/AI%20(artificial%20intelligence)/Businessman%20work%20with%20ai%20for%20economy%20analysis%20financial%20result%20by%20digital%20augmented%20reality%20graph%20by%20Natee%20K%20Jindakum%20via%20Shutterstock.jpg)

Wolfspeed (WOLF), the semiconductor company specializing in wide-bandgap materials and devices, has shifted its incorporation from North Carolina to Delaware to give itself more flexibility and more favorable treatment from the stringent Chapter 11 bankruptcy regulations. For this, Wolfspeed carried out a reverse stock split, along with submitting the applications for the required regulatory approval of related indentures.

Essentially, the company issued new stock to pay off its debtors, with its existing shareholders getting a maximum of 5% of the new shares. This has led to the bulk of the 329.4% year-to-date (YTD) upmove in WOLF stock and should be seen in that context.

But after years of shareholder wealth destruction, can WOLF stock finally make a comeback? Let's find out.

Unprofitable for Decades

Remarkably, since the company's listing in 1993, when it was known as Cree, Wolfspeed has never reported any profits. Meanwhile, over the last 10 years, the company's revenues have clocked a negative CAGR of 7.39%. So, Wolfspeed's performance has certainly been nothing to “wolf” about.

This continued in the most recent quarter as well, as the company's losses came in wider than the consensus estimates.

Revenues were down 1.8% from the previous year to $197 million, as net losses swelled markedly in the same period to $669.3 million from $174.9 million. On a per-share basis, however, the losses narrowed to $0.77 from $0.89. Yet, it came in wider than the consensus estimate of a loss of $0.70 per share.

For the fiscal year ended June 29, cash used in operating activities was $711.7 million, almost similar to the prior year's $725.6 million. Overall, the company closed the fiscal year with a cash balance of $955.4 million. Not only was this significantly lower than the prior year's figure of $2.2 billion, but it was also much lower than the company's short-term debt levels of $6.5 billion. This makes the company's Chapter 11 bankruptcy claims less surprising.

The Business Is Interesting

Wolfspeed, despite its severe issues like financial mismanagement, persistent losses, and a crippling debt load, still owns a vital asset, which is one of the few operational silicon carbide (SiC) factories in the U.S. This gives it a serious advantage. The company is poised to benefit significantly from huge, near-to-long-term SiC semiconductor demand, mainly fueled by the booming electric vehicle (EV) sector and data centers.

Market forecasts back this up with hard numbers. Experts estimate the SiC device market will explode to somewhere between $11 billion and $14 billion by 2030. Crucially, about 70% of that massive demand is expected to come directly from EVs.

Operationally, Wolfspeed just hit a massive milestone during its messy restructuring when it rolled out its 200mm silicon carbide wafer portfolio. This is a potential game-changer. It could totally reposition the company in the chip supply chain. Before now, Wolfspeed mostly manufactured using the older 150mm standard. Shifting to the 200mm line represents a huge leap in efficiency and scale. Bigger wafers let chipmakers squeeze more devices onto each one. In theory, this should lower production costs per unit and generally improve manufacturing yields.

Meanwhile, to power this expansion, Wolfspeed is betting big on new facilities coming online. The shell of the John Palmour Manufacturing Center in Chatham County, North Carolina, is now complete. This new facility is expected to become one of the world's largest 200mm SiC wafer fabs. Simultaneously, the company is working to upgrade their existing device fab in Marcy, New York, turning it into a fully automated 200mm power device plant. This upgrade is supposed to boost output by about 30%, keeping Wolfspeed on track with its aggressive long-term goals.

But challenges remain, even beyond the money problems. The firm is facing intense competitive heat. Not only are public rivals like STMicroelectronics N.V. (STM) and ON Semiconductor Corporation (ON) racing to scale their own 200mm capabilities, but there's also major pressure from Chinese competitors aggressively building up their domestic SiC capacity. And speaking of bankruptcy, the Japanese player JS Foundry filed for bankruptcy earlier this year. While strategy errors played a role, that failure serves as a harsh reminder that success here is far from guaranteed.

Analyst Opinion on WOLF Stock

Before diving into what Wall Street thinks, I reckon that Wolfspeed's business has a role to play in the wider AI revolution. Notwithstanding all the noise around its finances and the stock, Wolfspeed has legitimate capabilities and expertise in the silicon carbide space. Thus, the best outcome for its existing stakeholders would be a buyout by any of the chip giants, where Wolfspeed's capacities can complement their existing chipmaking business.

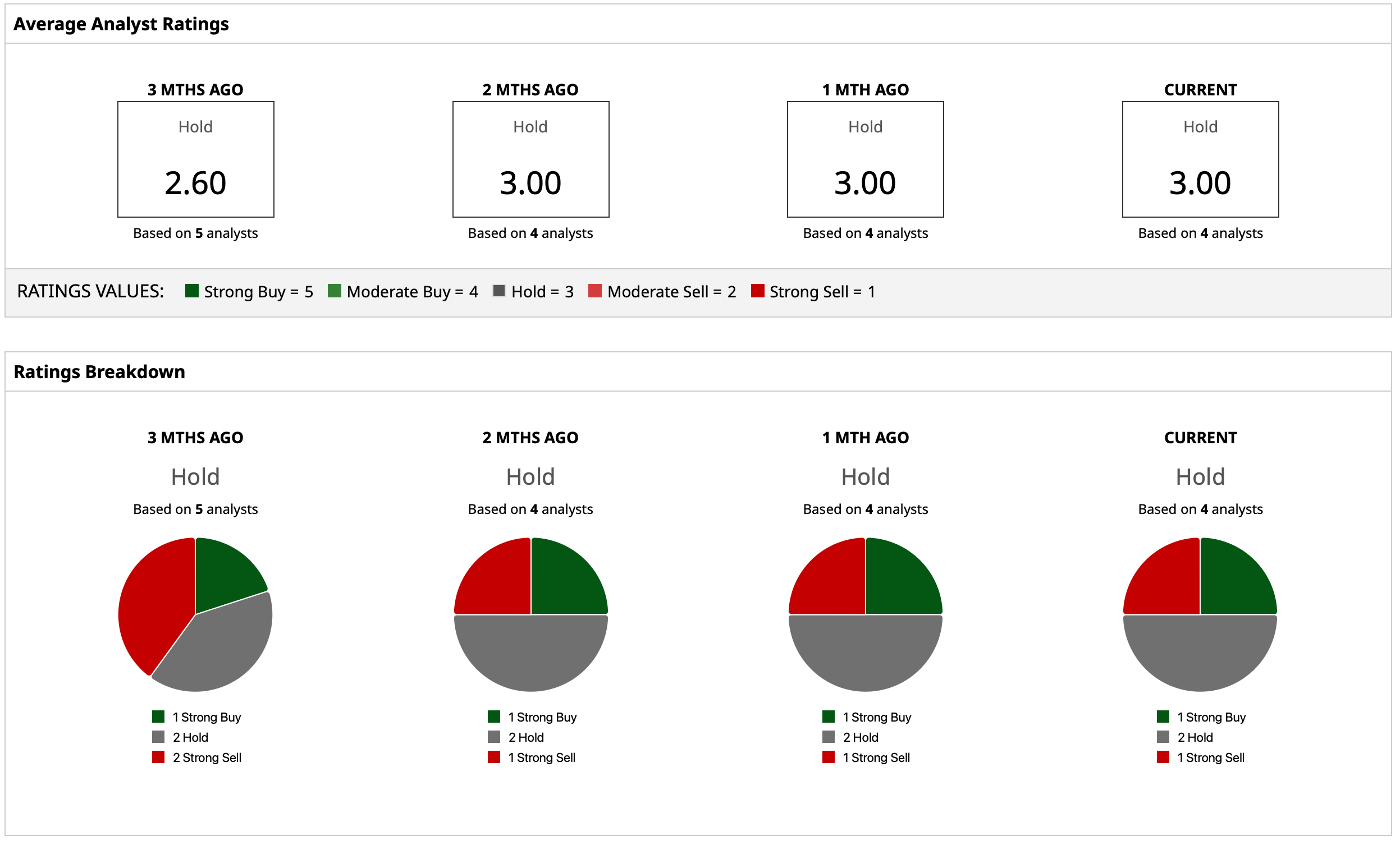

Overall, analysts have deemed the stock a “Hold,” with a mean target price of $3.75 and a high target price of $6. Both have already been surpassed. Out of four analysts covering the stock, one has a rating of “Strong Buy,” two have a “Hold” rating, and one has a rating of “Strong Sell.”