Good morning. There are more leadership changes in the Fortune 500, with Verizon’s CFO, Tony Skiadas, gaining a new strategic partner—Dan Schulman—as chief executive.

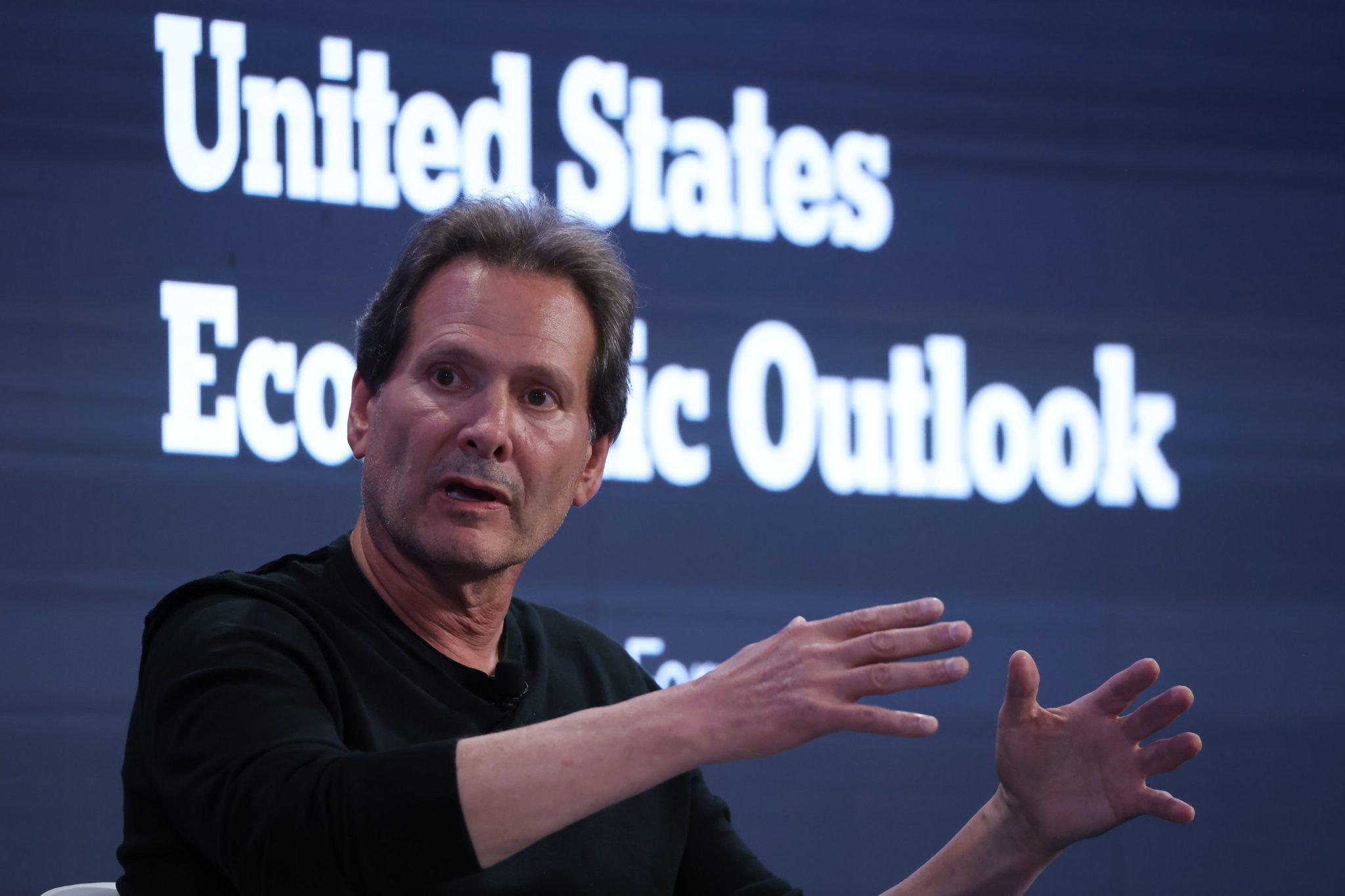

Verizon (No. 30) announced on Monday that its lead director, Schulman, most recently CEO of PayPal and formerly with AT&T and Virgin Mobile, is succeeding Hans Vestberg as Verizon’s CEO, effective immediately. The company reconfirmed its full-year 2025 guidance and postponed the release of its third-quarter earnings report to Oct. 29.

Mark Bertolini, Verizon’s chairman, called Vestberg, in a statement, “an extraordinary leader” who drove network investment and innovation. He said that with the Frontier Communications acquisition nearing completion, “the board and Hans discussed that now is the right time for a CEO transition.”

Bertolini stated that Schulman is the right leader to guide Verizon’s next phase of increased customer focus and financial growth. Schulman said in a statement that he’s honored to serve as CEO, adding, “Verizon is at a critical juncture.” Schulman has served on Verizon’s board since 2018 and was elected lead independent director in December.

Michael Hodel, director of communications services equity research for Morningstar, told me that Verizon underperformed under Vestberg, “at least in the eyes of many market participants.” He continued, “From my view, Verizon has struggled to articulate a clear strategy around market positioning, branding, and pricing, sticking too long to messaging that produced success when it was clearly the best network in the industry.”

Hodel added that Verizon needs to adapt to the current market structure and “has failed to live up to growth forecasts under Vestberg.” Hodel added: “My guess is that the board was losing patience given how the stock has performed.”

Scott Simmons, co-managing partner at executive search firm Crist Kolder Associates, commented on Verizon’s announcement: “Vestberg was named CEO in 2018, seven years ago, and the stock has not moved in the right direction the past few years, which increased pressure from investors,” Simmons said.

Verizon’s stock price has dropped notably since its peak between 2018 and 2020 and is down about 30% over the past five years, reflecting sustained underperformance compared to broader market indices. On Monday, the stock fell by 5% following the announcement that Schulman has replaced Vestberg as CEO. Verizon did not provide further comment on the reason for the CEO change.

Simmons, who has more than 20 years of experience in executive recruiting, described Schulman as bringing a fresh perspective to Verizon, with leadership experience across multiple industries, including telecom and fintech. He noted that Schulman successfully transformed PayPal, now valued at nearly $70 billion. “Schulman is the force that will change Verizon’s direction,” Simmons said.

Wireless industry ‘entering a new era’

Mike Dano, lead analyst at Ookla, a tech company that measures internet connection speed and performance, wrote in a LinkedIn post on Monday: “Broadly, we’re entering a new era in the U.S. wireless industry, with early 5G buildouts wrapping up and, now, a big focus on fiber getting underway.”

Verizon is competing with major industry players, including AT&T and T-Mobile. In September 2024, Verizon announced its $20 billion acquisition of Frontier Communications, a leading U.S. fiber broadband provider. Although Vestberg has stepped down as CEO, he will serve as special advisor through Oct. 4, 2026, and will oversee the integration with Frontier Communications, which is expected to close in the first quarter of 2026, according to Verizon.

When I asked Skiadas last month what distinguishes Verizon among its competitors, he cited the company’s investment of about $200 billion in wireless spectrum and networks over the past seven years—almost $18 billion annually—to strengthen its network. “That’s really the hallmark of our company, and then giving customers choice and flexibility,” Skiadas said. He became CFO in 2023 and has been with Verizon and its predecessors for nearly three decades.

Regarding the CEO-CFO dynamic, “I would argue CEOs and CFOs must be strategic partners, or else something in that equation is broken,” Simmons said. “Knowledge diminishes risk, and the familiarity between a board member, Schulman, and the CFO, Skiadas, should smooth the path toward success as strategic partners—assuming a certain level of professional respect exists between the two.”

Sheryl Estrada

sheryl.estrada@fortune.co