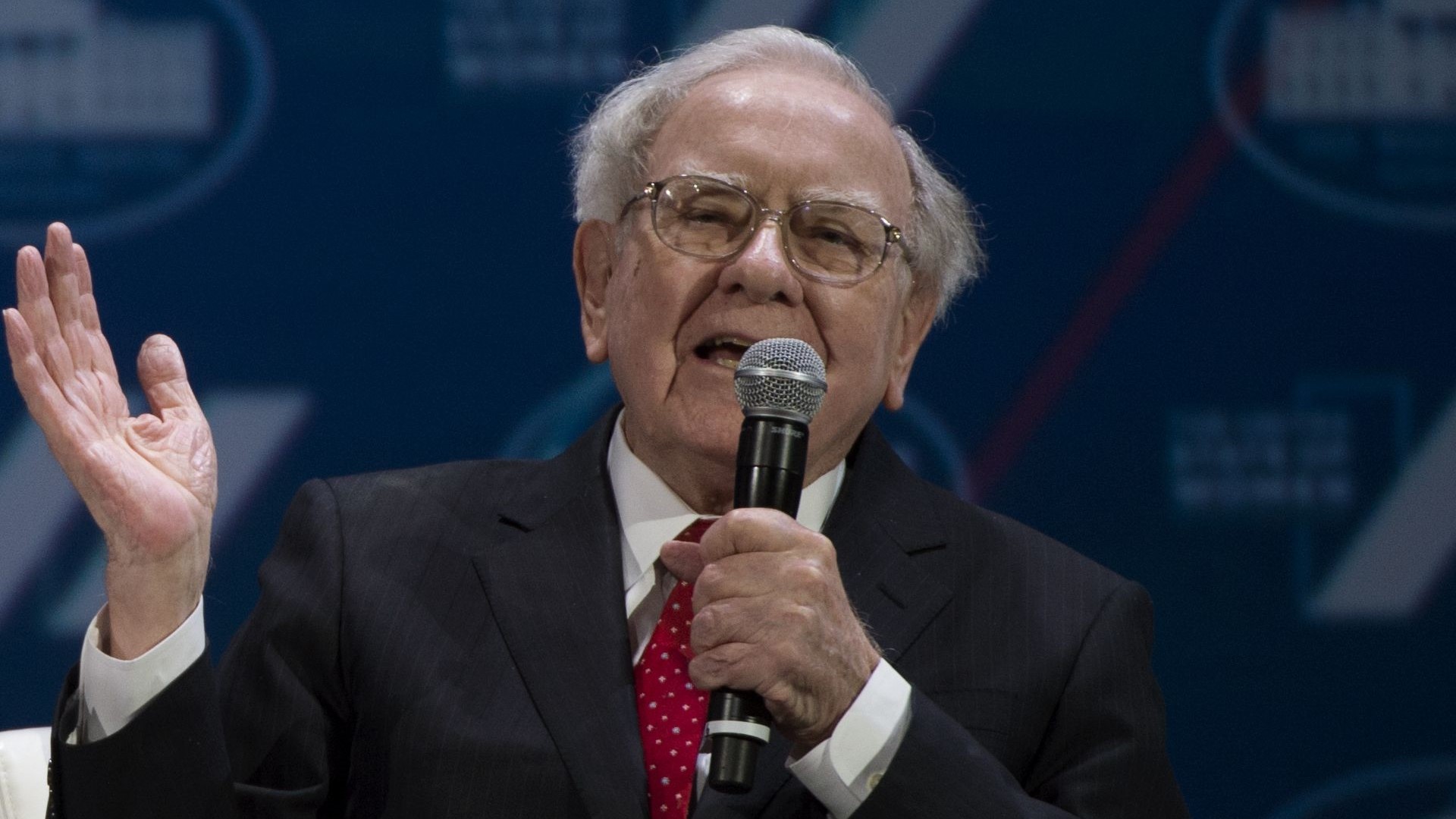

When billionaire investor Warren Buffett is asked whether he’d ever buy a lottery ticket, his answer is both revealing and consistent with a lifetime of disciplined investing. In short: he wouldn’t buy one, even if he could afford the entire series.

That simple line tells a larger story about how Buffett thinks about risk vs. reward, how gambling differs from investing, and what everyday people can learn from his risk-averse approach.

Buffett’s (Very Clear) Stance on Lottery Tickets

Buffett has said in interviews and public appearances that he will “be happy to accept a lottery ticket as a gift, but I’ll never buy one.” That’s because, even for someone with nearly unlimited resources, the odds just don’t make sense. The expected return on most lottery tickets is negative, meaning in aggregate players lose money, even if one person occasionally wins big.

This quote often circulates in investor circles because it perfectly captures Buffett’s guiding philosophy: don’t gamble with money unless the odds and logic are in your favor.

Trending Now: I’m a Self-Made Millionaire — 6 Steps I Took To Become Rich on an Average Salary

Discover More: 9 Low-Effort Ways To Make Passive Income (You Can Start This Week)

Gambling vs. Investing: A Buffett Lens

To understand why Buffett wouldn’t waste money on the lottery, it helps to look at how he distinguishes gambling from investing:

Gambling: A Transfer, Not Creation, of Wealth

Buffett has been candid about gambling as an activity that merely transfers money from many players to a few winners, and often to the house. In past comments, he’s said gambling as something he views negatively: “Gambling is socially revolting … it’s a tax on ignorance.”

In a Berkshire Hathaway meeting, he deeply criticized the idea of profiting off people’s hopes with little chance of payoff, which is exactly how lotteries work.

Investing: Ownership With Upside Over Time

By contrast, Buffett views investing as buying a piece of a real business. Each stock share represents a slice of earnings, management and long-term growth potential. This is a far cry from a lottery ticket that has no underlying economic value.

As Buffett himself has said “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

This mindset encourages long-term thinking, research and owning value as opposed to chasing short-term windfalls.

Why Buffett’s Approach Works So Well

Buffett’s aversion to something like a lottery ticket reflects several core principles:

1. Probabilities Matter

Lottery odds are deliberately stacked against players. The expected value, what you statistically should win, is often much less than the cost of the ticket. Buffett doesn’t waste capital where negative expected value is baked in.

2. Investing Builds Value; Gambling Does Not

When Buffett buys stocks, he looks at the fundamentals of the underlying business: earnings, competitive advantage and management quality. A lottery ticket has no such fundamentals because it’s pure chance.

3. Risk Aversion Is Rational

Unlike gamblers who may irrationally hope for outsized wins, Buffett carefully evaluates risk and seeks situations where the reward outweighs the downside. He’s famous for saying:

“The first rule of investment is: don’t lose money.”

This simple rule puts lottery tickets, wherein losses are almost inevitable, well outside his playbook.

Lessons for Everyday Investors

Whether you’re saving for retirement, planning a home purchase or just managing everyday finances, Buffett’s perspective has a few clear takeaways:

- Avoid investments with negative expected value, like lottery tickets.

- Think long-term instead of chasing quick wins.

- Base decisions on fundamentals, not luck or speculation.

- Treat investing as buying ownership in real assets, not as gambling.

Warren Buffett may be worth billions, but his refusal to buy a lottery ticket has nothing to do with cost, and everything to do with principle. His perspective makes one thing crystal clear: real wealth doesn’t come from lucky breaks. It comes from making smart, repeatable decisions over time.

Lottery tickets offer a moment of excitement, but they don’t offer a path forward. Investing, on the other hand, gives you ownership, compounding growth and the chance to steadily build a future that isn’t dependent on chance.

More From GOBankingRates

- The $20 Dollar Tree Haul That Looks Like Williams-Sonoma

- The Nuclear Savings Rule: 10 Frugal Living Tips From the 1950s Era

- 9 Low-Effort Ways To Make Passive Income (You Can Start This Week)

- 6 Safe Accounts Proven to Grow Your Money Up to 13x Faster

This article originally appeared on GOBankingRates.com: Would Warren Buffett Buy a Lottery Ticket? What He Says About Risk vs. Reward