/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

Tesla (TSLA) will announce its third quarter 2025 financials after the market closes on Wednesday, Oct. 22. Heading into the earnings, TSLA stock has been on an impressive run, climbing more than 35% over the past three months and soaring roughly 80% in the last six. The rally reflects renewed optimism around the electric vehicle (EV) leader’s performance and outlook.

Adding to the positives, Tesla’s Q3 delivery numbers, released earlier this month, came in stronger than expected. The company delivered nearly 500,000 vehicles (497,009 vehicles to be exact) during the quarter, marking a 7% increase year-over-year.

Part of this surge in demand can be traced to the recently expired federal EV tax credit of $7,500, which ended in September. Many customers might have rushed to finalize their Tesla purchases before the deadline, driving up deliveries for the quarter.

While higher deliveries are likely to drive Tesla’s revenue in Q3, the recent run-up in the stock price means the market has already priced in many positives. Thus, if Tesla’s Q3 financials or guidance falls short of expectations, the stock could see a pullback.

Options market data indicate that traders are bracing for a potential post-earnings swing of about 7.3% in either direction for contracts expiring on Oct. 24. That’s slightly below Tesla’s average move of around 9.6% over the last four quarters. Also, after its last earnings report, shares fell roughly 8.2%.

With nearly 500,000 deliveries and a powerful rally behind it, let’s look at Q3 expectations.

Tesla: What Investors Should Expect from Q3 and Beyond

Tesla has an uneven earnings history, missing Wall Street expectations in two of the past four quarters. As for Q3, analysts expect Tesla to report earnings of $0.41 per share, a notable decline from $0.62 in the same period last year. However, given the company’s stronger delivery numbers in Q3, there’s reason to believe results could come in better than expected.

In addition, improved production efficiency and a more favorable product mix are likely to play in Tesla’s favor. A lower cost per vehicle and higher deliveries could help offset some of the pressure from a challenging pricing environment.

Beyond the financial numbers, investors’ attention will most likely be on Tesla’s new growth initiatives, including autonomous mobility, artificial intelligence (AI), and robotics. Tesla made headlines in June when it officially launched its long-awaited robotaxi service, signaling a significant step into the world of self-driving transportation. The move could eventually reshape Tesla’s revenue model, reducing its reliance on vehicle sales and opening the door to recurring, high-margin service income.

Further, its ongoing improvements to Full Self-Driving (FSD) continue to differentiate the brand and lay the groundwork for a future where fully autonomous systems are mainstream. As this technology matures, it could dramatically expand Tesla’s addressable market.

The company’s introduction of more affordable vehicle options is another key development, especially important after the expiration of federal EV tax credits. By making its vehicles more affordable, Tesla aims to keep demand strong despite a tougher macro and competitive environment.

In short, Tesla is well-positioned to benefit from higher deliveries and cost efficiencies in Q3. However, a positive update about its new growth initiatives is likely to drive its share price higher.

Is Tesla Stock a Buy Now?

The recent surge in Tesla stock is driven by the belief that the company is far more than just an automaker. Many see Tesla as a major force shaping the future of transportation, automation, and AI.

But for all the optimism, much of that future promise already appears to be baked into the stock price. Tesla currently trades at 370 times its forward earnings, a significant premium compared to other major carmakers. Even with analysts projecting a 67% jump in earnings per share by 2026, the valuation suggests that investors are already paying for a lot of future success today.

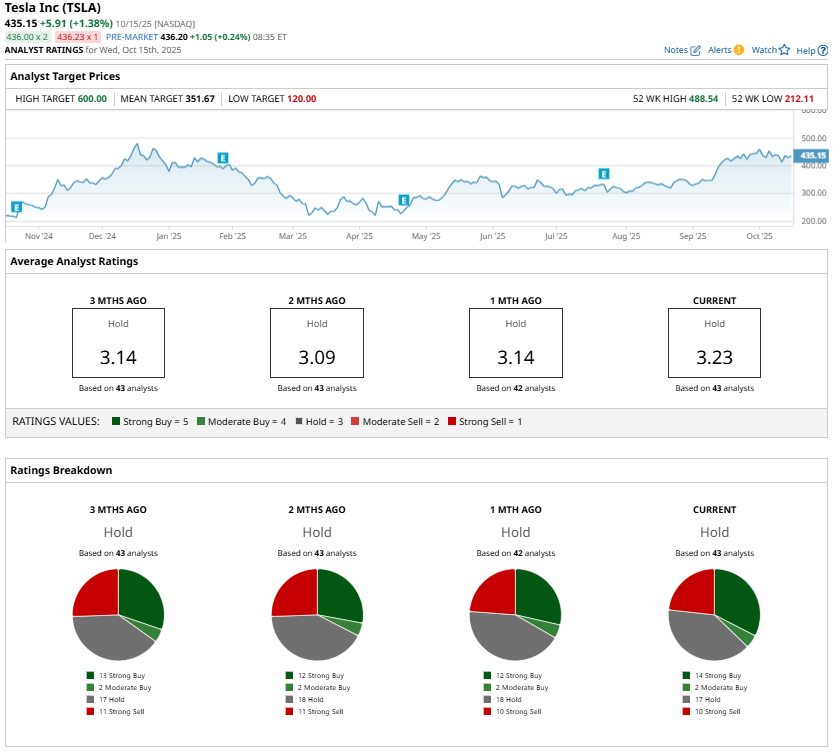

At the same time, Tesla faces challenges in the short term, including intensifying competition and loss of the EV tax credit. Moreover, Wall Street analysts maintain a “Hold” consensus rating on the stock.

With Q3 earnings around the corner, many investors may remain sidelined for clearer signs of how Tesla’s new growth initiatives are progressing or for a potential pullback before buying.