The Metals sector has taken center stage of late, with the spotlight now on the industrial metals of silver, copper, platinum, and palladium.

-

The Grains sector was quiet overnight through early Wednesday morning, with the major markets in the green pre-dawn.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis. It's possible China was buying US soybeans overnight, though if so it doesn't look to be in large quantities.

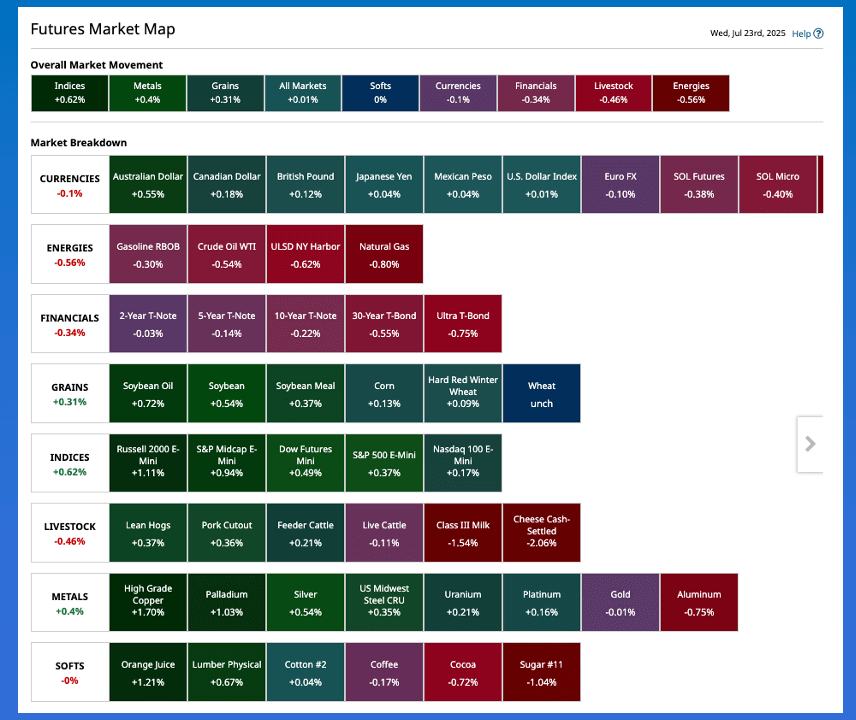

Morning Summary: A look at the Barchart Futures Heat Map early Wednesday morning shows it to be a quiet Wednesday morning. All sectors in the commodity complex are within the range of a cumulative gain of 0.6% (Indices, US stock index futures) and (-0.6%) (Energies). Individually, discounting those markets that don’t trade overnight (e.g. orange juice, lumber, Livestock sector, etc.), the biggest mover pre-dawn is Dr. Copper the economic indicator with a gain of 1.7%. Metals have taken center stage lately as the rest of the sector moves to catch up with gold. Since its May close, the Cash Copper Index (HGY00) is up 22% with the Cash Silver Index (SIY00) showing a gain of 19.5%. Meanwhile, the Cash Gold Index (GCY00) has taken a breather, sitting just below its April 2025 high of $3,495.89. (For the record, the Gold Index came in Tuesday at $3,430.73.) The metals sector is interesting in that it provides us a number of different indicators. Yes, gold continues to be the global safe-haven market, and the recent consolidation near its all-time high tells us long-term investors are waiting for the next round of chaos from the US administration. On the other hand, both silver and copper – industrial metals – have registered new all-time highs this month.

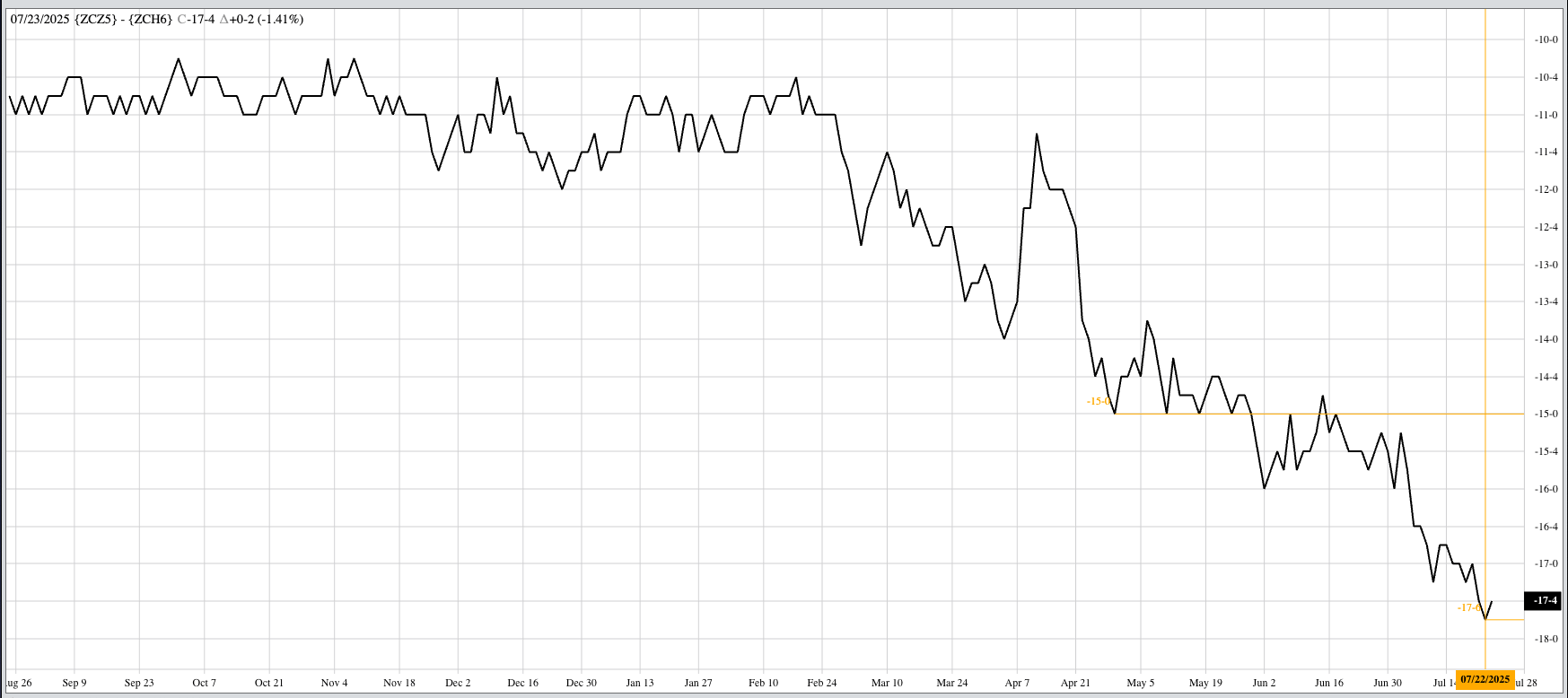

Corn: The corn market did not hit a record high overnight. Nor did it fall to new lows through the pre-dawn hours. In fact, we need to check to see if King Corn even has a pulse early Wednesday morning. The nearby September contract posted a 2.5-cent trading range, from down 0.75 cent to up 1.75 cents, while registering only 8,400 contracts changing hands and was sitting 0.25 cent higher at this writing. December (ZCZ25) didn’t do much more as it also showed a trading range of 2.5 cents on trade volume of 13,000 contracts and was sitting on unchanged to start the day. Pretty exciting late summer stuff, right? A look back at Tuesday’s close and we saw the Dec-March futures spread finish at a new lifetime low of 17.75 cents carry and cover 57% calculated full commercial carry. Additionally, the National Corn Index was calculated near $3.8625 putting available stocks-to-use at 13.3%. On the noncommercial side, September closed 2.0 cents lower from Tuesday-to-Tuesday indicating Watson may have increased its net-short futures position slightly this past week. Similarly, December was down 1.75 cents from Tuesday-to-Tuesday. Recall the latest CFTC Commitments of Traders report (legacy, futures only) showed a noncommercial net-short futures position of 129,457 contracts.

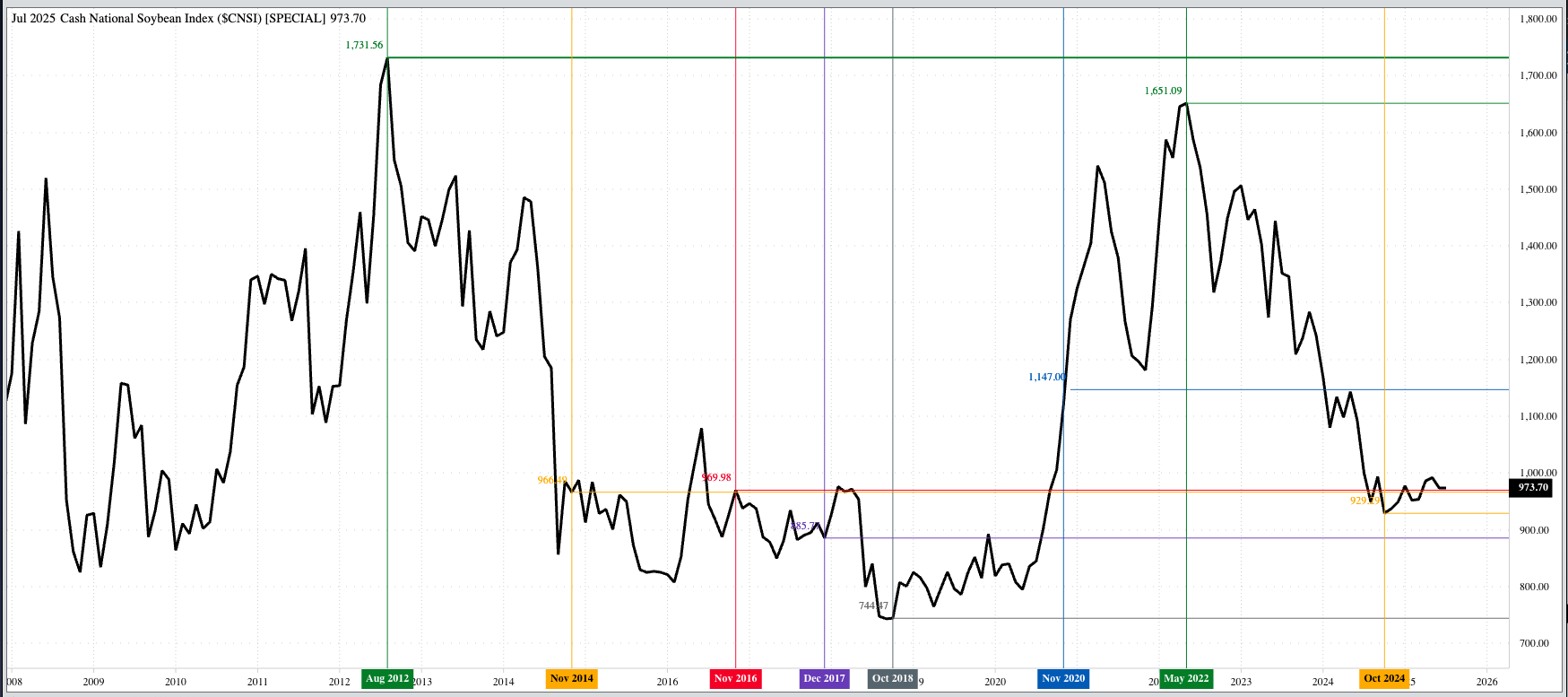

Soybeans: The soybean market was sitting in the green early Wednesday morning, again on light trade volume. November (ZSX25) was showing a gain of 6.5 cents after rallying as much as 8.25 cents overnight while registering 18,000 contracts changing hands. Was this a sign of renewed buying interest from the world’s largest soybean buyer, or its alias “unknown destinations”? It’s possible. The National Soybean Index came in Tuesday evening near $9.7375 putting available stocks-to-use at 16.4%, on par with the end of June and above the previous 10-year end of July average of 14.7%. As for national average basis, the latest calculation came in at 51.75 cents under November futures as compared to last Friday’s final figure of 50.5 cents under November. The bottom line, from a fundamental point of view, is the US has ample soybean supplies available if anyone – China maybe – is looking to buy. On the noncommercial side the November issue closed 23.75 cents higher from Tuesday-to-Tuesday indicating Watson added to its net-long futures position this past week while commercial interests were selling, a possible Rubber Band Disposition. The previous Commitments of Traders report showed a net-long of about 15,300 contracts, a decrease of 22,774 contracts from the Tuesday before (July 8).

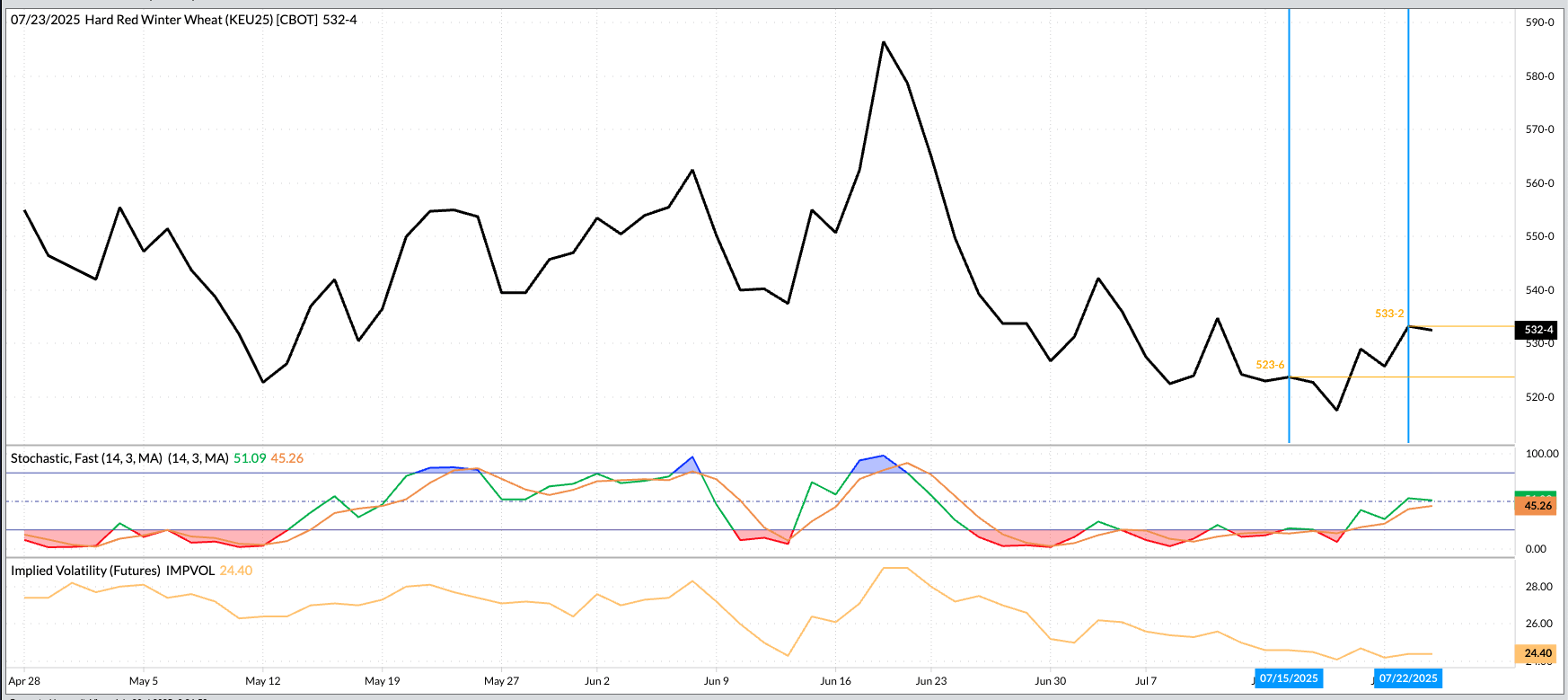

Wheat: At the Barchart Grain Merchandising & Technology Road Show meeting in Ames, Iowa Tuesday, I occasionally checked in on markets. While most of the conversation had to do with corn and soybeans, the market that grabbed my attention was HRW wheat[i]. As yesterday’s session progressed, I saw the September issue (KEU25) rise and fall but stay in the green before closing with a gain of 7.5 cents. At the same time the December issue finished 6.75 cents higher. Does this mean winter wheat is finding renewed commercial buying interest? Maybe, but I’m not ready to jump on that bandwagon yet. Another look back at last Friday’s Commitments of Traders report shows Watson held a net-short futures position in HRW of 29,300 contracts, an increase of 2,330 contracts from the previous week. This past week saw the September issue close 9.5 cents higher while the carry in the September-December futures spread weakened by 0.5 cent. (Again, it weakened by 0.75 cent Tuesday alone.) This indicates most of the support was likely tied to noncommercial short covering rather than new commercial buying interest. Early Wednesday morning finds September HRW up another 3.0 cents and on its overnight session high as of this writing.

[i] A market we will certainly be talking about during Thursday’s Road Show meeting in Manhattan, Kansas. You can still register here.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.