/Uber%20Technologies%20Inc%20logo%20on%20phone-by%20DenPhotos%20via%20Shutterstock.jpg)

Valued at $169.7 billion, Uber Technologies (UBER) is much more than just a ride-hailing app now. It has transformed into a global, AI-powered marketplace for mobility, delivery, and local commerce, all designed to connect people, businesses, and opportunities in real time at massive scale. The company is fully focused on building a profitable, cash-generating business. This is probably why Wall Street is strongly bullish about UBER stock and expects it to climb 84% in 2026 following its 29% climb last year.

Explosive Growth in Trips and Engagement

Uber began as a simple ride-hailing service and has now grown into a multi-sided marketplace supporting millions of users, drivers, couriers, merchants, and shippers around the world. This has led the business to become a highly profitable, cash-generating platform.

In the most recent third quarter, trip volume increased 22% year-on-year (YoY) to 3.5 billion, marking Uber's best growth rate since 2023. This growth was driven by a 17% increase in Monthly Active Platform Consumers and a 4% increase in trips per user. Mobility revenue increased by 20%, while Delivery increased by 29% during the quarter. Importantly, average pricing remained essentially stable, indicating that demand increase was organic rather than price-driven.

Gross bookings increased 21% YoY to $49.7 billion. Total revenue rose 20% to $13.5 billion. Uber's top-line momentum resulted in a remarkable earnings increase of 154% YoY to $6.6 billion. CEO Dara Khosrowshahi announced six strategic initiatives that will guide Uber's next phase of growth. These include transitioning from one-time journeys to lifetime client relationships and merging autonomous vehicles with human drivers in a hybrid marketplace. Third, the company is rapidly increasing local commerce, such as groceries and retail, with an annual gross bookings rate of over $12 billion. Uber is also expanding income potential for its 9.4 million drivers and couriers by offering “multiple gigs” and developing advertising and demand capabilities for over 1.2 million merchants. Finally, it is implementing generative AI throughout its operations to improve productivity and personalization.

Uber is entering its next chapter of growth with significant financial backing. In the third quarter, free cash flow reached an impressive $2.2 billion, showing Uber's capacity to fund expansion while returning capital to shareholders. Uber ended the third quarter with $9.1 billion in unrestricted cash, cash equivalents, and short-term investments. Management has announced plans to redeem $1.2 billion in convertible notes due in December 2025, signaling confidence in cash generation and balance sheet stability. This level of liquidity enables Uber to invest in innovation while minimizing financial risk.

Looking ahead, Uber expects the Q3 momentum to continue. Gross bookings are expected to climb by 17% to 21% YoY in the fourth quarter, reaching $52.2 billion to $53.7 billion. Adjusted EBITDA is expected to climb 31% to 36% YoY, reaching $2.51 billion. Although management did not issue a full-year forecast, analysts estimate Uber's sales to rise by 18.2% to $52 billion, followed by earnings growth of 18.4%. This outlook reflects confidence that Uber’s growth engine and profitability flywheel remain firmly intact.

What Are Analysts Saying About UBER Stock?

Overall, Wall Street remains strongly bullish about UBER stock. Recently, Bernstein analyst Nikhil Devnani reiterated his “Buy” rating for the stock while increasing the price target to $115 from $110. Devnani argues that Uber’s valuation now trades at a discount to its underlying earnings power, owing primarily to increased media coverage of autonomous vehicle competition. While businesses like Waymo, Zoox, and Tesla (TSLA) have raised investor concerns, Bernstein feels the market is overestimating the near-term threat these players offer to Uber's core business.

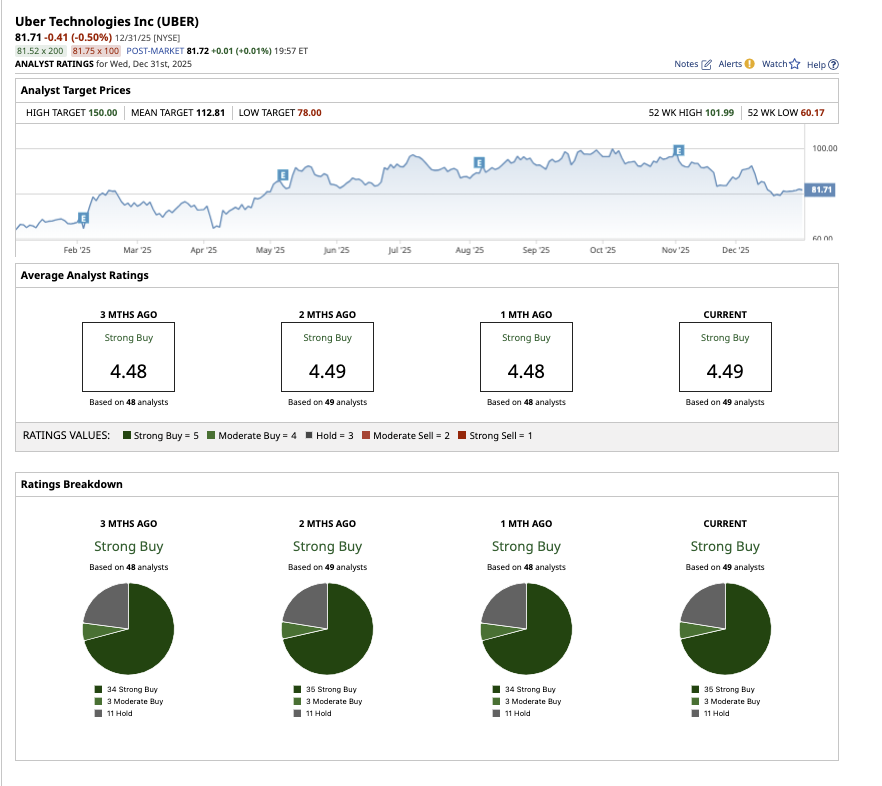

Of the 49 analysts covering UBER, 35 have a “Strong Buy” recommendation, three have a “Moderate Buy” rating, and 11 suggest a “Hold.” Based on the analysts’ average price target of $112.81, UBER stock has upside potential of 38% from current levels. Its high price target of $150 suggests the stock can climb as high as 84% over the next 12 months.

Why Wall Street Sees Another Uplifting Year for Uber

Wall Street optimism for Uber stems from its Q3 results, which highlight a company entering a more mature, durable phase of growth. Rapidly rising trips, expanding margins, ample free cash flow, and a defined long-term strategy centered on AI, autonomy, and local commerce distinguish Uber as more than just a ride-hailing company. Instead, it is evolving into a diverse, global platform capable of delivering wealth over many years, supporting its investment case not only for 2026 but for the long term.