/Facebookname%20backlite%20by%20Alex%20Haney%20via%20Unsplash.jpg)

Meta Platforms (META) has spent the last few years evolving from a social media powerhouse to something far more ambitious.

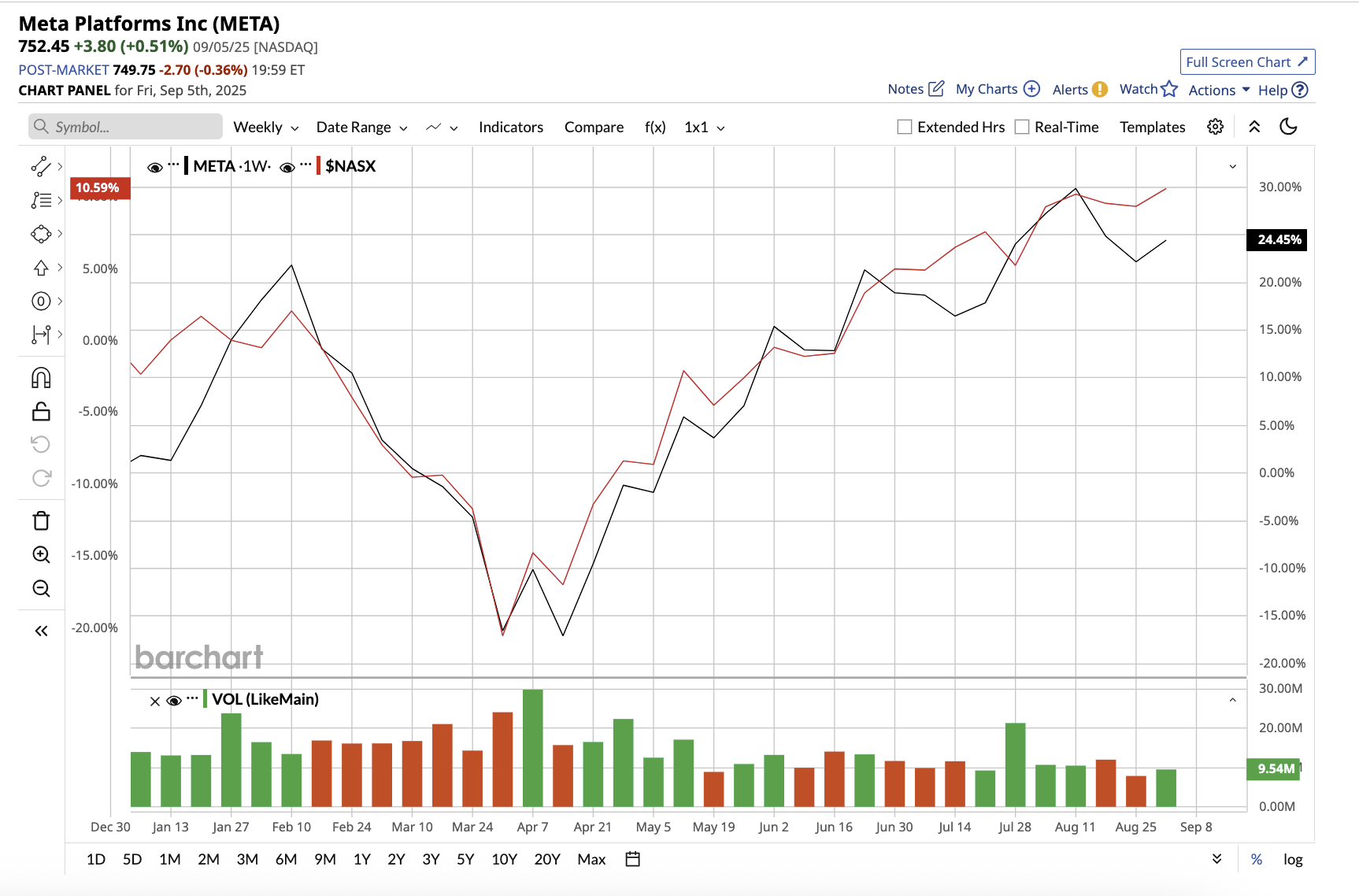

Meta owns several popular social media platforms, including Facebook, Instagram, WhatsApp and Threads. Over the last five years, Meta’s stock has returned 182%. This year, so far, the stock has gained 29.6%, outperforming the tech-heavy Nasdaq Composite Index’s ($NASX) gain of 12.9%. The social media giant is now betting its future on artificial intelligence (AI), immersive experiences, and what it still refers to as the “metaverse.”

Although Meta is currently thriving with its core social media business, a critical question arises. Will Meta’s massive investment in AI, immersive hardware, and superintelligence, which CEO Mark Zuckerberg sees as the foundation for the metaverse, ever pay off?

Let’s dig in to learn more.

Reality Labs Is Burning Cash, but Meta Remains Optimistic

Despite Wall Street’s skepticism, Meta’s Reality Labs (RL) business segment remains an integral part of Meta’s metaverse ambitions. The segment specializes in developing hardware, software, and content for virtual reality (VR), augmented reality (AR), and the metaverse. The segment’s products include the Quest 2, Quest Pro, and the latest Quest 3, as well as Ray-Ban Meta smart glasses, among others.

In the second quarter, the company reported increased sales of Ray-Ban Meta glasses, with plans to expand supply later this year. Meta believes that AI glasses will be the primary means of integrating superintelligence into everyday life, and the popularity of Ray-Ban Meta models provides support to this claim. However, Reality Labs has consistently lost money due to significant R&D and infrastructure investments. Notably, in the second quarter, the RL segment generated $370 million in revenue, up a modest 5% year over year. However, operating losses totaled $4.5 billion, mostly due to technology development costs.

Zuckerberg insists that the Quest ecosystem is still expanding, citing the launch of the Quest 3S Xbox Edition and increased interest in cloud gaming and media. However, the scale of ongoing losses raises concerns about how long Meta can continue to pour billions of dollars into Reality Labs without seeing clear signs of monetization.

For now, Meta has a lifeline. While Realty Labs is burning cash, it is compensated by the Family of Apps (FoA) segment, which includes all its social media platforms and is a cash cow. The FoA segment generated $47.1 billion in revenue, up 21.8% year on year, driven by a 21% increase in advertising revenue. Meta reported a 22% year-over-year increase in total revenue in the second quarter to $47.5 billion, with earnings up 38% to $7.14 per share.

Analysts covering Meta expect its earnings to increase by 16.5% in 2025, followed by another 7.17% in 2026.

Aggressive Capital Spending to Support the Long-Term Ambitions

Meta is focusing its capital expenditures more on infrastructure and talent for AI, monetization, and Reality Labs. Capital expenditures for 2025 are expected to range between $66 billion and $72 billion, an increase of approximately $30 billion annually at the midpoint. Another similar increase is expected in 2026, as the company builds massive AI clusters such as Prometheus (1GW+) and Hyperion (scaling to 5GW). These investments are intended to ensure Meta’s capacity to train and deploy next-generation AI models on a global scale.

While these investments may result in long-term AI leadership, they raise concerns about return on capital and balance-sheet flexibility. Investors will simply have to wait and see if Realty Labs’ success eventually justifies the multibillion-dollar quarterly burn. For the time being, Meta’s $47.07 billion cash balance and increasing profitability provide it with the financial firepower to sustain these investments.

Investors should stay tuned for the Meta Connect on Sept. 17 for more information on how Reality Labs fits into the overall AI strategy and whether there is a path to profitability.

What Does Wall Street Say About Meta Stock?

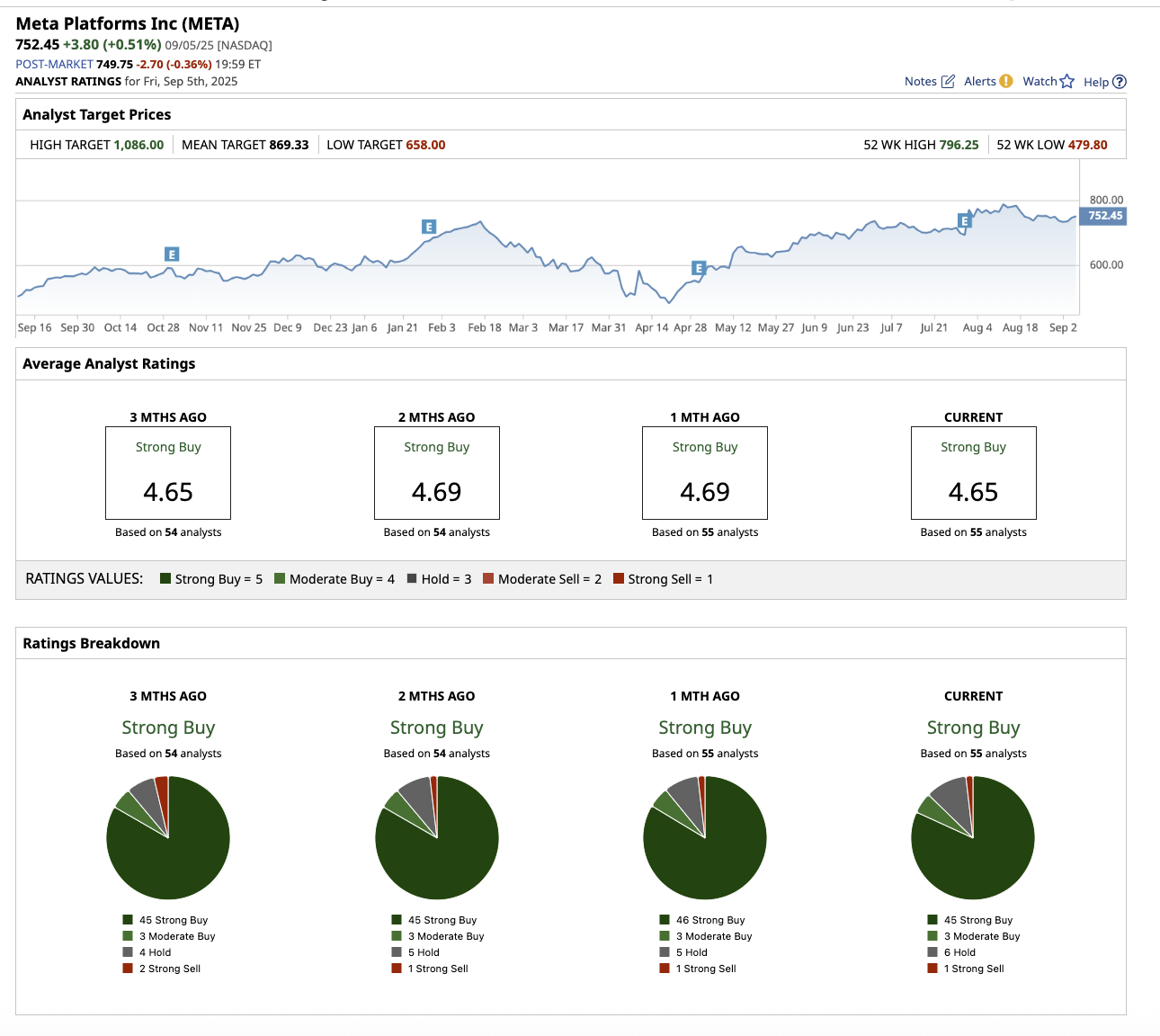

Overall, the consensus for META stock is an overall “Strong Buy.” Among the 55 analysts covering the company, 45 give it a “Strong Buy” rating, three recommend a “Moderate Buy,” six suggest holding, and one rates it a “Strong Sell.” The average price target of $869.33 indicates potential 15.5% upside from current levels. Meanwhile, the high price target of $1,086 implies the stock could surge by as much as 44.3% over the next year.

The Key Takeaway

Meta’s core social media and advertising businesses, as well as its AI efforts, are generating strong results. This profitability is funding the Reality Labs experiment. However, investors should keep in mind that this could be a decade-long experiment to generate long-term profitability. Meta’s efforts on the metaverse and superintelligence remain a gamble, and only time will tell whether it pays off or remains a costly legacy. As a result, META stock is best suited to long-term investors with a high risk tolerance.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.