While daily stock price moves tend to dominate headlines, shifts in fundamental ranking scores can often tell a deeper story about a company's trajectory. This week, Benzinga's proprietary Growth, Value, Quality and Momentum data revealed major swings among several popular stocks, from retail to semiconductors.

Benzinga Edge Stock Rankings evaluate companies across four key factors: Value, Momentum, Growth and Quality. The Growth score specifically measures how quickly a company's revenue and earnings have expanded, blending both long-term trajectories with more recent performance trends.

Here are three big companies that stood out.

Costco: Value Gains

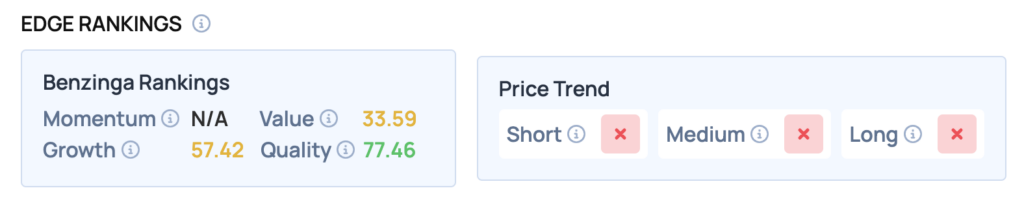

Costco Wholesale Corp (NASDAQ:COST) saw its Value score increase by 6.13 points, rising from 27.12 to 33.25.

As a $400B-plus retail giant, Costco's shift reflects stable cash flow and membership-driven strength. In an uncertain consumer environment, the gain underscores its role as a defensive favorite for both institutional and retail investors.

Costco recently reported strong fourth-quarter results with EPS of $5.87 and revenue of $85.16 billion, beating analyst estimates, alongside solid membership fee and e-commerce growth.

Despite the earnings beat, shares have been volatile as analysts adjusted price targets downward, citing cautious outlooks in discretionary categories like electronics and home goods.

Read Also: Stock Of The Day: Where Is The Bottom For Costco?

Accenture: Tech Services Leader Improves

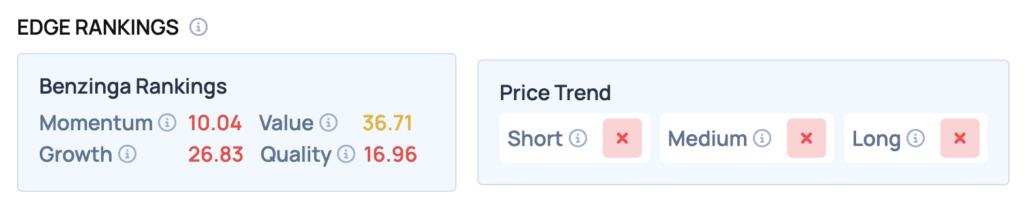

Accenture Plc (NYSE:ACN) posted a 16.14-point jump in Value, climbing from 19.48 to 35.62. The consulting and IT services powerhouse continues to benefit from digital transformation demand, even as corporate budgets tighten.

Accenture recently beat fourth-quarter earnings estimates with EPS of $3.03 and revenue of $17.6 billion, and projected stronger fiscal 2026 results, including $71 billion–$73 billion in sales. Despite the solid report, multiple analysts cut their price targets on the stock, though most maintained positive ratings.

Read Also: Accenture Posts Solid Growth — Can Restructuring And AI Push Secure Long-Term Profitability?

Wolfspeed: Momentum Rocket

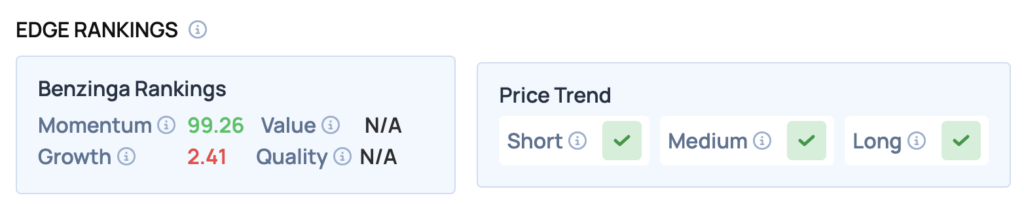

Wolfspeed Inc (NYSE:WOLF) delivered one of the most dramatic moves across the entire dataset, with its Momentum score surging 96.48 points, from 2.44 to 98.92.

Specializing in semiconductors and silicon carbide technology, Wolfspeed has become a popular name in EV and renewable energy supply chains. Shares surged 1,800% this week after the company announced its successful emergence from Chapter 11 bankruptcy.

The rally was driven by a court-approved restructuring that cut debt by 70%, reduced interest costs, and strengthened the balance sheet, despite significant dilution for existing shareholders.

Read Also: Wolfspeed Stock Continues To Climb: What’s Going On?

Why It Matters

From Costco's defensive Value gain to Accenture's steady tech resilience and Wolfspeed's explosive Momentum breakout, these moves reveal how quickly fundamentals can shift. For retail investors, tracking percentile changes offers early signals of leadership shifts, often before they're fully priced in.

Image: Shutterstock