/Unitedhealth%20Group%20Inc%20HQ%20photo-by%20jetcityimage%20via%20iStock.jpg)

UnitedHealth Group (UNH) last week officially confirmed what Wall Street has suspected for months: The healthcare giant is facing both criminal and civil Department of Justice investigations into its Medicare billing practices.

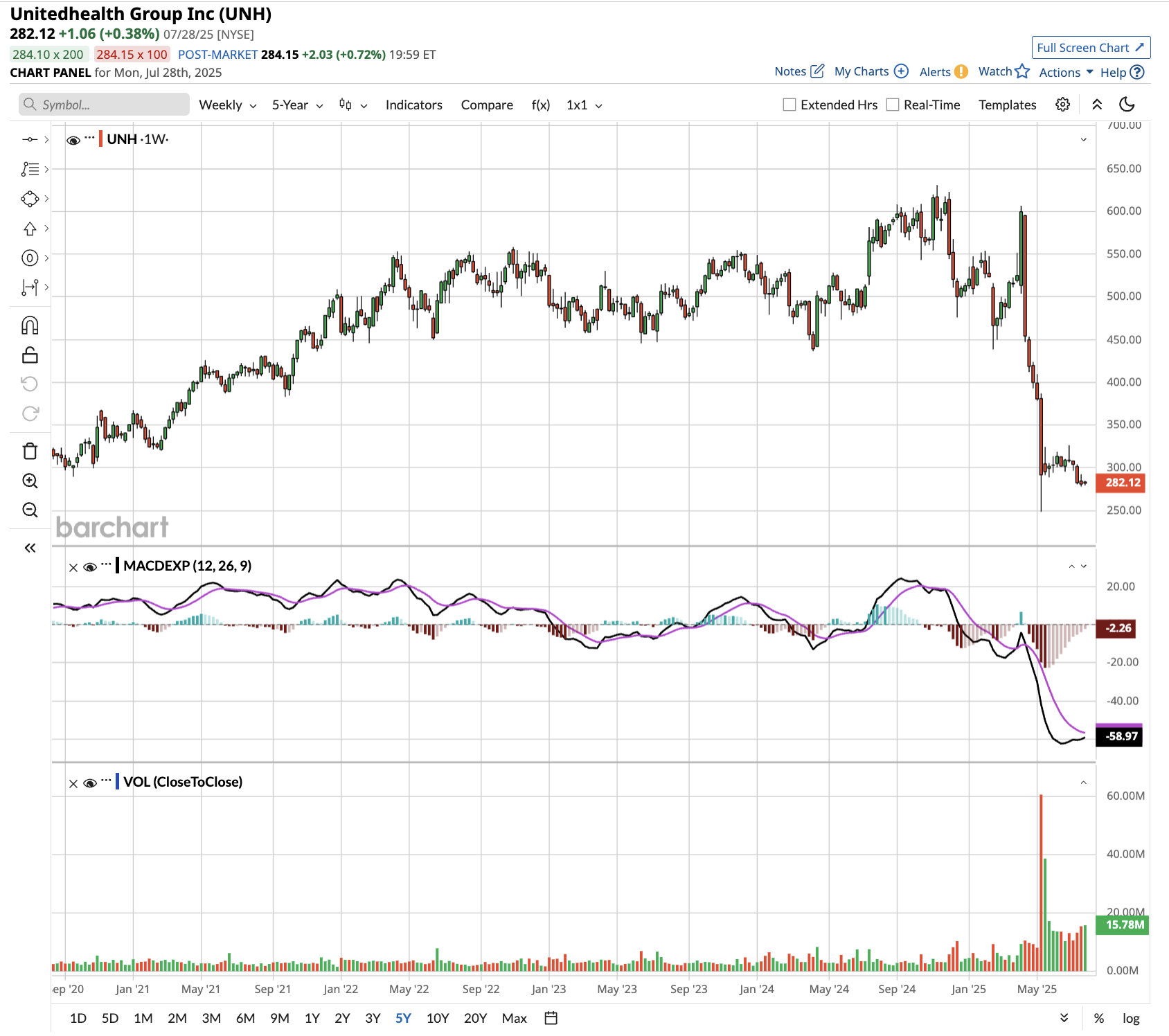

The announcement sent UNH stock lower by more than 3% last week, adding another layer of uncertainty to what has already been a tumultuous year for the nation’s largest private insurer.

In a securities filing, UnitedHealth revealed it is cooperating with formal DOJ requests and has launched a third-party review of its business policies. The company maintains “full confidence in its practices” and expects to complete the independent audit by the end of the third quarter. However, this confirmation marks a significant shift from previous denials of any DOJ investigation.

UnitedHealth now faces what Mizuho analyst Ann Hynes calls a “perfect storm.” UNH stock has plummeted over 45% this year following a cascade of setbacks including the abrupt departure of CEO Andrew Witty in May, suspended 2025 earnings guidance due to skyrocketing medical costs, and ongoing fallout from the December murder of CEO Brian Thompson.

The DOJ investigations target the company’s Medicare Advantage business, which generated $139 billion in revenue last year. Reports suggest that prosecutors are examining whether UnitedHealth inflated diagnoses to trigger higher Medicare payments and whether doctors felt pressured to submit claims for certain conditions that would boost reimbursements.

Investment Outlook for UNH Stock: Cautiously Optimistic

Despite the mounting challenges, several analysts maintain a measured outlook. Mizuho’s Hynes believes investor concerns are overblown, noting “the stock is trading like the government’s going to kick them out of Medicare and Medicaid, and the likelihood of that is zero.” Hynes expects the situation to be resolved with a financial settlement and a corporate integrity agreement, a common outcome for such investigations.

Plus, UnitedHealth’s fundamentals remain strong despite current headwinds. It serves nearly 150 million people and has built an integrated healthcare ecosystem spanning insurance, medical services, and pharmacy benefits. Its scale advantages and market position in Medicare Advantage provide long-term defensive qualities.

UNH stock also faces ongoing challenges with its Optum Health physician practice unit, where profits have collapsed due to changes in Medicare reimbursement. Recovery here is essential for the integrated care model that has driven UnitedHealth’s competitive advantages.

Is UNH Stock Undervalued?

Analysts tracking UNH stock forecast adjusted earnings per share to narrow from $27.66 in 2024 to $18.07 in 2025. However, earnings are forecast to improve to $34.61 by 2029.

UNH stock trades at a forward price-earnings multiple of 13.3x, which is reasonable. If it trades at 15x forward earnings, UNH stock should be priced around $510 in early 2029, indicating upside potential of almost 100% from current levels.

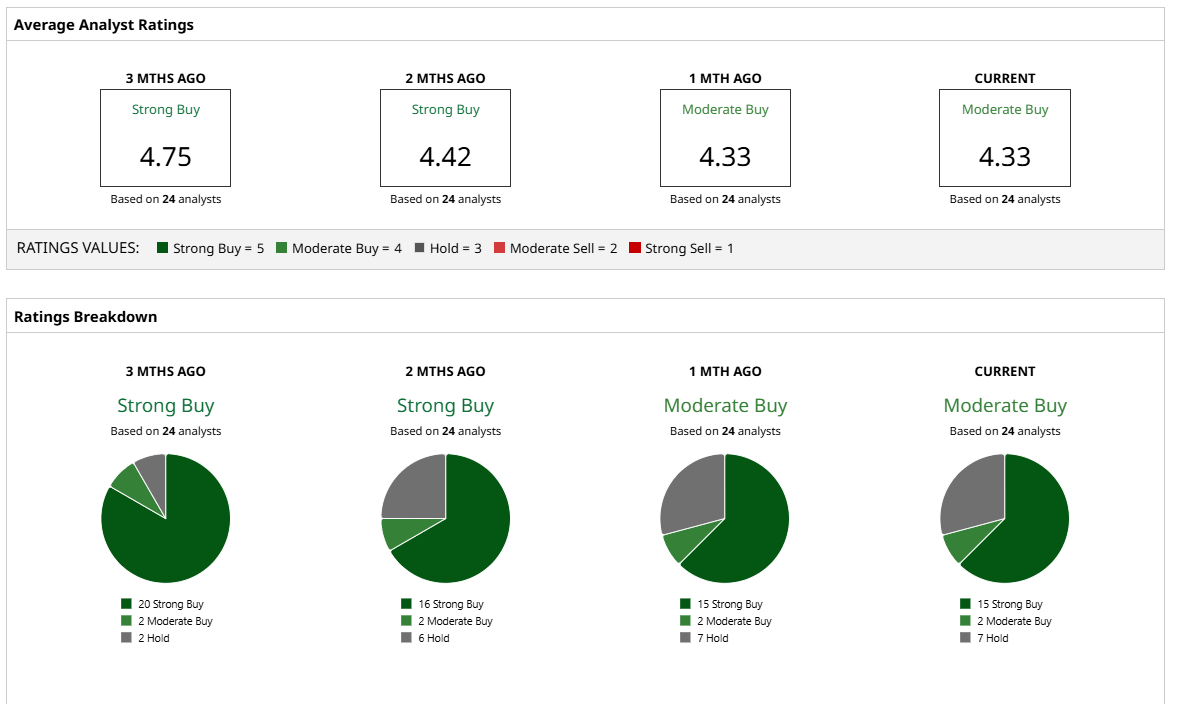

Out of the 24 analysts covering UNH stock, 15 recommend “Strong Buy,” two recommend “Moderate Buy,” and seven recommend “Hold.” The average target price for UNH stock is $354.42, 33% above the current price.

For existing shareholders, this appears to be a “Hold” situation. While near-term volatility is likely to continue, UnitedHealth’s market position and the essential nature of healthcare services provide downside protection. The DOJ investigation, although serious, is unlikely to pose existential threats to the business.

New investors may want to wait for more clarity on earnings guidance and investigation outcomes before establishing positions. However, long-term investors willing to weather current storms may find opportunity in the significant valuation compression already reflected in the stock price.