For decades, Intel (INTC) was the crown jewel of the tech industry. It dominated the CPU market, generated tens of billions in annual profits, and was a dividend darling for income investors. But over the past 10 years, Intel has fallen from glory, trying to compete in the AI-driven semiconductor era dominated by Nvidia (NVDA), Advanced Micro Devices (AMD), and Taiwan Semiconductor Manufacturing Company (TSMC) (TSM).

In an unexpected turn of events, Washington has made a strategic investment that has the potential to reshape the relationship between the U.S. government and the tech industry and boost Intel back to glory. The flood of cash, along with the company’s aggressive attempt to turn around its story, has sent its shares up 84.7% year-to-date, compared to the S&P 500 Index ($SPX) gain of 13.1%.

Why Did Washington Choose Intel?

On Aug. 22, Intel and President Donald Trump’s administration reached an agreement under which the U.S. government will invest $8.9 billion in Intel common stock, representing a nearly 10% stake in the company. It also includes a five-year warrant allowing the government to acquire an extra 5% stake, but only if Intel loses majority control of its foundry business. The funds will be allocated from the CHIPS and Science Act grants and the Secure Enclave program funding.

Washington’s investment and policy support for Intel is a strategic partnership to ensure that the U.S. regains control of the world’s most important technology: semiconductors. Advanced chips are the backbone of everything from smartphones and cloud computing to AI systems and military defense. Intel remains the only American company capable of producing advanced semiconductors at scale on U.S. soil, which is most likely why Washington chose Intel. Washington’s interest in Intel could also stem from its next-generation foundry strategy. Domestic chip production is now a national priority, and Intel’s ability to deliver cutting-edge nodes on U.S. soil provides the government with a secure, reliable source of advanced semiconductors.

In August, Intel also secured a $2 billion investment from SoftBank Group (SFTBY). Under CEO Lip-Bu Tan’s leadership, Intel has taken significant steps to restore its engineering culture and financial health. Tan has focused on operational discipline, product excellence, and engagement with industry partners to reclaim Intel’s long-lost competitive advantage.

Profit Pressure, But a Clear Cost Discipline

The company’s turnaround efforts were evident in its most recent second quarter. Intel generated $12.9 billion in revenue, exceeding expectations and displaying strong execution across its core businesses.

Intel’s foundry revenue reached $4.4 billion in Q2, slightly down sequentially but above forecasts due to robust Intel 7 wafer output and increased advanced packaging services. Importantly, Intel 18A has begun manufacturing in Arizona, ahead of the Q4 launch of Intel’s new client processor, Panther Lake. The company has begun imposing financial discipline after years of heavy spending and underperformance. In Q2, Intel incurred $800 million in non-cash impairment and accelerated depreciation charges, along with $200 million in one-time period costs, which weighed on profitability. Setting aside these one-time charges, adjusted gross margin was 37.5%, and EPS was $0.10, both of which exceeded expectations. The business intends to meet its $17 billion and $16 billion operating expense targets in 2025 and 2026, respectively, which are significant milestones in recovering profitability.

The company still holds a robust $21.2 billion in cash and short-term investments, giving it the flexibility to continue deleveraging as operations improve. Intel’s Q3 outlook reflects a mix of caution and confidence. The company anticipates revenue between $12.6 billion and $13.6 billion, a gross margin of around 36%, and break-even adjusted EPS. Analysts estimate the company to make a profit of $0.12 per share this year, which could climb to $0.64 by 2026.

What Is Wall Street Saying About Intel Stock?

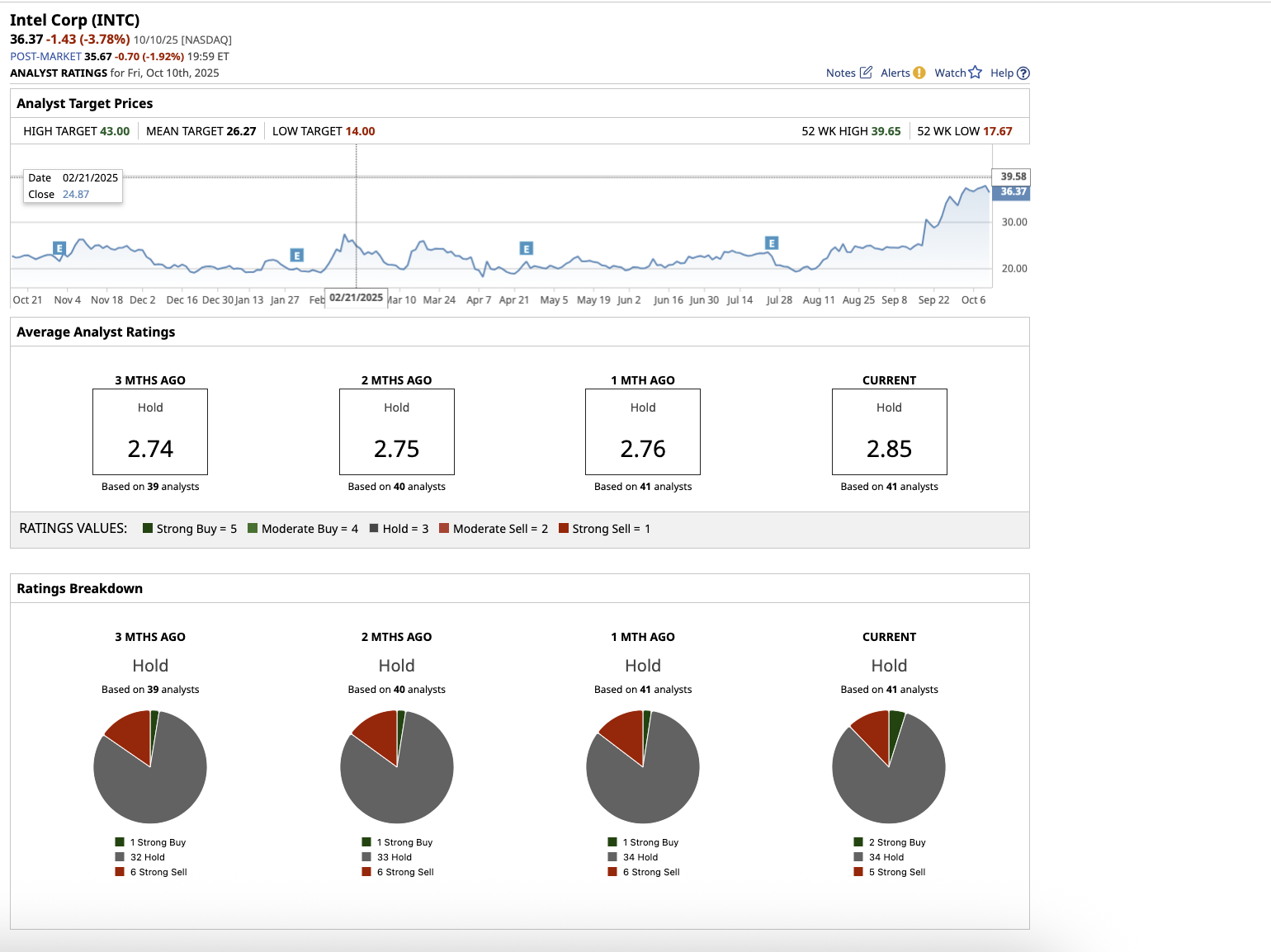

Overall, Wall Street rates INTC stock a “Hold.” Of the 41 analysts covering the stock, two rate it a “Strong Buy,” 34 rate it a “Hold,” and five suggest a “Strong Sell.” The stock has surpassed its average target price of $26.27. However, the Street-high estimate of $43 suggests the stock has upside potential of 16% over the next 12 months.

The Key Takeaway

With Nvidia and AMD making aggressive moves, Intel may not look like the clear winner today. It has fallen behind rivals, battled with leadership, and missed much of the AI boom. Its turnaround tale is far from over, but its trajectory is changing. Washington’s investment signals a long-term bet on America’s self-sufficiency in technology, which could help Intel strengthen its position in this heated AI race.