/Tesla%20charging%20station%20black%20background%20by%20Blomst%20via%20Pixabay.jpg)

Tesla (TSLA) has spent the past few years battling shrinking margins, rising competition, and a skeptical Wall Street. Nonethless, its ambitions keep getting bigger. As CEO Elon Musk shifts the spotlight from cars to artificial intelligence (AI), robotics, and autonomy, the real question is whether these bold bets can power a turnaround and enable Tesla restore its top growth-stock crown by 2026.

Musk’s Vision: Robotics, Autonomy, and an AI Supercomputer Future

While Tesla’s most recent third quarter revealed a company under significant short-term pressure, its CEO seemed more interested in steering the conversation toward an ambitious, AI-driven future. These bold bets led to the stock rising 17% year-to-date, despite reporting disappointing quarter. He boasted about Grok 5, a next-generation xAI model built for Tesla’s custom GV300 chips, AI 4 and AI 5 systems, which Musk claims will make Tesla vehicles feel “like living creatures,” and the Optimus humanoid robot, which is set to begin production in 2026 with a long-term goal of scaling to 1 million units per year.

These initiatives highlight Musk’s vision for Tesla as a dominant player in real-world AI, robotics, and autonomy. However, this will increase the financial strain for the company, which is already battling to remain profitable. Capital expenditures are likely to increase in 2026 as Tesla ramps up chip design, robotics manufacturing, and autonomy infrastructure. However, for now, Tesla’s cash position remains strong, with $41.6 billion in liquidity and $3.9 billion in free cash flow at the end of the quarter, giving it room to fund these futuristic bets.

Why Investors Can’t Ignore the Present?

Despite the excitement surrounding Tesla’s AI roadmap, its core businesses, EVs and energy are facing headwinds. In the most recent third quarter, revenue climbed to roughly $28.1 billion, up 12% from last year, while deliveries increased 7.4% to just over 497,000 vehicles. But profitability was another story. Operating income fell 40% to around $1.6 billion, reducing the operating margin to just 5.8%. Adjusted earnings per share plummeted 31% year over year, while gross margin fell to 18% as price cuts continued to affect profitability.

With competition increasing, notably from low-cost Chinese EV manufacturers, Tesla’s moat is no longer secure. Rivals are matching Tesla’s technology while undercutting it in price. Despite these pressures, Musk focused much of the earnings call on Tesla’s long-term innovation pipeline rather than short-term margin issues.

Analysts expect earnings to decline by nearly 32% in 2025. Yet Tesla trades at an extraordinary forward price-to-earnings ratio of 270x, reflecting investor confidence in Musk’s long-run narrative rather than its near-term fundamentals.

What Wall Street Is Saying Now About Tesla Stock

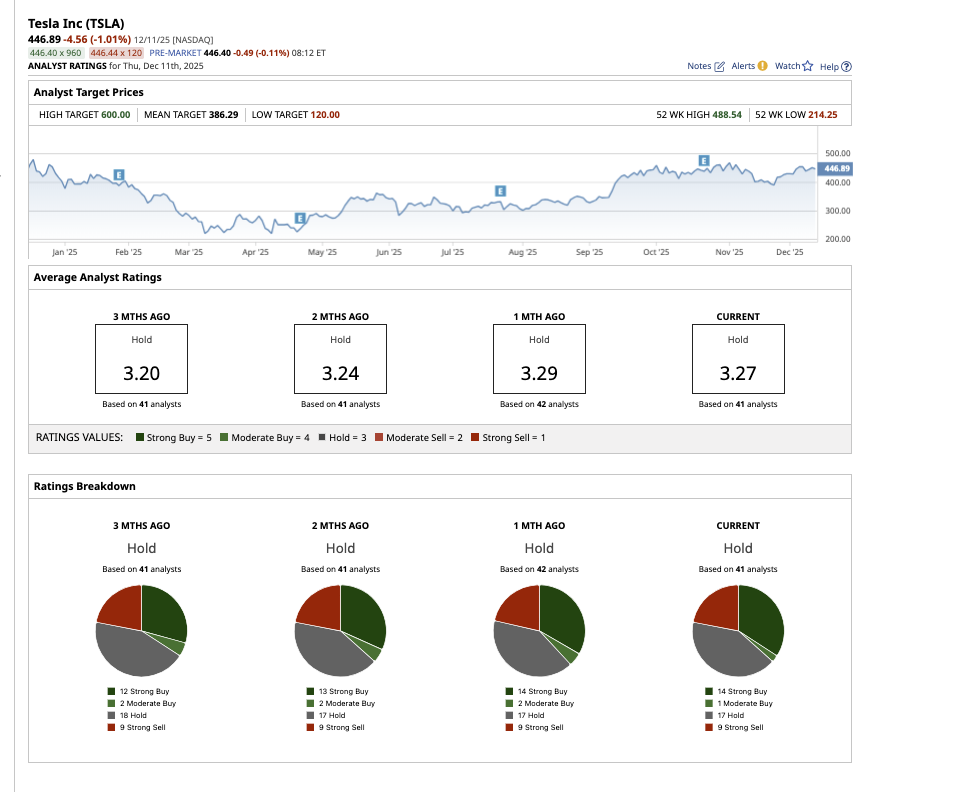

Analysts remain divided but overall cautious about Tesla stock.

Out of the 41 analysts covering the stock, the consensus rating is a “Hold,” with 14 rating it a “Strong Buy,” one recommending a “Moderate Buy,” 17 rating it a “Hold,” and nine recommending a “Strong Sell.” Tesla has surpassed its average analyst target price of $386.29. The high price estimate of $600 implies that the stock can rise by 35% in the next 12 months, but only if Tesla’s long-term bets start to materialize faster than expected.

The Bottom Line

What remains undeniable is that Tesla is no longer simply an EV company. Musk is positioning it as a leader in autonomous systems, robotics, and AI infrastructure, all of which has massive potential. However, potential alone will not be enough to recover Tesla’s position as the market’s leading growth stock. Tesla will need to stabilize margins, show clear progress in FSD adoption, show the early commercial feasibility of Optimus, and prove that AI and robotics investments can scale profitably.

Tesla is at a crossroads. Investors will have to watch out if Musk’s ambitions can translate into sustainable earnings growth in time to justify the stock’s premium valuation.