Taking out life insurance can be a great way to guarantee financial safety for your loved ones in a worst-case scenario. In 2023, there were around 134 million individual life insurance policies in the U.S. and 118 million people with group life insurance.

But in a twist of drama, sometimes people choose beneficiaries that might surprise their families. In this story, the man chose his ex, which caused his family to demand she give away the payout to his baby and their mom. Feeling like she “earned” the money and wanting to honor his decision, the woman refused.

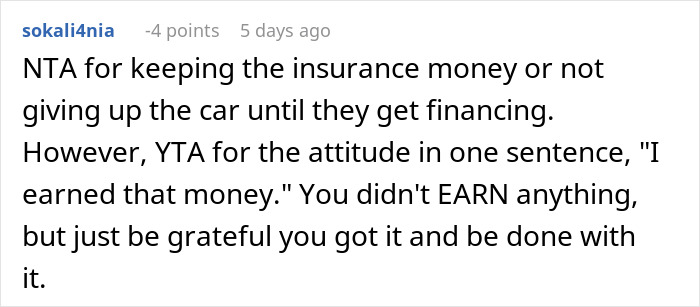

A woman received her ex’s life insurance payout but was soon approached by his parents

Image credits: Kaboompics.com / pexels (not the actual photo)

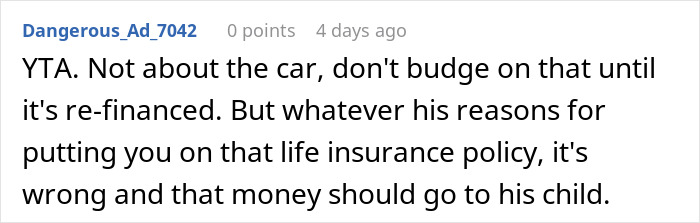

They believed her money should go to them and the man’s child

Image credits: drazenphoto / envato (not the actual photo)

Image credits: throwsnsawa

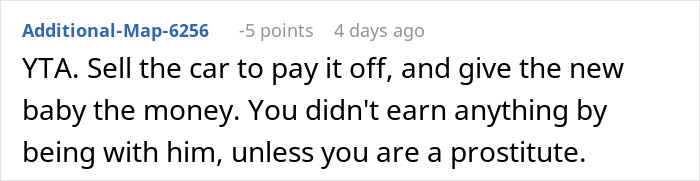

This story shows how important it is to untangle finances with an ex

Image credits: FabrikaPhoto / envato (not the actual photo)

Going through a breakup is hard enough without having to worry about finances. But there are some things all couples should do after breaking up, one of which is to untangle their shared finances. Even if they’re not married – and many couples in this day and age are not.

Recent research shows that around 12% of American couples are cohabiting instead of living in a married household. So, it’s natural that couples in long-term relationships merge their finances. After all, 61% of couples in the U.K. say they share household expenses.

Financial experts generally recommend carefully assessing what belongs to whom after a breakup. And we’re talking about more serious assets than a shared Netflix account. Some advise making a comprehensive list and including everything from credit cards, car loans, and mortgages to jewelry, collectibles, and furniture.

A car that is under one partner’s name but is financed by the other certainly creates serious financial entanglement. It’s then no surprise that the author of this story wanted her name off the car lease.

Figuring out finances after a breakup is hard, so couples should discuss the “what ifs” while still together

This story is like a cautionary tale for others on how important it is to figure out shared finances when you break up with someone. The author details how she asked her ex-boyfriend to refinance the car multiple times, but got nowhere.

The truth is that having conversations about finances is awkward after you’ve broken up. The experts at Patriot Federal Credit Union recommend sorting things out as calmly and rationally as possible. Sometimes, having a neutral third party, like a mediator or a financial advisor, can help.

Some experts even recommend discussing these things while still in the relationship. However, for many, it’s a taboo topic. A study by researchers from the universities of Cornell and Yale found that people often avoid money topics because they think it’ll lead to a fight.

But financial therapist Aja Evans told The New York Times that, ideally, couples should talk about money at least once a month. “I love the ‘money date’ concept,” she said.

For some couples, it might be best to discuss the financial changes after a potential breakup while still together. As family lawyer Catherine Costley told Refinery29, unmerging finances after a breakup is “like shutting the door after the horse has bolted.”

If nothing else works, couples should consider reaching out to a professional. “Emotional support from family is great, but if your finances are tangled, professional advice is key,” personal finance expert Aaron Peake told Stylist. “[They] can help you understand your options and support you through the financial side of things.”

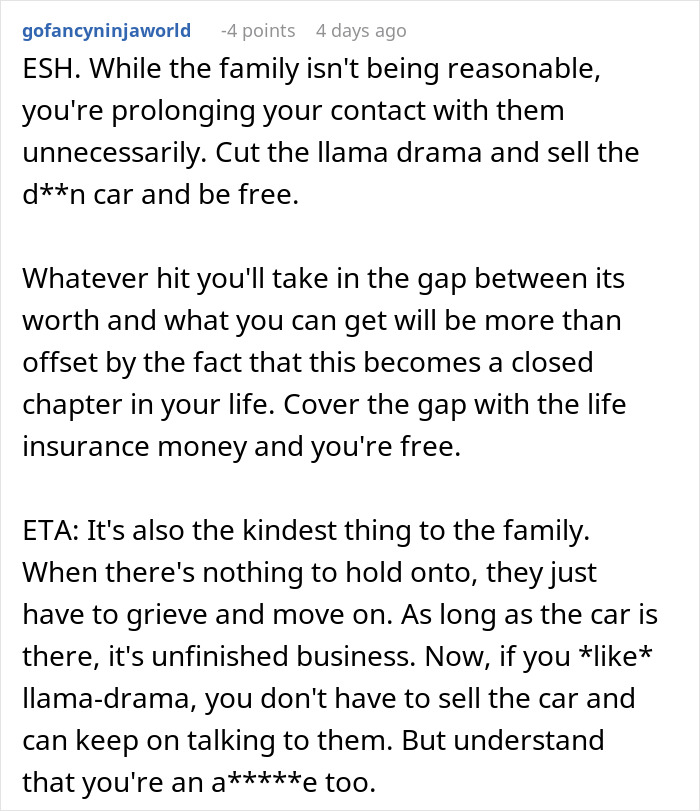

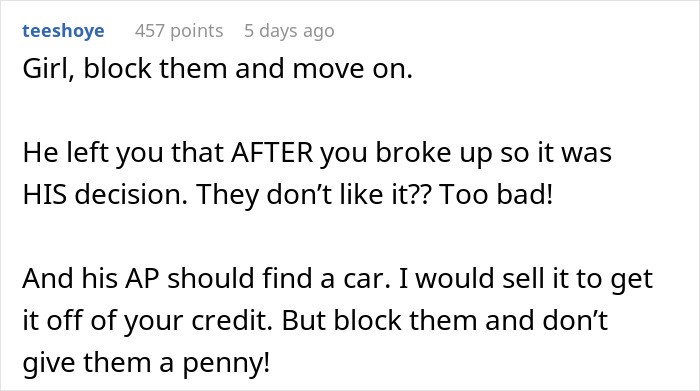

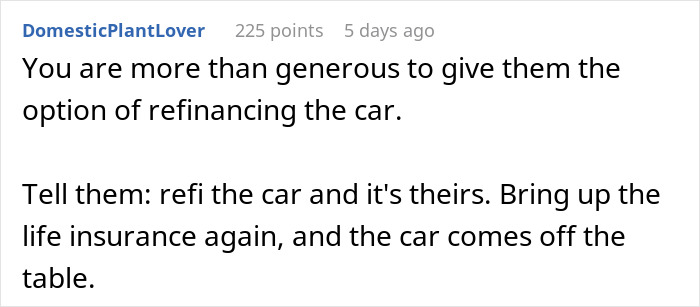

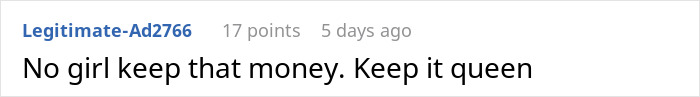

In the comments, the woman detailed how much the car the man left her was worth

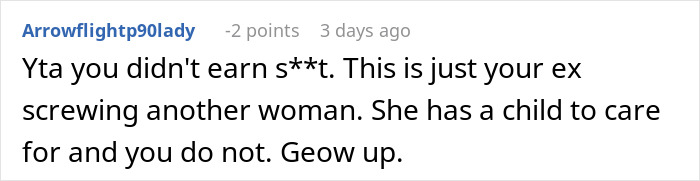

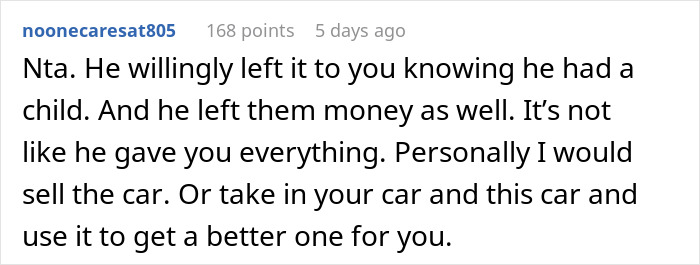

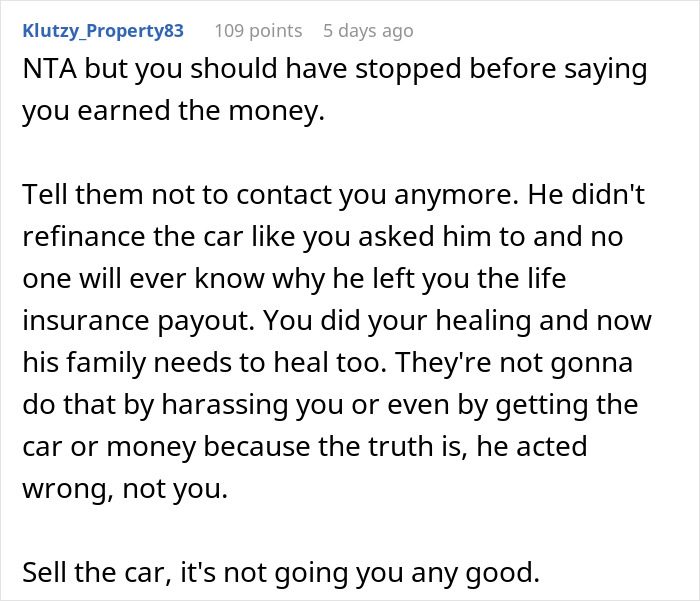

Most commenters sided with the woman: “It was HIS decision”

Still, others thought she should act in good faith and give away the insurance payout to the kid’s mom