In my Q2 Barchart Precious Metals Report on July 8, 2025, I concluded with the following:

Silver, platinum, and palladium formed powerful bullish formations in Q2, with each metal falling below its Q1 low and closing the quarter above the previous quarter’s peak. The bullish key reversal patterns could indicate that the bullish trend in the precious and industrial metals will continue over the coming months and quarters, as silver, platinum, and palladium catch up with gold.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.

I remain bullish on the precious metals sector, but even the most aggressive bull markets rarely move in straight lines. Buying on price corrections has been optimal in gold since the 1999 low, and I expect that trend to continue in gold, silver, platinum, and palladium over the coming months.

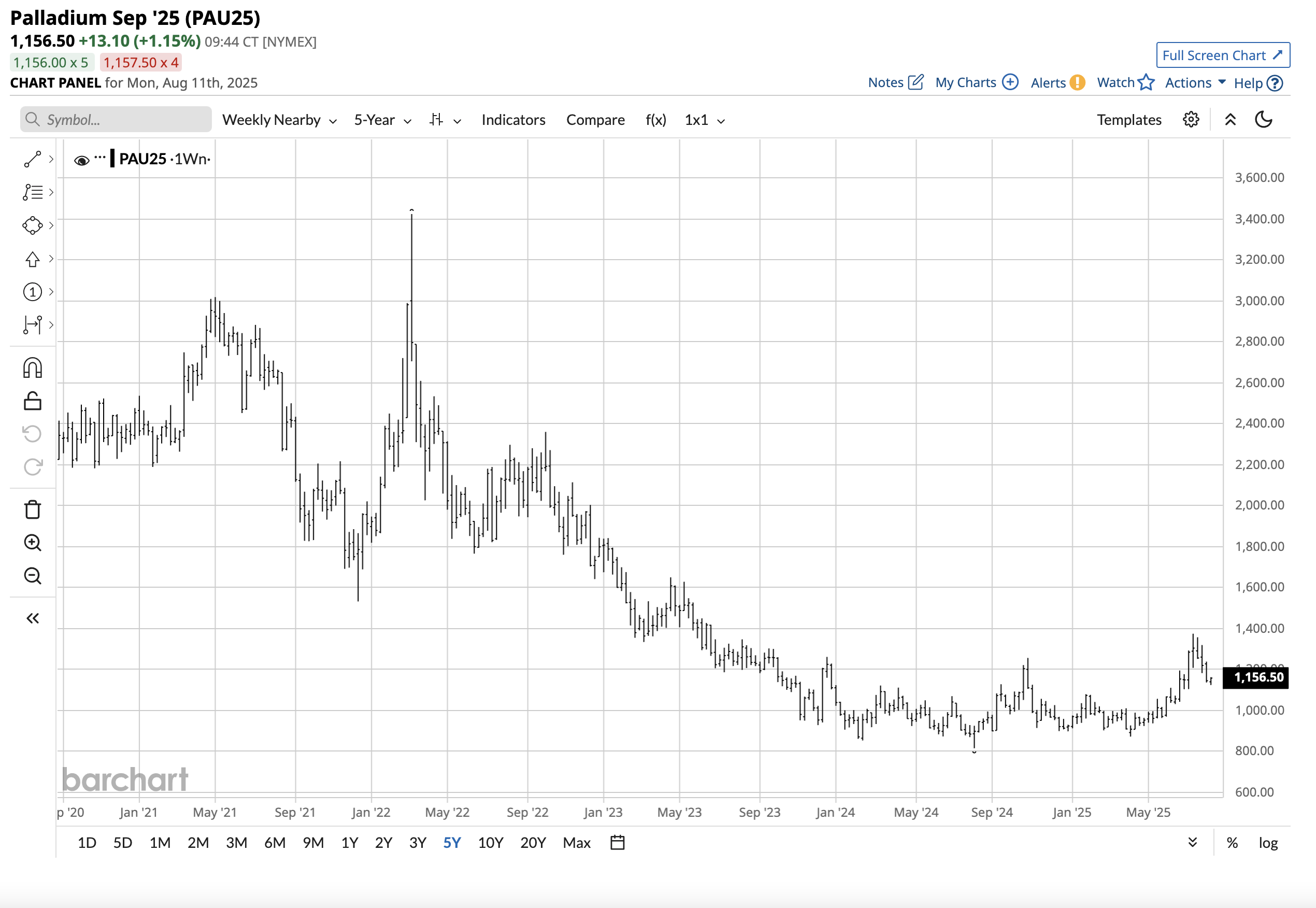

Nearby NYMEX palladium futures moved 10.63% higher in Q2 and were 21.69% higher over the first half of 2025. The futures settled at $1,107.10 per ounce on June 30 and rose to over $1,370 in July. At over $1,150 in August, palladium was higher than the Q2 closing level and remains in a bullish trend.

Palladium rises to the highest price since June 2023

After trading around the $1,000 pivot point from late 2023 through June 2025, palladium prices took off on the upside in July.

The monthly continuous NYMEX palladium futures chart highlights palladium’s rise to $1,373.50 per ounce in July 2025, the highest price since June 2023. Palladium moved above the critical technical resistance level at the October 2024 high of $1,255, ending the bearish trend since the March 2022 record high of $3,425 per ounce.

Tariffs and geopolitics can impact palladium- Production comes from only two countries

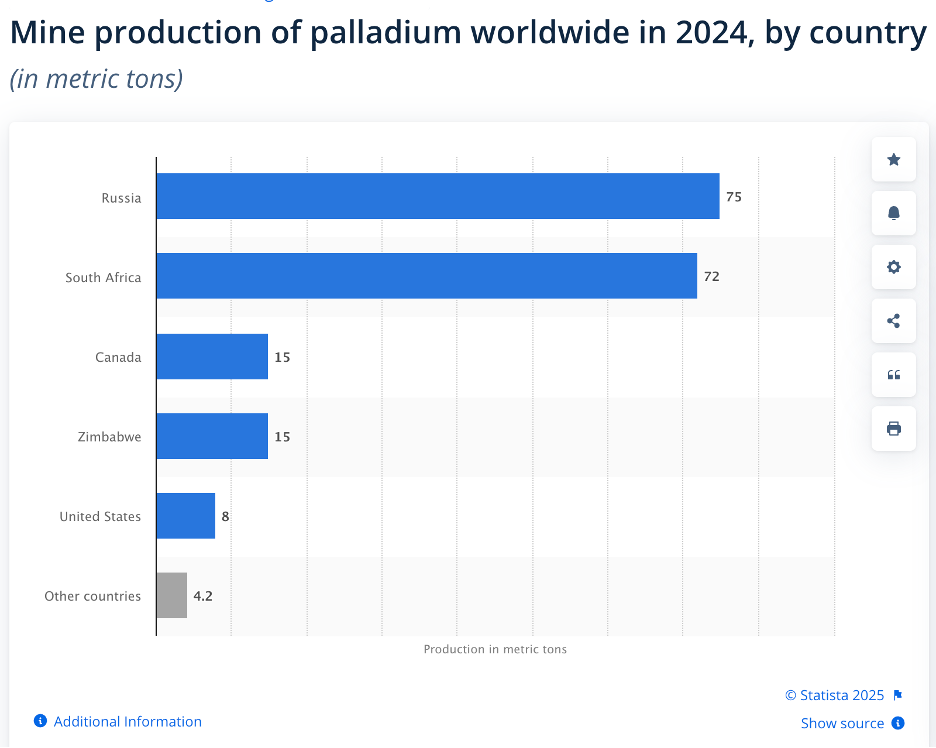

Total palladium mine production in 2024 was approximately 190 metric tons or just over 6.1 million ounces.

The chart shows that the two leading palladium-producing countries, Russia and South Africa, accounted for 147 tons or 77.4% of the world’s annual 2024 palladium output.

Sanctions on Russia and U.S. tariffs on South Africa could potentially impact palladium imports into the United States. However, the April 2025 announcement excluded bullion, including palladium. Meanwhile, recent developments in the copper market, where President Trump imposed a 50% tariff on some copper imports, could be impacting the palladium market as the U.S. administration could change its current trade barrier policy with an executive order.

On the other hand, deteriorating relations between Moscow and Washington, DC, could cause Russia to ban palladium exports to the U.S. The bottom line is that trade barriers, including sanctions and tariffs, have caused significant uncertainty for the palladium market. Palladium remains a critical ingredient for automobile catalytic converters and other industrial applications.

Liquidity could cause lots of price variance in the palladium futures market

The four precious metals trading on the CME’s COMEX and NYMEX divisions are gold, silver, platinum, and palladium. Palladium is the least liquid of the four. On August 8, 2025, total open interest, the total number of open long and short positions in the NYMEX palladium futures market, stood at 19,677 contracts or 1,967,700 ounces. At $1,155 per ounce, the futures market’s total value was $2.273 billion, far lower than the gold, silver, and even platinum futures markets. The average daily trading value runs around half the open interest level.

Palladium’s low liquidity in the futures and physical market in London can exacerbate price volatility. The rally to the March 2022 record high of $3,425 per ounce was an example of how low liquidity can ignite high volatility. When Russia invaded Ukraine, the price palladium surged higher due to supply fears.

After falling to a low of $813.50 in August 2024, palladium futures are now trending higher, with the price just over $1,150 per ounce. Low liquidity can cause bids to purchase disappear during bearish trends, as the palladium market experienced from March 2022 through August 2024. Conversely, offers to sell can evaporate during bullish trends, which caused palladium futures to explode to the March 2022 high.

Levels to watch in the palladium futures

The weekly continuous futures chart highlights the critical technical support and resistance levels in the NYMEX palladium market.

Technical resistance is at the most recent mid-July 2025 high of $1,373.50 per ounce, with technical support at the late January 2025 high of $1,077.50 level. At around the $1,150 level on August 5, palladium was below the midpoint of the support and resistance levels.

PALL is the palladium ETF product

The most direct route for a risk position or investment in palladium is the physical market for bars and coins. However, illiquidity can cause wide bid/offer spreads with premiums or discounts for the physical metal. The NYMEX futures contract size is 100 ounces. At $1,150 per ounce, each contract’s value is $115,000. NYMEX’s original margin requirement is $13,750, meaning that market participants can control $115,000 worth of palladium on the long or short side of the market for an 12% good-faith deposit. If the risk position’s equity slips below $12,500 per contract, the exchange requires posting maintenance margin.

The Aberdeen Physical Palladium ETF (PALL) is a liquid product that holds physical palladium bullion. At $14.75 per share, PALL had over $575.55 million in assets under management. PALL trades an average of 302,737 shares daily and charges a 0.60% management fee. The expense ratio covers storage, insurance, and other related administrative expenses.

Nearby palladium futures rallied nearly 49%, moving from $922 on April 30, 2025, to $1,373.50 per ounce on July 18, 2025.

Over the same period, PALL rallied 40.5%, moving from $84.90 to $119.30 per share. One of the ETF’s drawbacks is that while palladium futures trade around the clock, PALL is only available during U.S stock market hours. Therefore, the ETF may miss highs or lows that occur when the stock market is closed.

Palladium broke out of its bearish trend in July 2025. Tariffs and sanctions create the potential for higher highs over the coming weeks and months. However, investors and traders must realize that palladium’s liquidity can exacerbate price rallies and corrections. Expect lots of volatility in the palladium futures market, and you will not be disappointed.