With mega-cap tech giant Broadcom (AVGO) set to report earnings after the close on June 5, momentum is building — and the smart money is already positioning itself. Let’s break down why AVGO this could be one of the most important earnings plays of the season.

Wall Street’s Bold $301 Price Target

Analyst Mike Harrison from Redburn Atlantic just initiated AVGO with a “Buy” rating and a Street-high target of $301, citing Broadcom’s dominance in the ASIC (application-specific integrated circuit) space.

These chips power the artificial intelligence (AI) revolution — and AVGO is quietly becoming one of its most vital players.

Congress Bought the Dip

Two U.S. politicians, Reps. Kelly Morrison and Michael McCaul, disclosed AVGO purchases in April. Congressional buys don’t always mean bullish moves — but when they line up with institutional flow and analyst upgrades, it’s worth watching.

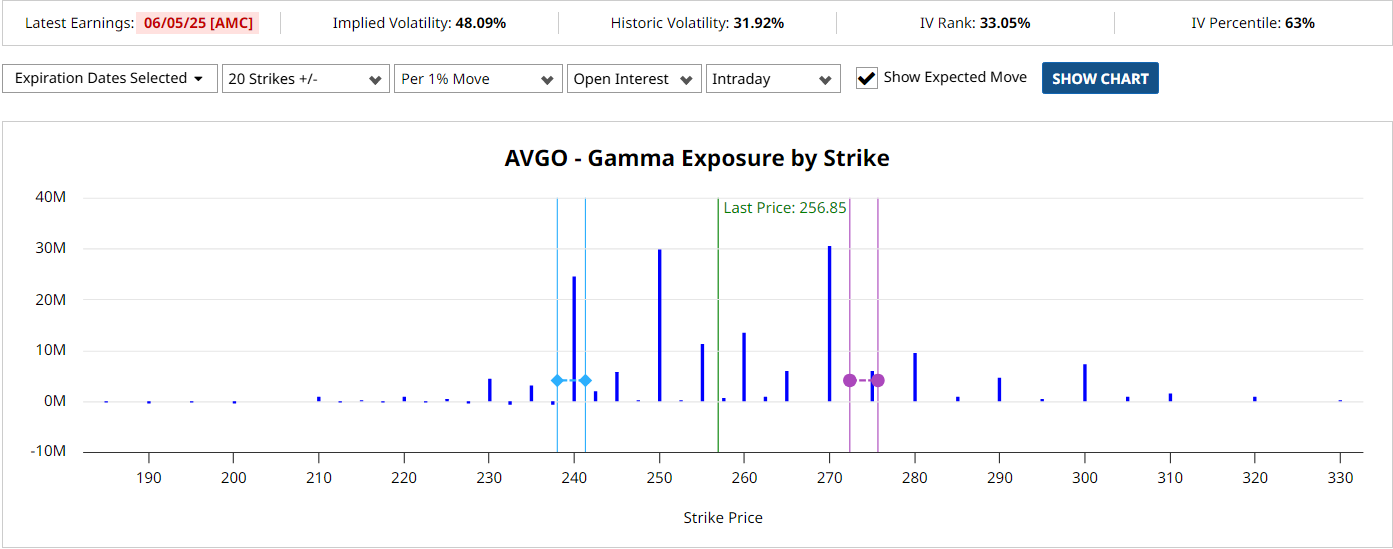

Gamma Exposure Above $250

Barchart’s Gamma Exposure Tool shows a high concentration of positive gamma above $250. This means market makers are hedging against big moves — often leading to price stability near these levels.

But that stability doesn’t last forever. As earnings approach, any break of key gamma levels could lead to powerful directional moves.

Expected Move for Earnings

Use Barchart’s Expected Move Tool to map the projected high and low ranges for AVGO after earnings. This tool uses options pricing to calculate where the stock could land post-report.

This is essential for planning straddle/strangle strategies, risk-reward ratios, or knowing when to scale in/out of positions.

Trade Setups Are Already Triggering

Barchart’s trading strategies have flagged multiple bullish signals on AVGO throughout April and May, including moving average crossovers and trend confirmation setups. That’s a strong confirmation that momentum has already shifting higher in anticipation of earnings.

However, the recent surge higher has left AVGO stock short-term overbought, based on its 14-day Relative Strength Index (RSI) of 82.01, which means a post-earnings reversal on any negative news is a very real possibility.

How to Prep for AVGO Earnings Like a Pro

- Review the Expected Move Range

- Check Gamma Exposure Levels

- Watch for updates in Analyst Ratings

- Look at historical Seasonal Returns

- Stream our latest AVGO Reel Breakdown