The cruise stocks have had a rough run this year and the earnings reports aren’t helping matters.

Case in point? Norwegian Cruise Line (NCLH) shares are off 12% on Tuesday after disappointing results.

The stock lately had been enjoying a nice run, up 22% from last week’s low to yesterday’s high.

At Monday’s high, the stock was breaking out over resistance, but selling pressure throughout the session (and ahead of the earnings report) kept it contained below resistance.

The cruise-line operator reported a top- and bottom-line miss and debt increased. Worse, despite strong consumer trends and pricing, management expects the losses to continue.

Norwegian made a recent Covid change that its rivals Royal Caribbean (RCL) and Carnival (CCL) haven’t, but so far, it doesn’t seem to be moving the needle enough.

We have been watching the cruise stocks as they remain under active resistance. Unfortunately for the bulls, that remains the case now too, as more selling pressure kicks in.

Will today’s decline kickstart a move to new 2022 lows for Norwegian Cruise stock?

Trading Norwegian Cruise Stock

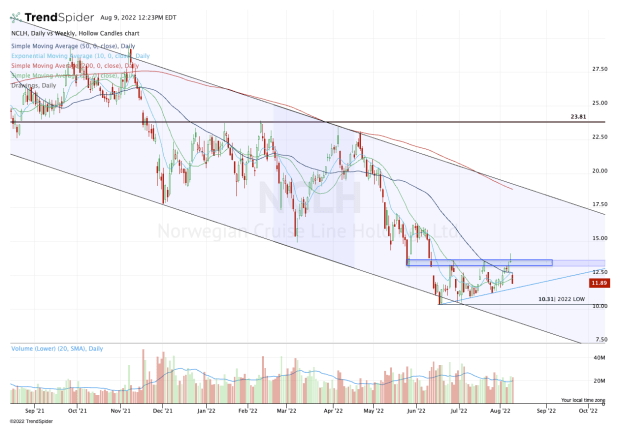

Chart courtesy of TrendSpider.com

On the chart above, one can see how Norwegian Cruise stock was trying to push through the resistance zone near $13 to $13.50. It was rejected on Monday and is now gapping lower on Tuesday.

The gap-down action and continued selling pressure has now put the shares below the 10-day, 21-day and 50-day moving averages. It’s not a good look.

On the plus side, Norwegian Cruise stock has uptrend support to lean on (blue line). But it’s quickly losing bullish catalysts when it comes to the technicals.

Here’s the problem for the bulls. If the stock breaks below uptrend support — particularly if it closes below it — then we’re looking at a situation where the July low and the 2022 lows are back in play in the $10.30 to $10.50 range.

Below uptrend support and there’s not really any meaningful technical level there to support Norwegian Cruise stock.

If uptrend support does hold, then a move back to the $12.50 zone is possible, where it finds the 10-day, 21-day and 50-day moving averages.

That may be good for a trade — particularly if the overall market is trading well — but until it can reclaim these measures, the bulls are going to struggle to find sustainable upside momentum.

Long story short: Norwegian Cruise stock needs to hold uptrend support. Otherwise it risks retesting this year’s low. If support holds, it may bounce to $12.50.