The winter holidays are just around the corner… and so too could be a chilly crypto crash.

Now, fans of Bitcoin (BTCUSD) and its cryptocurrency peers are no strangers to volatility. However, each time cryptos run up with a sense of urgency and confidence, the more it looks to me like a setup for subsequent plunges, the likes of which we see nearly every calendar year.

It’s Beginning to Look a Lot Like… April 2024

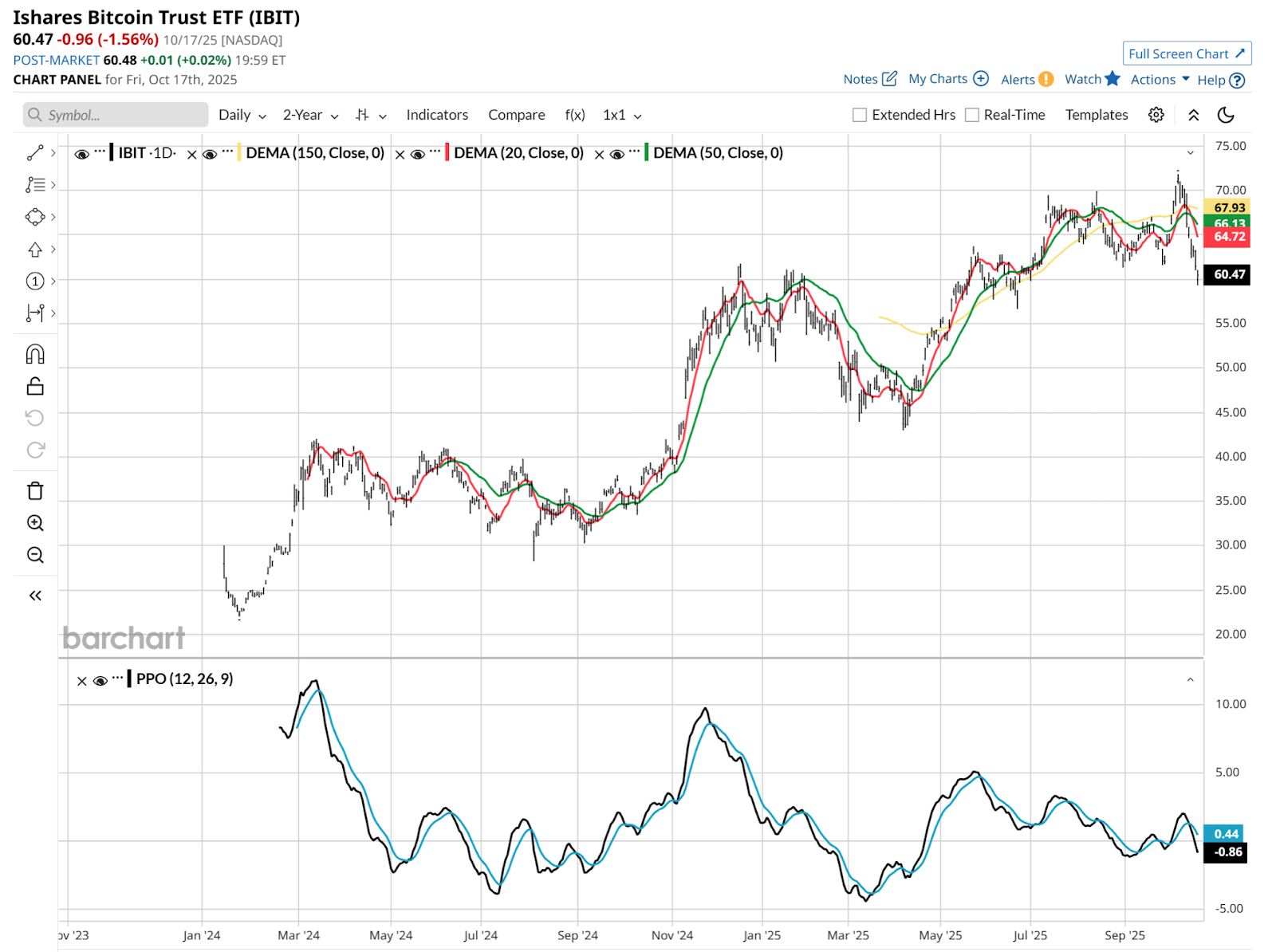

As we see below, in April 2024, following a 50% spike higher just months after the launch of a dozen spot Bitcoin ETFs, the iShares Bitcoin Trust ETF (IBIT), the biggest by far at more than $85 billion in assets under management, fell back by about 25%.

A similar pattern ran its course up and down during the first two months of this year. And now, the Percentage Price Oscillator (PPO) indicator that I frequently rely on is issuing a warning on Bitcoin: Its chances of going lower are getting stronger by the week.

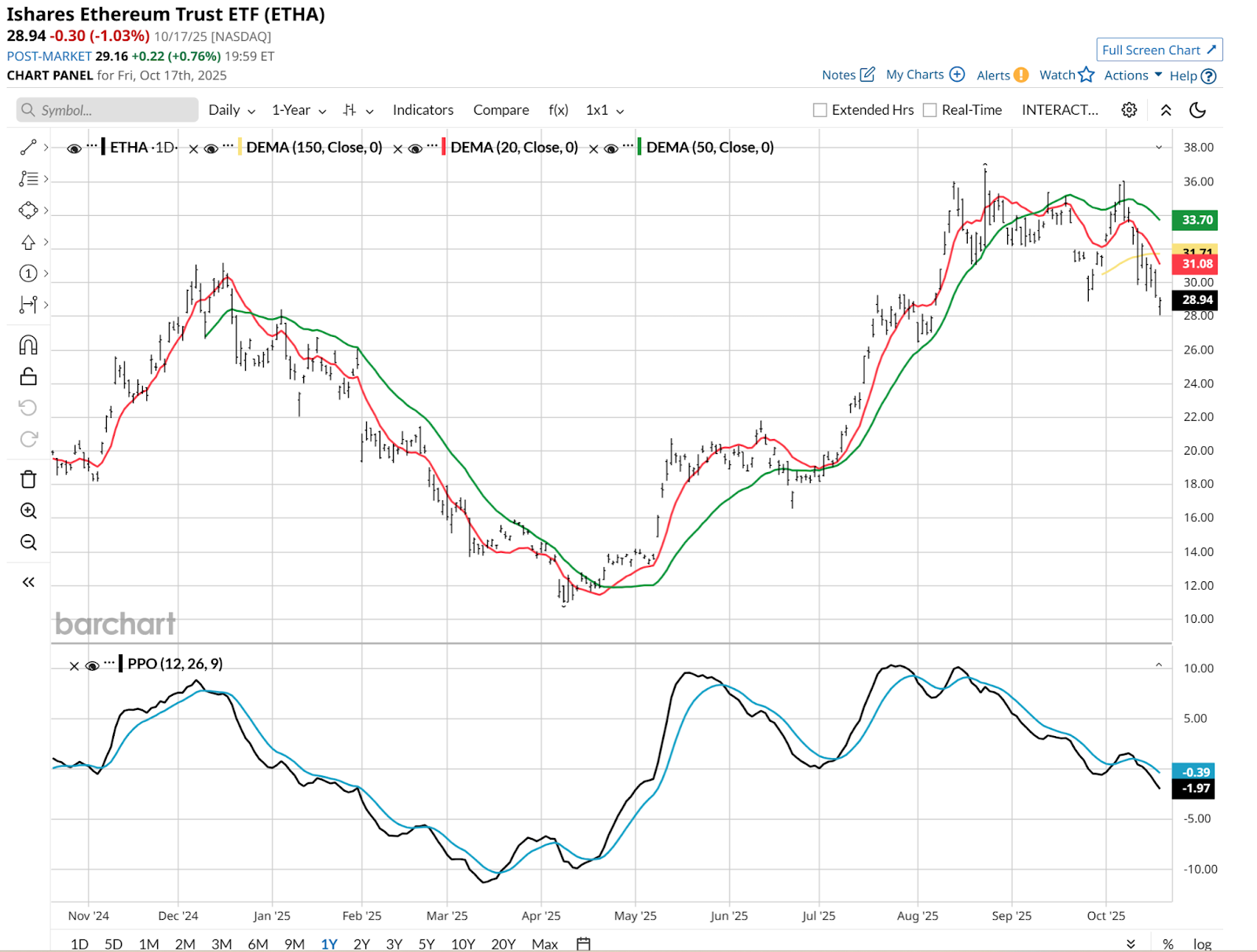

Ethereum (ETHUSD) looks quite similar. I observe that while Bitcoin is the head of the crypto monster, the correlation between coins is getting higher over time.

Translation: It should get tougher to hide out in other currencies when the big dog fails.

High correlation means that, for example, Ethereum could fall when Bitcoin does. But when it comes to crypto assets that are further from the Bitcoin epicenter, such as Solana (SOLUSD), an additional aspect of risk rears up. Correlation takes it down, but high “beta” takes it down by a bigger percentage. That’s volatility for you!

Case in point. When Bitcoin fell by about 15% from its recent high, the Solana ETF (SOLZ), which itself has amassed more than $220 million in assets in under 7 months, fell by double that amount.

What all three of the above charts have in common is that they all just made lower lows. That means they need to bounce quickly, or the next leg is more likely down. And while dips come with the territory for crypto investors, there’s reason to believe that this time could be different.

Why Gold Is Now a Bigger Competitor to Bitcoin

Gold (GCZ25) fans spent years watching Bitcoin steal its long-regarded role as the anti-U.S. dollar “currency.” But that might be changing, as global central banks are stockpiling gold. The U.S. has been the center of crypto growth and trading, but gold is as global as it is tenured, going back as far as, well, biblical times.

With gold running up as if it’s a cryptocurrency lately, it is reasonable to consider that the tug of war is headed back in gold’s direction.

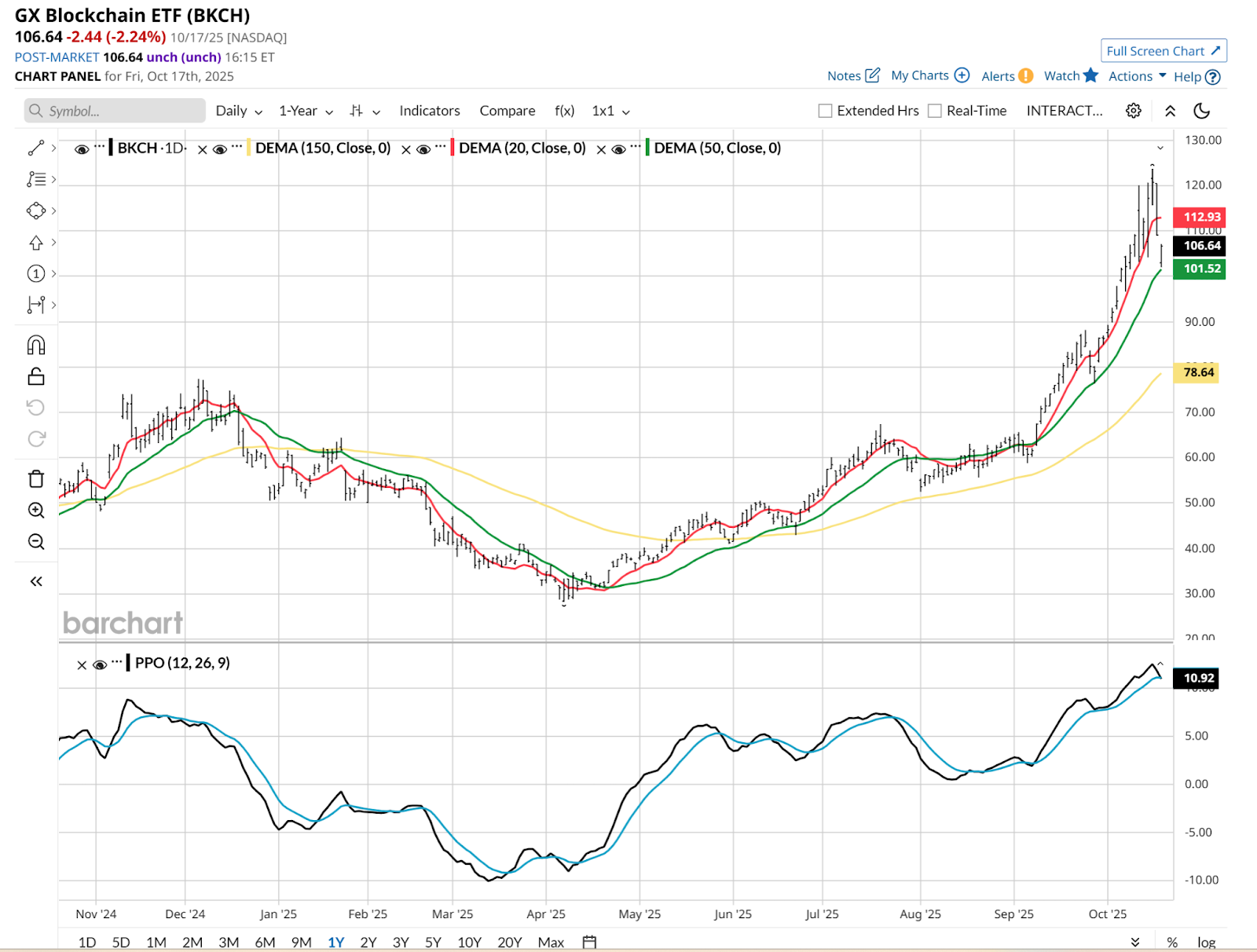

This has bled into blockchain stocks and ETFs as well. This one looks to be “toast” based on that PPO 1-year high it has nearly crossed down through.

Finally, here is a longer-term Bitcoin chart, which shows what we all know. That it is volatile, but has always made a higher high eventually.

That might happen again, but the odds are leaning more toward that next run coming from lower levels. That makes understanding some of the ways to essentially short Bitcoin through ETFs a good learning exercise.

Among many funds now equipped to do that is the Proshares Short Bitcoin Strategy -1X ETF (BITI), which aims to deliver the opposite of Bitcoin’s daily return, based on futures prices.

Crypto is as much a lifestyle as it is an investment. But despite the forward-looking optimism, markets still have a cyclical nature. And with the threat of gold competition, as well as liquidity reduction, this is a good time to assess what is at risk.