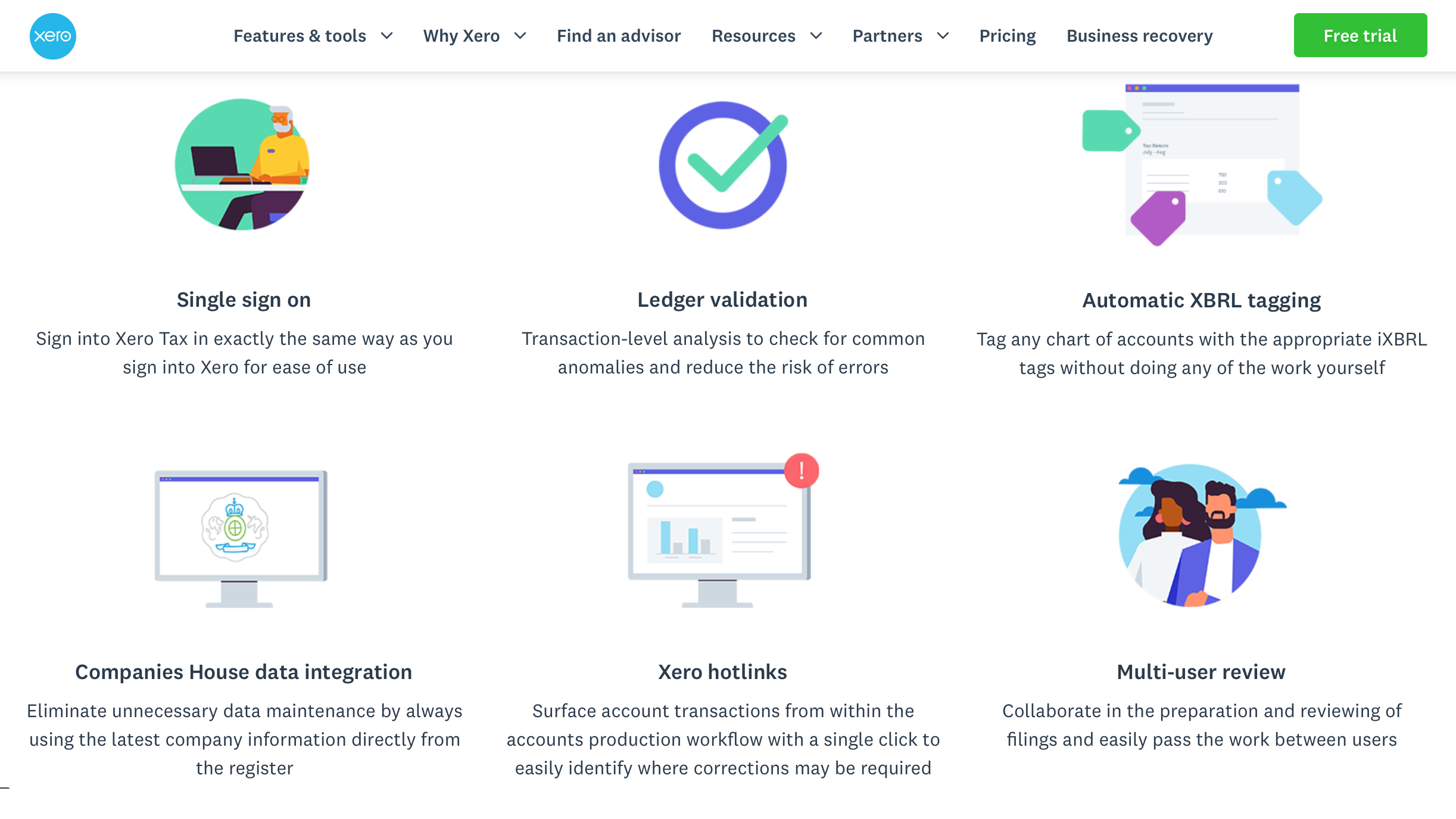

It’s easy to see why accountancy professionals will warm to Xero Tax as it’s been carefully put together and helps seamlessly join up the dots by covering a wealth of business bases. Being cloud-based, the package allows accountants and bookkeepers to analyse all aspects of businesses accounts, but also cross check data via Companies House and HMRC.

The software is nicely streamlined too, with a single sign-on that works just as it does for logging into Xero itself. Once you’re inside the interface it’s possible to carry out ledger validation, to check for any anomalies, benefit from automatic XBRL tagging for more efficient workflow and also offer updates on your progress that can be viewed by multiple authorised users.

Professional accountants also benefit from being able to customize their documents with company branding. Clients, meanwhile, can enjoy the ability of being able to approve filings using the built-in e-signing capability.

If you're looking to use the accounting software alongside Tax, you'll be able to send invoices and quotes, capture bills and receipts, reconcile bank transactions and submit VAT returns to HMRC.

We think where Xero's real strength lies is with its wide integration support of more than 1,000 different apps across its portfolio, including Hubdoc for document capturing.

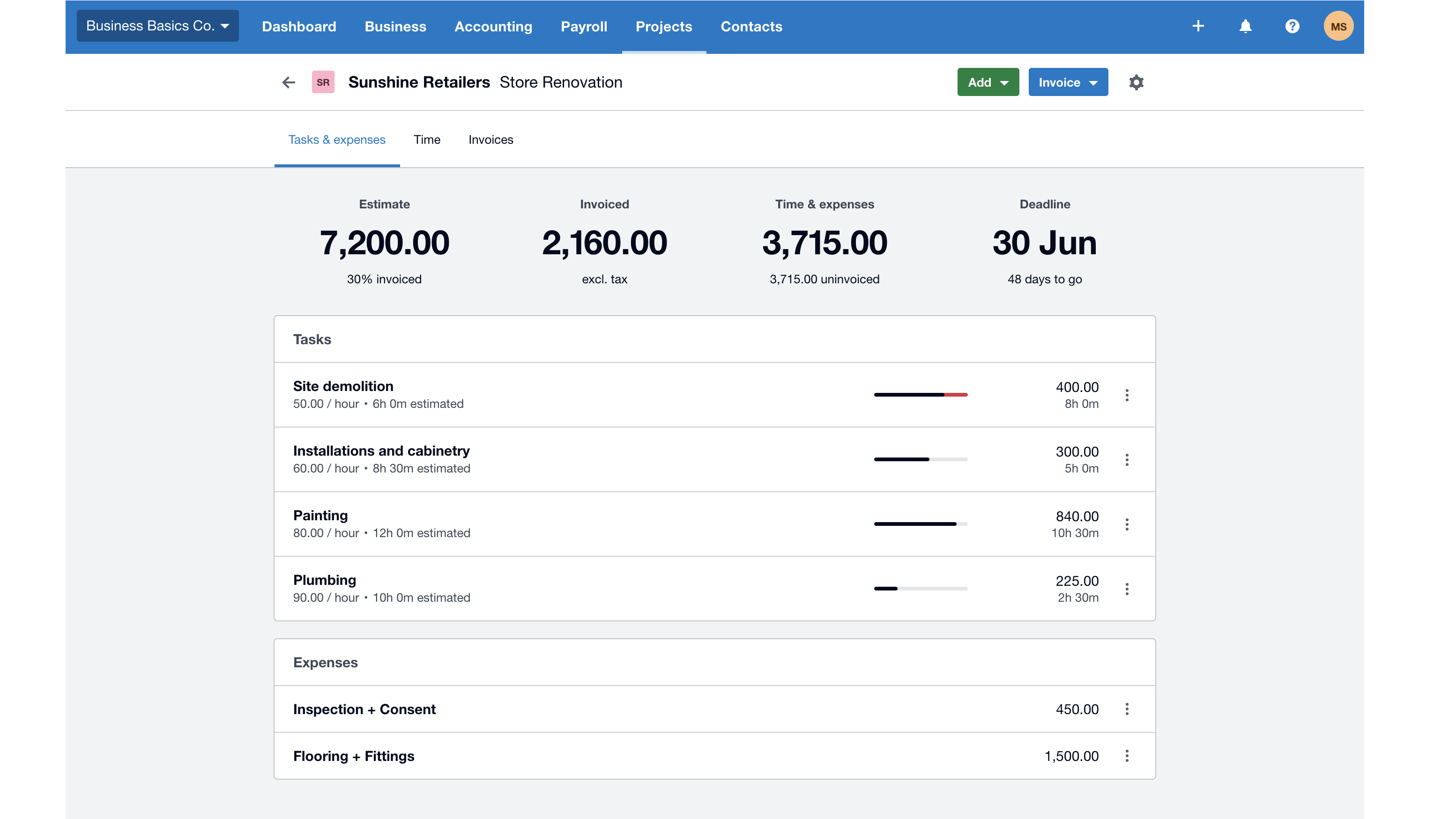

Unlike some other solutions, you can use Xero for project and time tracking if you need to be more granular about budgets, particularly if you're running multiple projects from different funding sources, and of course, you get the usual analytics and reporting to show you cash flow forecasts and such like.

Xero Tax Accounting: Performance

Xero has put a lot of effort into developing Xero Tax and recently added more features and functionality into the package to help with the evolving state of UK accounting requirements. Thanks to improved modules that support corporation tax and accounts production for small companies, the cloud-based software continues to build on its powerful foundations. Xero has said it will also be launching an open beta for Personal Tax during 2021.

In addition, the company is developing its Next Gen Practice concept, which is a developing vision that will help accountants streamline their workflow with clients.

By doing that, performance should also improve by harmonising several of the Xero apps, including the likes of Xero HQ, Xero Practice Manager, Xero Workpapers and, of course, Xero Tax.

Xero notes that customers' data is protected with multiple layers of security, but Xero Tax's true power comes from users populating their entire ecosystem with all the relevant data so that it can just be used to produce a report or return with ease – accountants and the software can then check if things look right and add any improvements or tweaks where necessary.

Because of how it works with the entire ecosystem and endless integrations, Xero Tax is a highly scalable option.

Xero Tax Accounting: Ease of Use

Xero Tax follows the theme pioneered in other areas of the Xero portfolio in that it is very easy to use. While it might appear to be something of a work in progress, with future tax modules including personal tax, partnership tax and trusts and estates still to come, along with other accounts production features that are in development, the overall stance of Xero Tax comes across as simple but effective.

Usefully, Xero has a dedicated migration team that can assist you if you’re moving a client, or clients from other tax software.

It helps that Xero is an industry giant, because besides integrating plenty of neat and powerful features into its products, the company can also spend a lot of time developing a visually clean dashboard with easy-to-understand charts. If you're not an accountant, you should have no major issues using Xero's software.

You can delve a little deeper into things like analytics if you need, and while they might take a bit longer to get your head around, they generally reflect the broader platform's no-nonsense approach so there shouldn't be any major headaches.

Xero Tax Accounting: Support

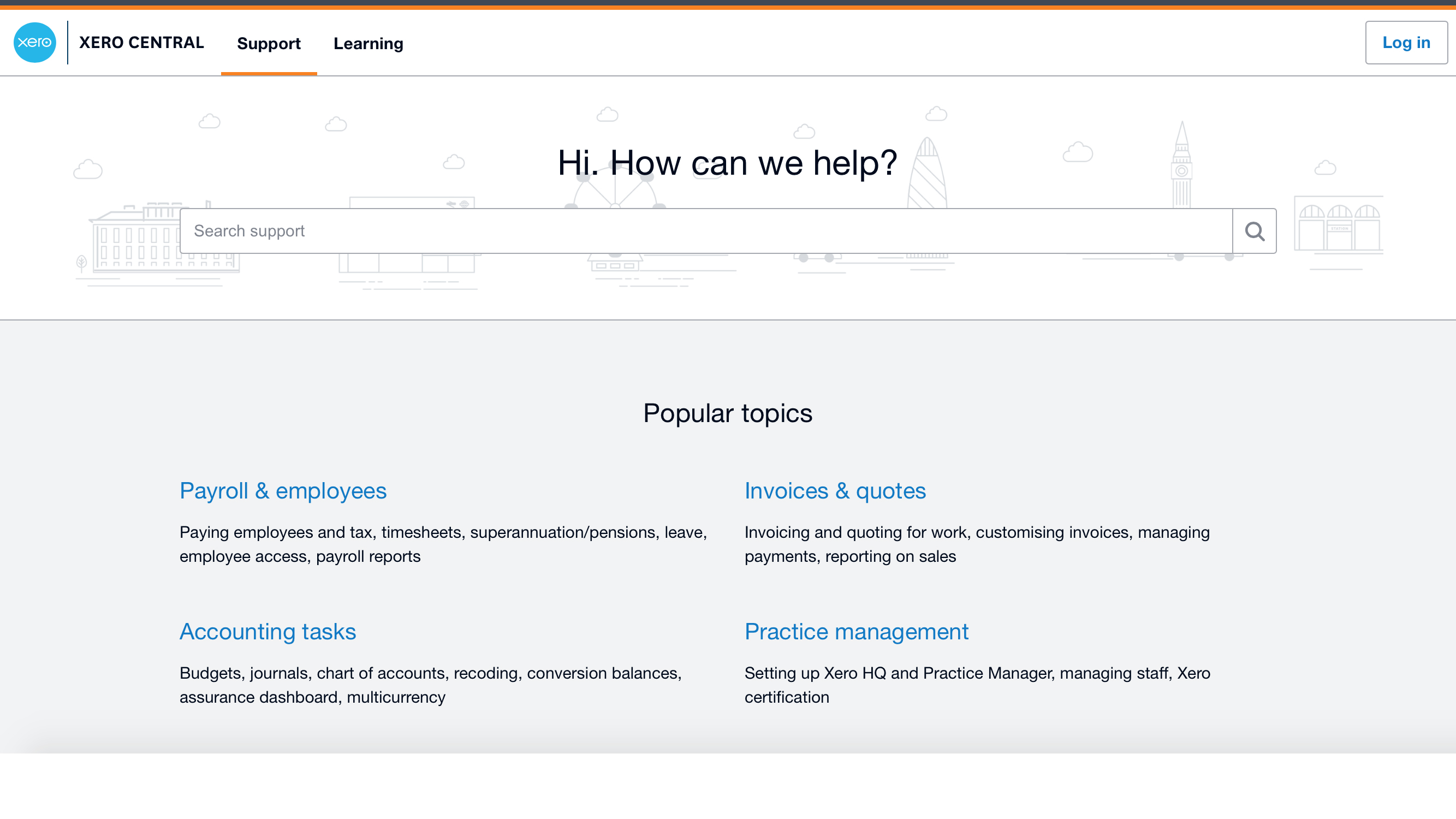

While Xero Tax has been designed to be pretty straightforward for accountancy professionals to get the hang of there is also plenty of help available on the support front.

Indeed, Xero is well known for the training it offers, such as for its Xero Tax education course. The company also holds regular webinars, which prove invaluable for any partners who have signed up.

All of this puts it rungs ahead of most other platforms, which offer comprehensive knowledge bases but no video guidance. For those who learn by seeing and doing, Xero has it in the bag.

On top of that you can get easy access to a plethora of support articles, but it’s still possible to speak to members of the help team if you need to get some hands-on help with an issue. Xero's blogs deserve a shoutout too, for their comprehensive coverage of company and product news but also what's going on within the industry.

Xero Tax Accounting: Final Verdict

Xero Tax is an ideal option if you’re a professional accountant and bookkeeper who might already be on the Xero user list. Considering that it can be called upon without any additional cost makes it a no-brainer in that respect. Added to that, the way that the cloud-based software can be used in conjunction with other apps in the Xero roster means that it’s useful for streamlining your bookkeeping and tax dealing duties.

The way it can be used to simultaneously deal with more than one client’s affairs adds extra appeal while the overall user experience is typically Xero with a simple-but-effective approach. With more features and functions due to be added, Xero Tax is a promising tool for accounting professionals.

If you're not a professional accountant then there are plenty of other options to explore, including Xero's own portfolio of finance and business-related software plus Sage Business Cloud Accounting, QuickBooks, Xero, FreshBooks, Freeagent, GoSimpleTax, TaxCalc, Nomisma, ABC Self-Assessment, Crunch or Zoho Books.

- We've also highlighted the best accounting software