George Efstathopoulos, multi-asset portfolio manager at Fidelity International, is shifting his gaze East.

"For the first time, I'm not selling the rally in China," he says, pointing to a structural innovation surge that's making the country's tech stocks serious contenders to their U.S. counterparts. Chinese tech stocks, long battered by regulatory uncertainty and global skepticism, are now outpacing their U.S. peers, the Magnificent Seven, in both performance and valuation appeal.

Alibaba Group Holding Ltd (NYSE:BABA) (NYSE:BABAF) is up over 33% year-to-date and BYD (OTCPK:BYDDF), China's EV juggernaut, has surged nearly 46%.

In contrast, Amazon.com Inc (NASDAQ:AMZN) is down more than 5% and Apple Inc (NASDAQ:AAPL) has tumbled 17% in the same period.

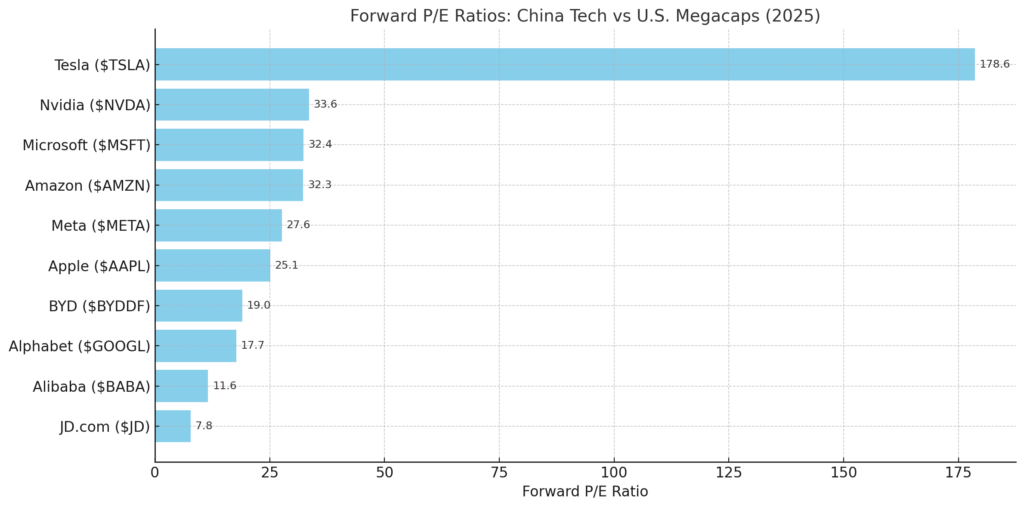

Valuations highlight the stark divergence.

Created using Benzinga Pro data

Tesla Inc (NASDAQ:TSLA), which has committed $8 billion to ramp up EV and AI development this year, including China's largest grid-scale energy storage project, trades at a forward P/E of 178, per Benzinga Pro data. BYD, already outselling Tesla in China, trades at just 19 times forward earnings.

Alibaba and JD.com Inc (NASDAQ:JD) look even cheaper, with forward P/Es of 11.6 and 7.8, respectively.

Chinese Tech: High Growth, Low Valuation, Government Tailwinds

EV sales in China hit a record in May, crossing 1 million units in a month for the first time. Research firm Rho Motion attributes the growth to strong domestic demand and rising exports, with BYD tapping into new markets like Mexico and Southeast Asia, reported Reuters.

Government policy is also playing a supportive role. With fewer regulatory shocks and more focus on innovation and energy transition, sentiment around China's tech sector is beginning to stabilize. "China is leading in many tech spaces," says Nandini Ramakrishnan of JPMorgan Asset Management, pointing to AI and green tech dominance as long-term drivers.

U.S. Tech: Great Companies, Stretched Prices

U.S. tech giants still dominate investor portfolios, but at premium valuations. Nvidia Corp (NASDAQ:NVDA) trades at a forward P/E of 33.6, Microsoft Corp (NASDAQ:MSFT) at 32.4, and even Alphabet Inc (NASDAQ:GOOGL) (NASDAQ:GOOG), the cheapest among them, sits at 17.7. Tesla's triple-digit multiple, compared to BYD's single-digit trailing P/E of 7.6, underscores how much optimism is already priced in.

Moreover, YTD returns have started to diverge. Alphabet is down over 12%, Tesla has slid 8%, and Amazon is still in negative territory. Only Meta Platforms Inc (NASDAQ:META), Microsoft, and Nvidia have posted double-digit gains.

How To Play The Shift

Investors interested in diversifying away from expensive U.S. names may consider:

- Direct exposure: Alibaba, JD, BYD

- Broad ETFs: The KraneShares CSI China Internet ETF (NYSE:KWEB) offers China Internet exposure, and the Invesco China Technology ETF (NYSE:CQQQ) offers China Tech exposure.

- Global innovation funds: The EMQQ The Emerging Markets Internet ETF (NYSE:EMQQ) for Emerging Markets Ecommerce & Internet exposure.

With structural growth drivers, cheap valuations, and improving sentiment, China tech is finally back on the menu.

Read Next:

Photo: Maxx-Studio On Shutterstock.com