/The%20logo%20for%20Wolfspeed%20displayed%20on%20a%20smartphone%20screen%20by%20T_%20Schneider%20via%20Shutterstock.jpg)

Wolfspeed (WOLF) stock jumped nearly 20% at market open today after the chipmaker confirmed that bankruptcy restructuring has reduced its overall debt load by a whopping 70%.

The announcement arrives about a month after WOLF exited Chapter 11 bankruptcy that its chief executive, Robert Feurle, said positions the company to “move swiftly on its strategic priorities.”

Including today’s rally, Wolfspeed stock is trading up nearly 40% over the past five days.

Why Did Wolfspeed Stock Rally on Thursday?

Investors are cheering WOLF stock on Thursday primarily because a big decline in debt load frees up capital for growth, research and development, and operational stability.

It improves creditworthiness, reduces interest expenses, and lifts investor confidence in the firm’s long-term viability.

The restructuring means stronger cash flow and strategic discipline, key for competing in the high growth power semiconductor space.

Now that Wolfspeed has emerged from Chapter 11 and boasts a leaner balance sheet, it is strongly positioned to attract partnerships, scale production, and capitalize on EV and renewable energy demand.

The recent share price rally reflects optimism about a cleaner, more agile Wolfspeed.

Is It Safe to Buy WOLF Shares in 2025?

Despite positive headline, several red flags warrant caution in playing Wolfspeed shares at current levels.

Exiting bankruptcy or lowering debt may not reflect underlying operational strength, revenue visibility or competitive positioning.

Considering these ongoing concerns, a 1,800% rally in this semiconductor stock in less than a month sure look disconnected from the fundamentals.

In short, Durham-headquartered Wolfspeed may be more akin to a meme stock than a sound, long-term investment in the second half of 2025.

Wall Street Warns of a Massive Crash in Wolfspeed

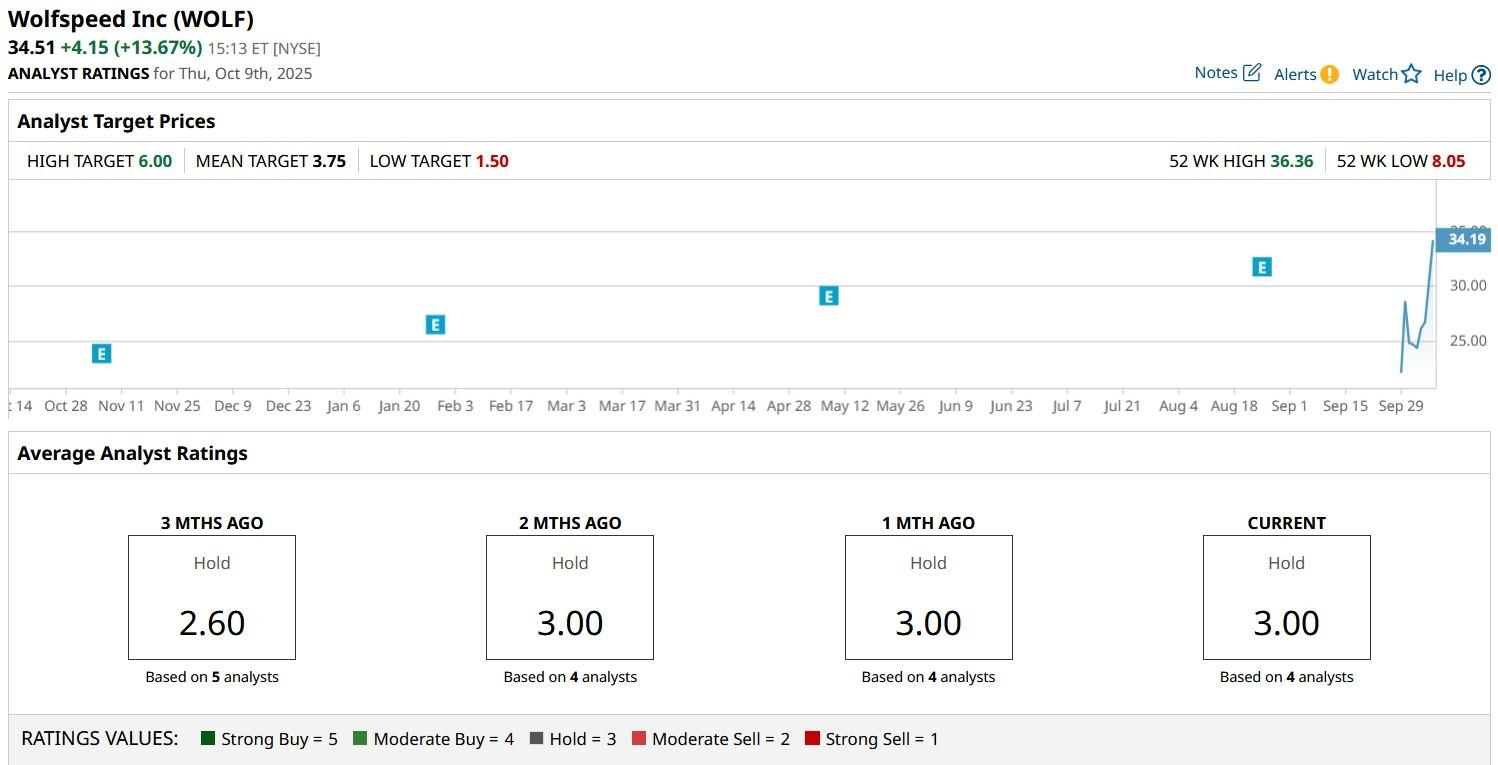

Investors should also note that Wall Street firms continue to forecast a massive crash in Wolfspeed stock.

According to Barchart, the consensus rating on WOLF shares currently sits at “Hold” only with the mean target of $3.75 only indicating potential downside of nearly 90% from here.