In a July 17, 2025, Barchart article on the cattle futures market, I concluded:

The cattle trend remains bullish, no pun intended, as the market is in the heart of the 2025 grilling season. While a correction becomes more likely as prices rise, the beef market fundamentals suggest that prices could continue to increase, tariffs being the latest factor that is causing U.S. beef consumers to pay higher prices for their steaks, burgers, hot dogs, and other beef products.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.

Any significant correction could be a tasty buying opportunity for the 2026 peak grilling season, which gets underway next May.

The trend in any market is always a trader’s or investor’s best friend, and when technicals and fundamentals agree, the results are typically explosive. Expect to pay more for beef over the coming months as the cattle bull continues to charge higher.

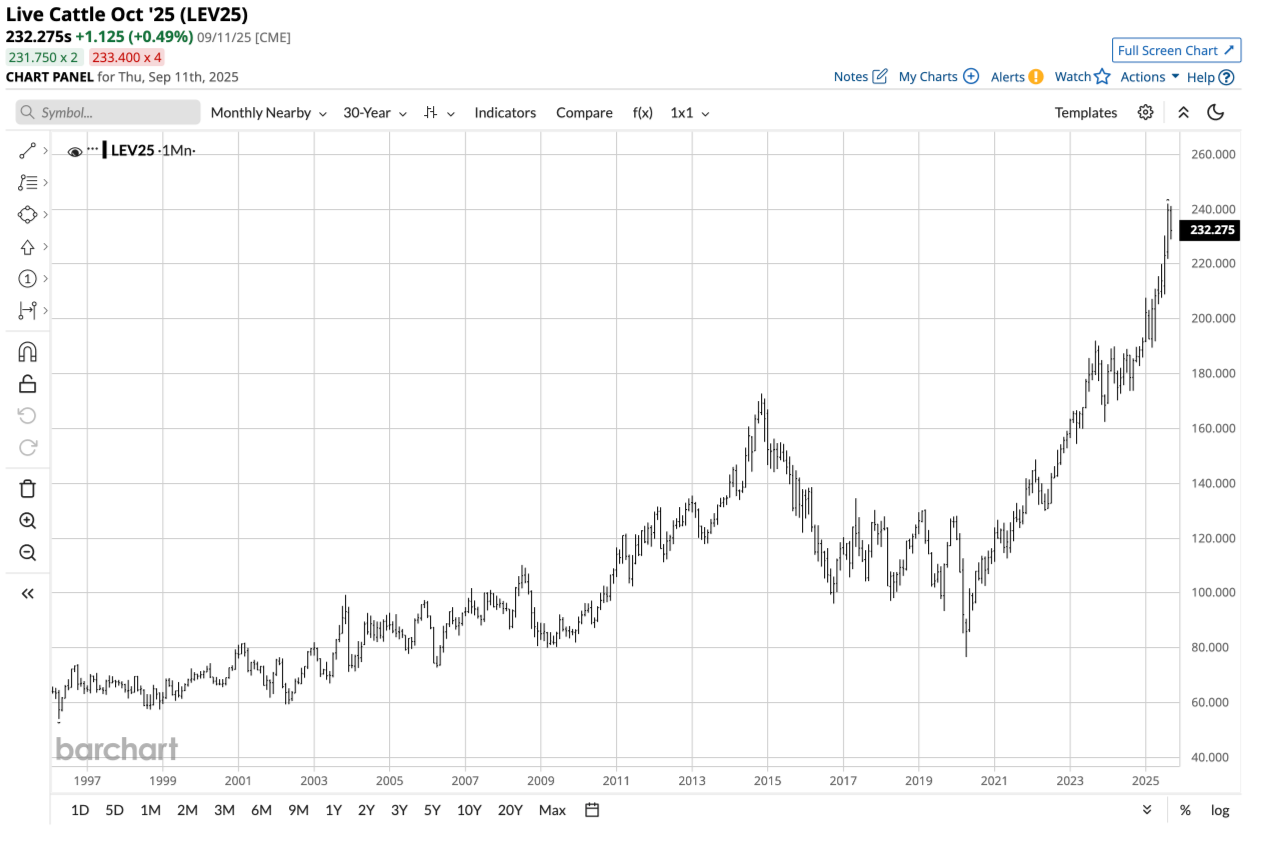

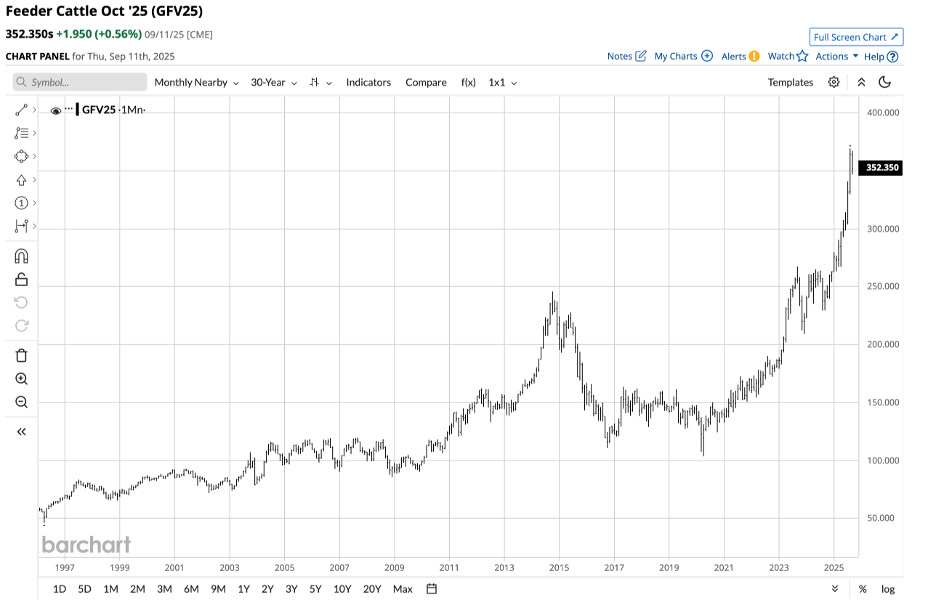

Nearby live cattle futures were trading at $2.2390 on July 16, 2025, with the feeders at the $3.25575 per pound level. The 2025 U.S. grilling season ended on September 1, but fat and feeder cattle prices were significantly higher than in mid-July during the peak demand period.

Fat cattle futures reach new record highs

Live cattle futures rose to a new record high in August 2025, at the end of the 2025 grilling season.

The monthly chart highlights the rise to a record high of $2.420750 in August 2025. Since then, live cattle futures have pulled back just under 10 cents per pound at the beginning of the offseason for demand in post-Labor Day trading.

Feeder cattle prices explode to the upside

Feeder cattle futures exploded to a new record high in August 2025, also at the end of the 2025 grilling season.

The monthly chart highlights the rise to a record high of $3.69375 in August 2025. In September, feeder cattle futures have pulled back over 17 cents per pound at the beginning of the offseason for demand.

Small herds and robust demand support high beef prices

One of the legacies of the 2020 global pandemic is that inflation caused rising feed and production costs, leading to smaller cattle herds. The decline in cattle herds has created tight beef supplies.

Meanwhile, U.S. tariffs on global trading partners have put additional upside pressure on cattle prices.

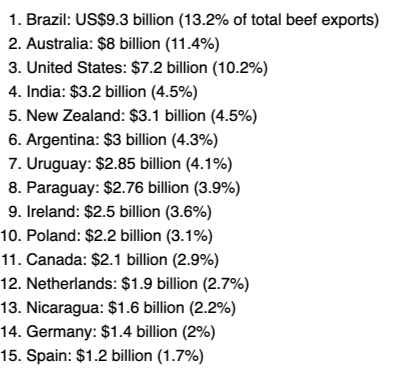

The chart shows that Brazil was the world’s top beef exporter in 2024.

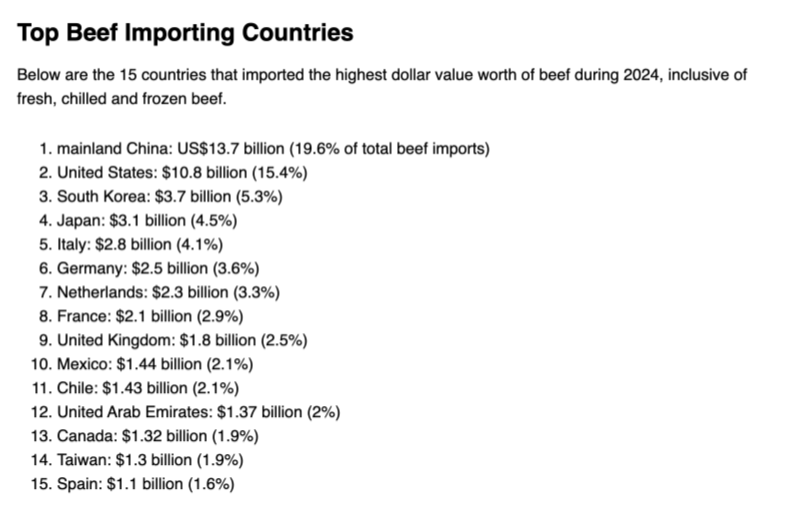

While the U.S. was the third leading beef-producing country in 2024, the United States was the second-leading beef-importing country for the year. Therefore, U.S. demand and tariffs have added additional upside pressure to live and feeder cattle futures, which reached record highs in August 2025.

The latest WASDE report has the USDA forecast chasing higher prices

The USDA’s August World Agricultural Supply and Demand Estimates Report told the cattle futures markets:

Beef production is lowered on reduced fed and non-fed cattle slaughter and lighter dressed weights. For 2026, beef production is lowered due to reduced expected placements in the second half of 2025, as well as reduced cow slaughter in 2026. Beef imports for 2025 are lowered to reflect reported trade data through the first half of the year, as well as reduced shipments due to higher tariff rates, particularly from Brazil. The reduction is carried into beef imports for 2026. The beef export forecast is reduced for 2025, reflecting tighter domestic supplies. The reduction is carried into lower exports for the first half of 2026. Cattle price forecasts for 2025 are raised for both the third and fourth quarters based on recent price strength and resilient demand for beef. The higher cattle price forecasts are carried into 2026.

The WASDE increased price forecasts for the rest of 2025 and into 2026 due to falling supplies. The USDA will release its September WASDE Report on Friday, September 12, at noon EST. The full text of the most recent report is available through the USDA website.

Futures are the only option for cattle risk positions- Price weakness could be a buy for the 2026 season

The only route for a risk position in the beef market is through the CME’s live and feeder cattle futures market.

At $2.32275 per pound, the value of one live cattle futures contract containing 40,000 pounds is $92,910. The CME’s current original margin requirement is $3,410 per contract. A market participant can control one contract of live cattle futures from the long or short side with a 3.67% down payment. If equity declines below $3,100 per contract, the exchange requires maintenance margin payments.

At 3.52350 per pound, the value of one feeder cattle futures contract containing 50,000 pounds is $176,175. The CME’s current original margin requirement is $5,500 per contract. A market participant can control one contract of feeder cattle futures from the long or short side with a 3.12% down payment. If equity declines below $5,000 per contract, the exchange requires maintenance margin payments.

The original and maintenance margin levels are subject to change at the CME’s discretion and are based on the volatility of live and feeder cattle futures prices.

The cattle markets are now at the start of the off-demand season, during which grills will be moved back into storage until next May. The lofty price levels increase the odds of downside price corrections. As the legacy of the 2020 pandemic is smaller U.S. herds and tariffs continue to lift prices of U.S. beef imports, prices are likely to remain elevated over the coming months before increasing as the 2026 peak grilling season approaches early next year. However, any substantial price corrections over the coming weeks and months could be a golden buying opportunity for the 2026 peak season. Leave plenty of room to add on further price weakness, as picking bottoms is virtually impossible.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.