Tulsa, Oklahoma-based The Williams Companies, Inc. (WMB) focuses on finding, producing, gathering, processing, and transporting natural gas and natural gas liquids. With a market cap of $76.9 billion, Williams operates as one of the largest transporters of natural gas by volume in the United States.

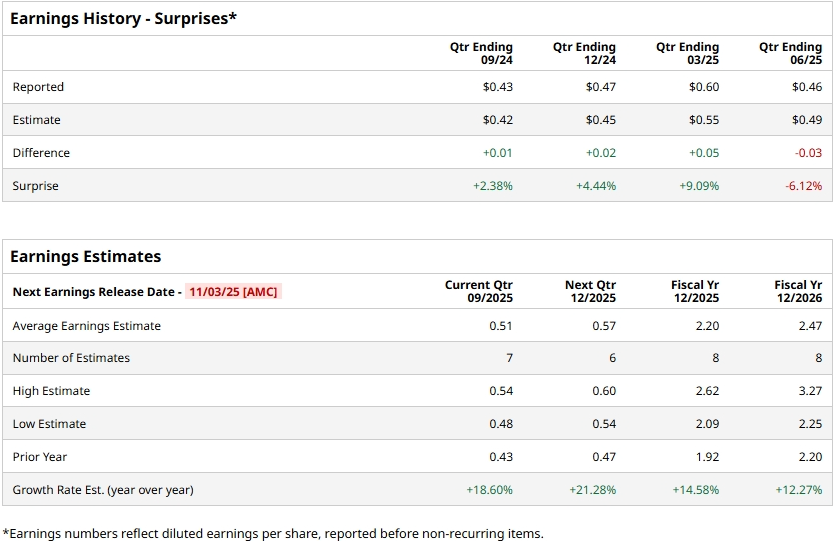

The midstream giant is gearing up to announce its third-quarter results after the markets close on Monday, Nov. 3. Ahead of the event, analysts expect WMB to report an adjusted EPS of $0.51, up a notable 18.6% from $0.43 reported in the year-ago quarter. While the company has surpassed Street’s bottom-line estimates thrice over the past four quarters, it has missed the projections on one other occasion.

For the full fiscal 2025, WMB is expected to deliver earnings of $2.20 per share, marking a 14.6% surge from $1.92 per share reported in fiscal 2024. While in fiscal 2026, its earnings are expected to further grow by 12.3% year-over-year to $2.47 per share.

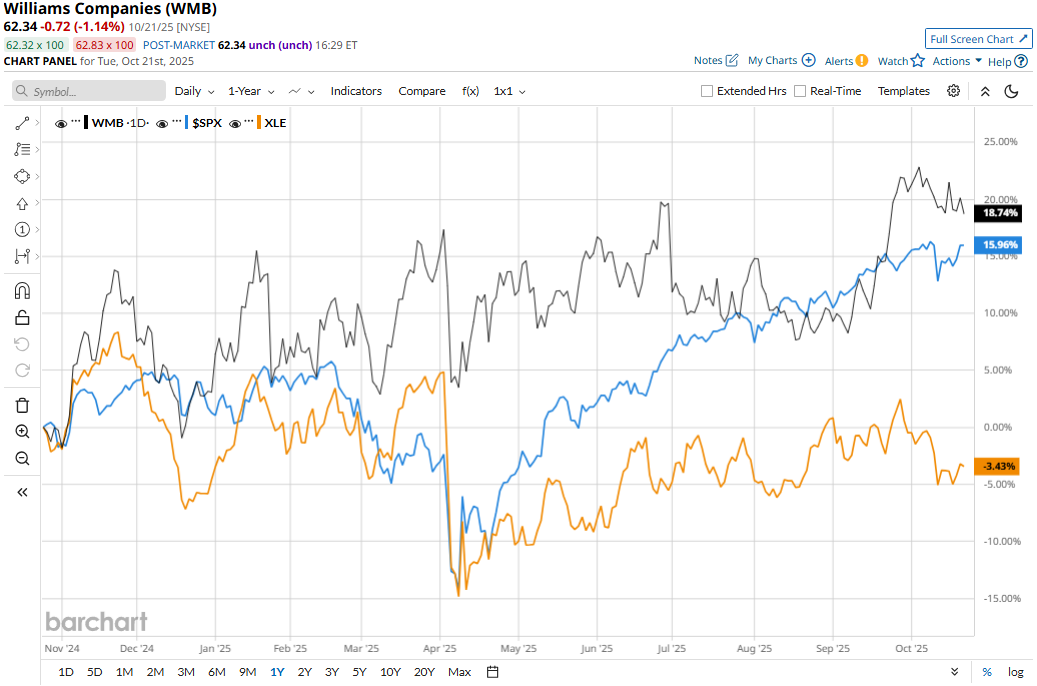

WMB stock prices have surged 19.9% over the past 52 weeks, notably outperforming the Energy Select Sector SPDR Fund’s (XLE) 3.8% dip and the S&P 500 Index’s ($SPX) 15.1% returns during the same time frame.

Despite reporting impressive topline and earnings growth, Williams’ stock prices dropped 2.1% in the trading session following the release of its Q2 results on Aug. 4. The company experienced a high growth in volumes across various segments. Driven by solid growth in service revenues and product sales, Williams’ overall topline for the quarter increased 19.1% year-over-year to $2.8 billion. However, this figure missed the Street’s expectations by a large margin.

Meanwhile, its adjusted net income grew by a much more modest 8.6% year-over-year to $566 million, and its adjusted EPS of $0.46 fell short of the consensus estimates by 6.1%.

Analysts remain optimistic about the stock’s long-term prospects. WMB has a consensus “Moderate Buy” rating overall. Of the 23 analysts covering the stock, opinions include 13 “Strong Buys,” two “Moderate Buys,” seven “Holds,” and one “Strong Sell.” Its mean price target of $67.60 suggests an 8.4% upside potential from current price levels.